Today’s Topstep live trade daily recap showcases how a single trade—executed with discipline and a simple edge—produced $2,277.50 across five funded accounts. My only trading strategy is the 2-minute Break of Structure (BOS), and I let it guide every decision I make. If you’ve followed my content or watched my videos, you know I don’t use indicators, oscillators, or guessing. Just clean structure, price, and discipline.

The Setup

The trade began just before the 9:30 AM bell. I was initially short 4 contracts on the Micro E-mini Nasdaq (MNQ) June 2025 contract, when a 2-minute BOS to the upside confirmed it was time to reverse. I flipped long and started scaling in—an important technique I use to keep my average entry close in case I need to reverse again.

A clean break of structure (BOS) to the upside right as the 9:30 AM bell rings on the Micro E-mini Nasdaq June 2025 contract. The green line marks the BOS; the red line shows the stop level.

The green line marks the BOS; the red line shows the stop-loss area. This confirmation came at the exact moment the market opened, giving the move real conviction.

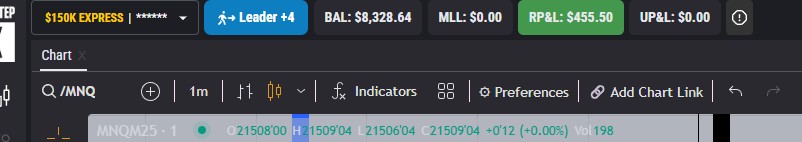

The Trade

I sold my short position of 4 contracts, then entered long with 13 contracts, leaving me net long 9 contracts. As price moved in my favor, I exited all 9 contracts for a total realized profit of $455.50 on the leader account.

Topstep trade breakdown: Initial short of 4 contracts, reversal with 13 long contracts, and final exit with 9 contracts locked in for profit.

Every arrow on the Topstep chart is timestamped and labeled, showing precisely where I entered, scaled, and exited.

Today’s Realized Profit

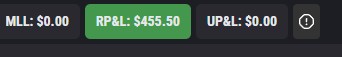

Here’s a look at today’s realized P&L from my Topstep account:

Realized profit from today’s session: $455.50 in the green. This is the result of executing disciplined structure-based entries on Topstep.

The green P&L box shows a $455.50 gain on the leader account. Since I’m copy trading across five accounts, that single number becomes $2,277.50 in total profit for the day.

Scaling Across Accounts

I trade using a Topstep leader account, which mirrors every move to four additional funded accounts. This means the realized P&L and total account balance scale significantly.

Topstep leader account with four copy-traded accounts attached. A $455.50 realized gain multiplies to $2,277.50 across all five accounts.

The leader account shows a current balance of $8,328.64. Multiplied across five accounts, that’s $41,643.20 in total equity, grown through one structure-based strategy.

The Bigger Picture

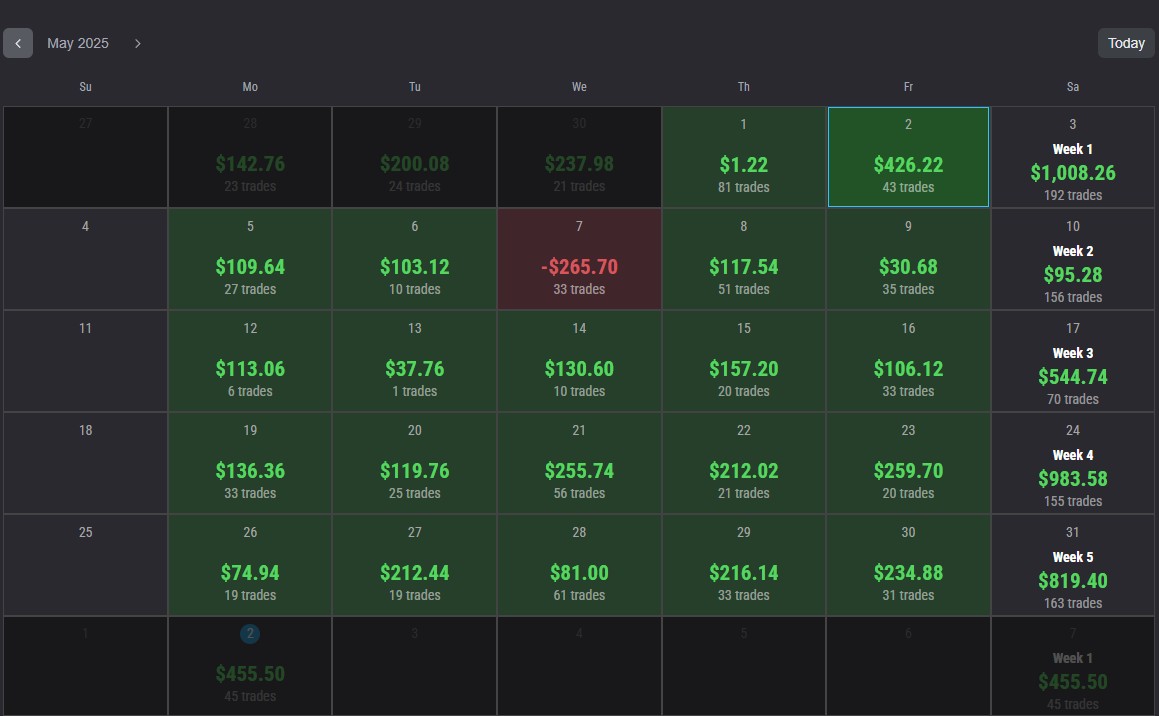

Days like today aren’t rare—they’re part of a bigger pattern of disciplined, repeatable success.

Consistency is key: 18 consecutive green days and just one losing trade in the past 26 Topstep-funded sessions.

Over the last 26 trading days, I’ve had only one red day. We’re currently riding an 18-day green streak, built on the same 2-minute BOS strategy I trade every single morning.

Conclusion

This trade was not luck—it was structure. Every entry and exit was based on real-time price action and nothing else. If you’re trying to make trading work, stop looking for the holy grail. Use what works. Stay disciplined. And when you find your edge—trade it like a machine.

Thanks for following along with today’s Topstep live trade daily recap. Stay tuned for tomorrow’s breakdown, and if you want to learn more about the 2-minute BOS, check out my videos and past recaps at edgeucatedtrading.com.