Introduction

If you’re reading this, you’re probably at a crossroads in your trading journey. Maybe you’re overwhelmed by the flood of gurus, chat rooms, indicators, and “exclusive” courses promising to turn you into a profitable trader. I get it. I’ve been there. In fact, this blog post isn’t just a story. It’s a cautionary roadmap filled with real receipts and raw truth about everything I spent money on while trying to become consistently profitable.

My goal is simple: If I can save even one person from wasting thousands of dollars like I did, then this post has done its job. I’m not here to sell you anything. I’m not linking to affiliate sites. I don’t have codes, partnerships, or any hidden motive. I’m simply a trader who learned things the hard way and is sharing this so others don’t have to.

The Obsession With Edge

Every new trader wants one thing: an edge. And when you’re new, you think edge comes from software, signals, chat rooms, or a paid guru who has “cracked the code.”

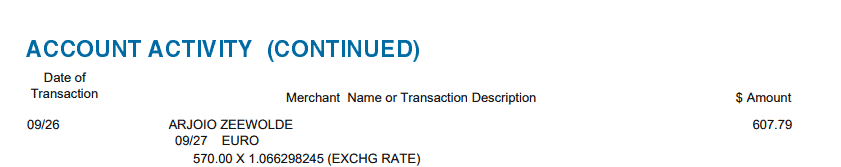

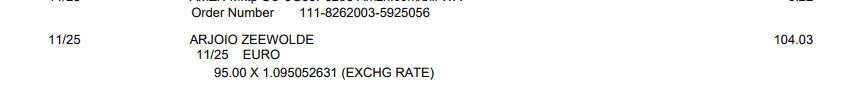

For me, that pursuit began with Arjoio.

My $104.03 payment to Arjoio. Found him on YouTube, bought the course, and quickly realized I was chasing shortcuts instead of skill.

He was charismatic, ran a channel, and talked with confidence. I figured, “For just over $700, I could learn what took him years to master.” I was wrong. The lessons were generic, vague, and untested. Still, I pressed on.

