When we first started trading, we did what most traders do: we chased strategies, bought expensive tools, and followed mentors who promised shortcuts. And like most traders, we blew up accounts. Over and over.

The breakthrough didn’t come from a magic indicator or a new “holy grail.” It came from one simple habit: we logged every trade.

Trading Is Probabilities, Not Predictions

Nobody knows where the market is going next. Trading is about probabilities. That means you will have losing trades—sometimes one, two, or even three in a row. The difference between traders who quit and traders who succeed is how they respond. Do you abandon your system and go strategy-hopping? Or do you analyze the data and refine your edge?

The Power of the Last 20 Trades

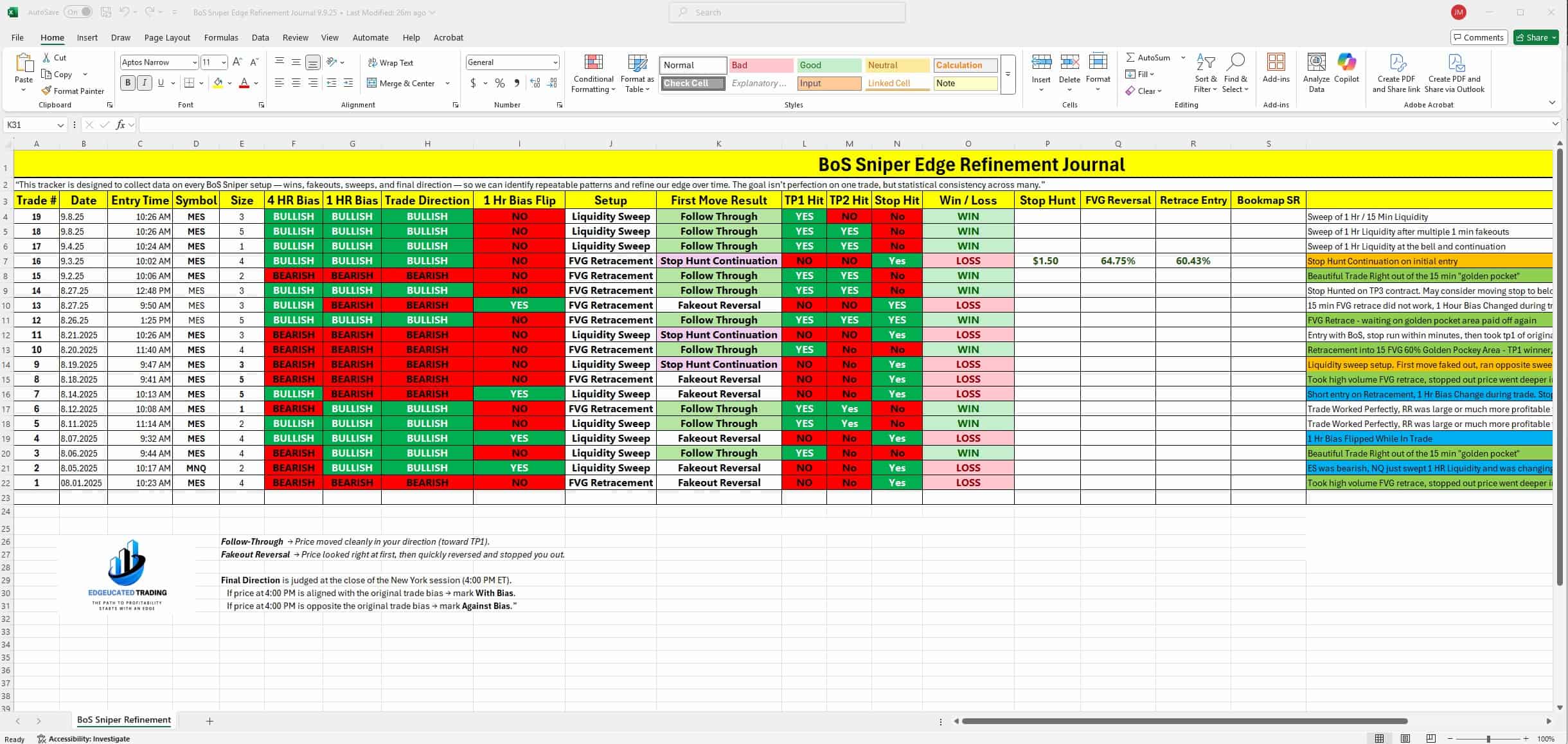

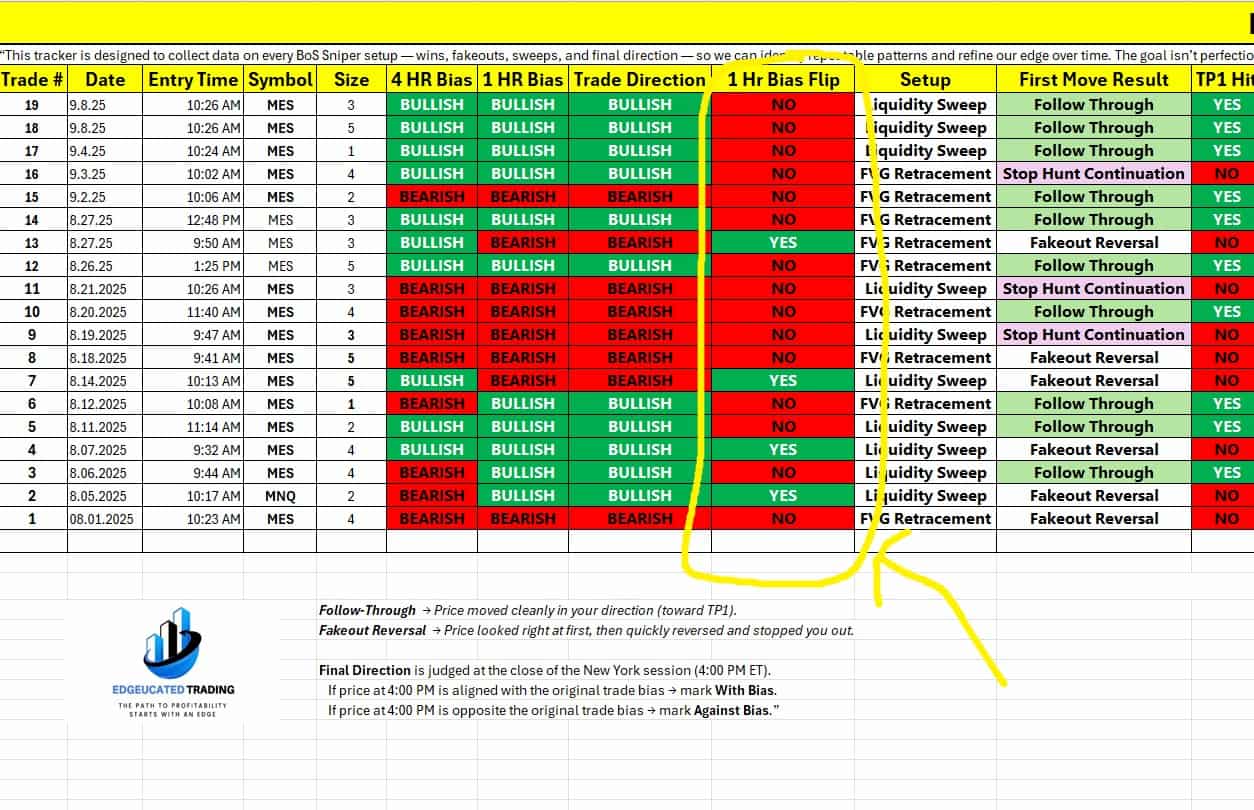

We set a simple rule: track the last 20 trades in a rolling log. That gave us a measurable way to see what was working, what wasn’t, and how market conditions were shifting.

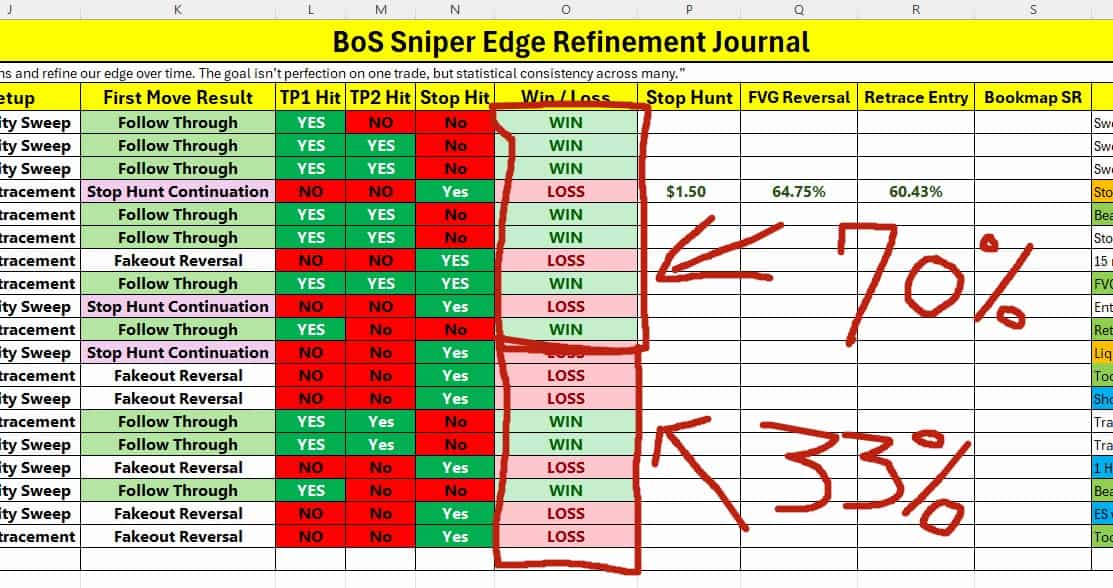

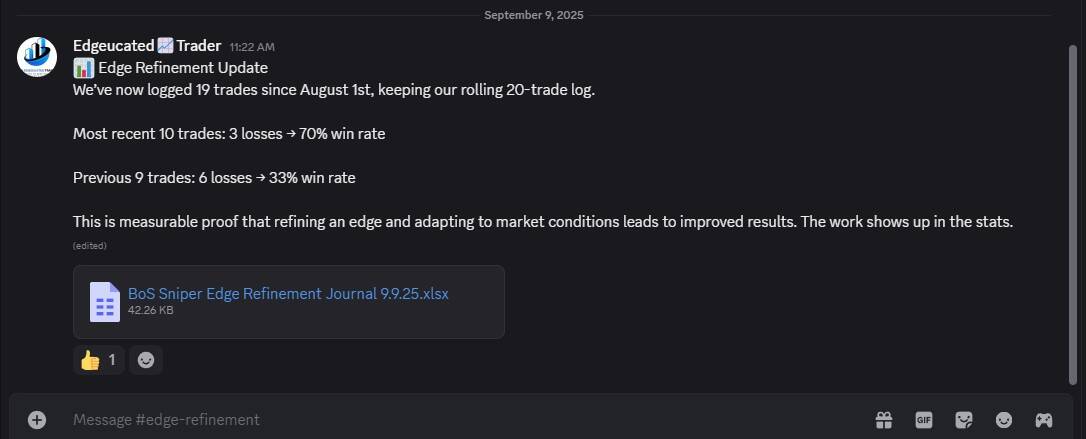

Proof of Refinement (70% vs 33%)

When we began logging on August 1, the first nine trades had six losses—a 33% win rate. The next ten trades had only three losses—a 70% win rate. Nothing about the market changed. The difference was our awareness and our discipline to refine based on data.

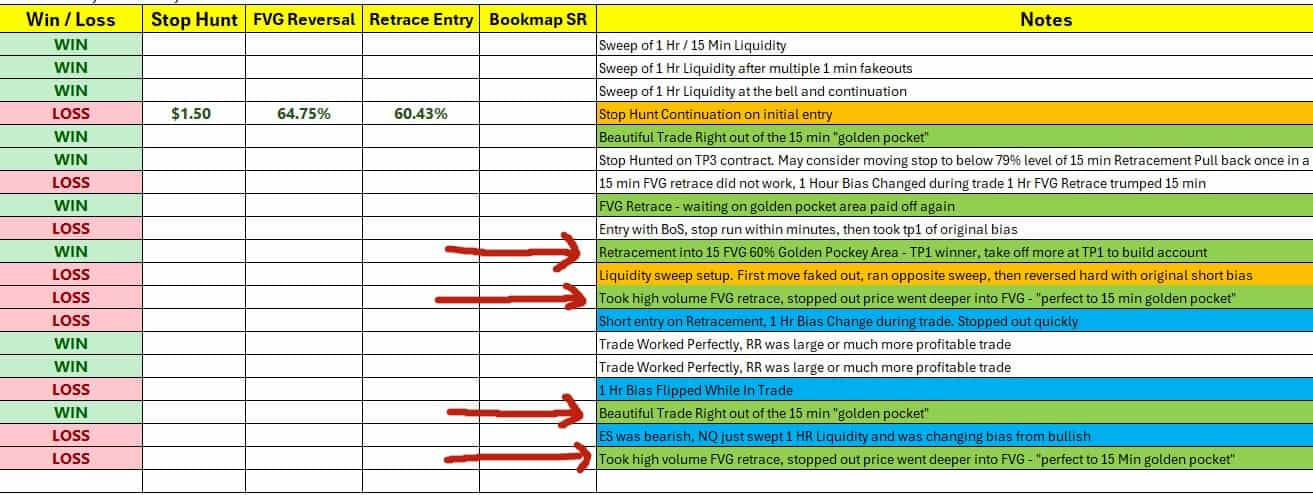

Refinement in Action: Shifting to the Golden Pocket

At first, we used a 50% retracement entry. The log showed consistent losing trades. Instead of ditching the system, we looked closer. The market was consistently retracing deeper—into the golden pocket. We refined the rule. The very next trade turned into a win, and the wins kept stacking.

Bias Tracking: Staying True to the Rules

We also tracked how often the one-hour bias flipped. Out of 19 trades, it flipped just 4 times—about 21%. That told us something powerful: most of the time, staying aligned with the original bias keeps you in sync with the market. Logging it gave us the confidence not to second-guess every move.

Why This Matters

- Find a setup or pattern you like.

- Understand why it works—what traders are doing, where liquidity hides, how behavior repeats.

- Log every trade.

- Refine your rules based on data—not emotion—and stick to them.

That’s the real path to consistency.

How Long Does It Take to Build a Habit?

You may have heard the old saying that “it takes 21 days to form a habit.” That idea came from Maxwell Maltz in the 1960s, but modern research shows the real answer is very different. A 2009 study by University College London found that on average, it takes 66 days for a new behavior to become automatic, though the range can be anywhere from 18 to 254 days depending on the person and the habit (source).

That means logging trades won’t feel effortless right away. But if you commit to doing it daily, it will eventually become second nature—and that habit is what transforms inconsistency into consistency.

A Gift, Not a Pitch

We spent thousands on tools and spreadsheets that never helped. That’s why we give ours away. If you want the exact trade log we use daily, it’s free in our Discord—no paywall, no hidden upsells. Use it, put in the work, and let the data guide your refinement.

© 2025 Edgeucated Trading. All rights reserved. Terms of Service

We write this blog content for free. If it has been helpful to you, please like and share it on Twitter/X. That gives us the reason to keep creating. This is our journey of how we got out of the reset trap and became profitable, and we share it to help other traders move faster in their own journey.

Follow & Share on X @edgeucated

© 2025 Edgeucated Trading. All rights reserved. Terms of Service