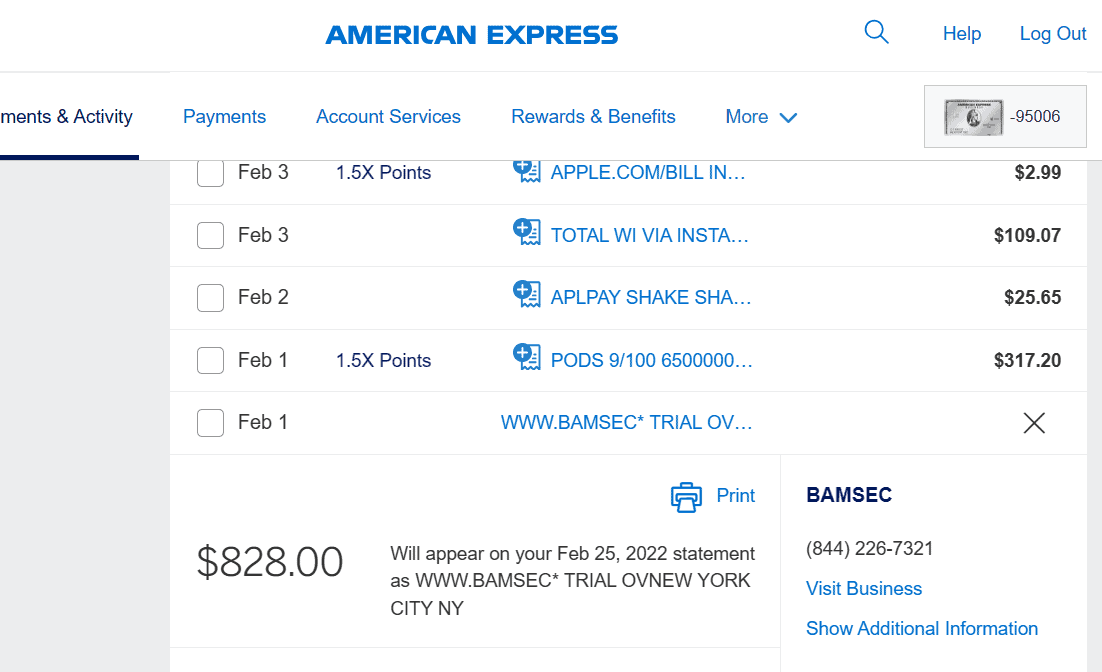

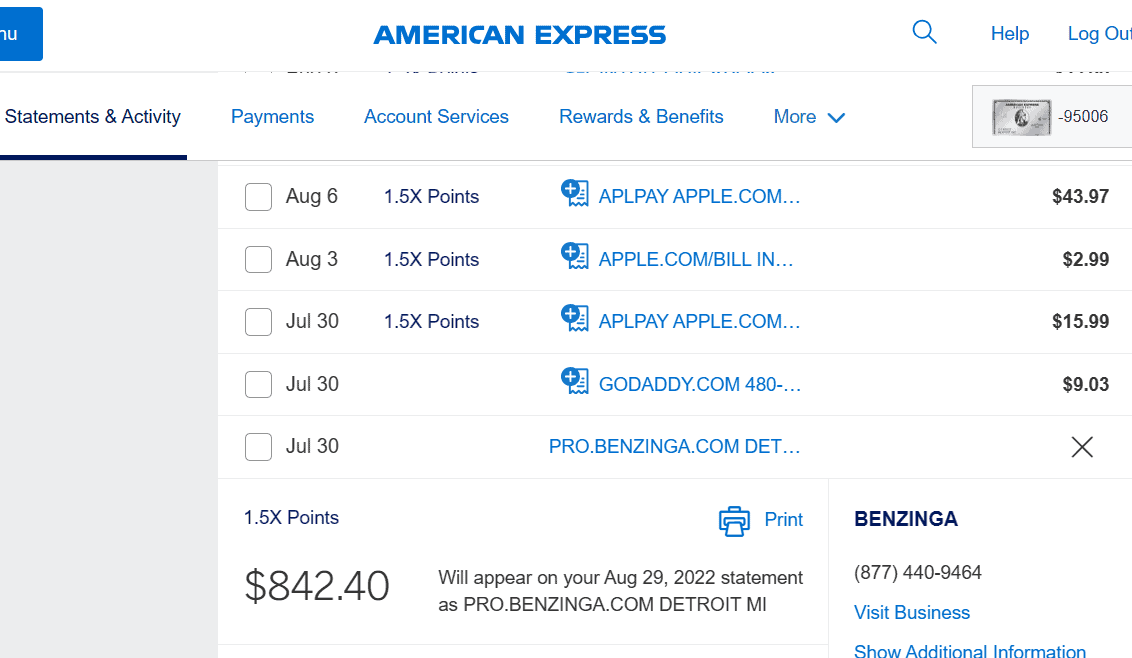

$842.40 for Benzinga’s news service subscription. By the time I read it, the market already moved.

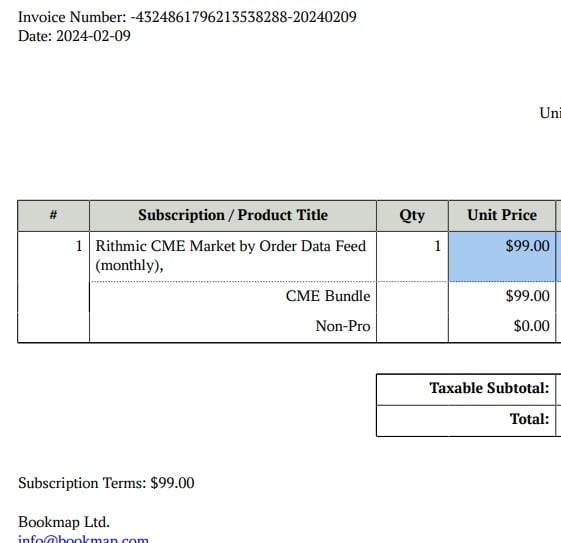

$99/month for Rithmic CME data feed.

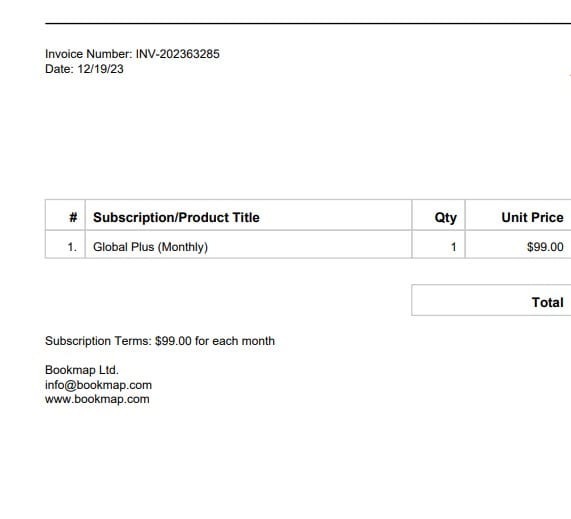

$99/month for BookMap Global Plus access.

MBO Bundle subscription — needed to make BookMap usable – $134 per month.

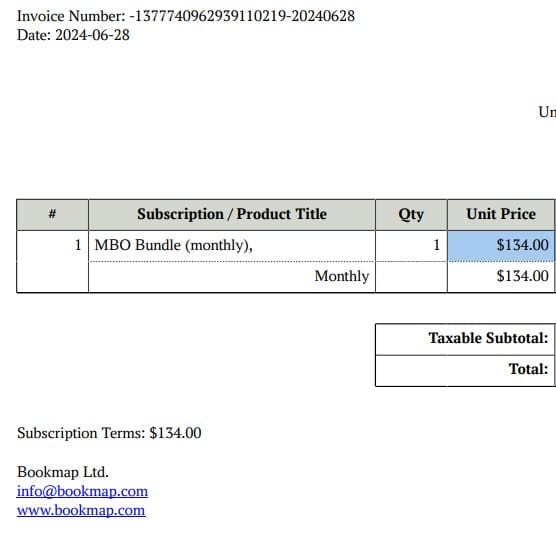

$79/month for Scott Pulcini’s Zones indicator.

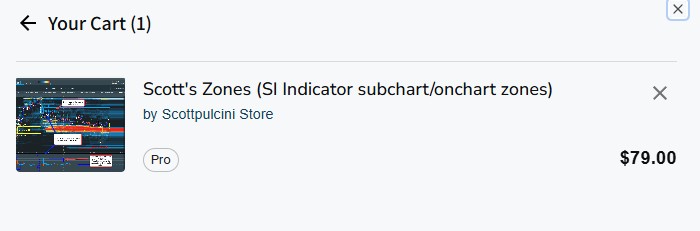

$1,220.95 spent on ScottPulciniTrader.com.

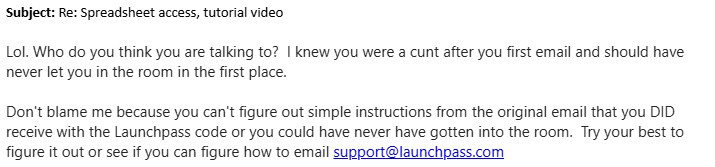

The email Scott Pulcini sent me after I asked to cancel.

After he refused to provide any proof of profitability or a basic P&L, I requested to cancel my subscription. This was his response — a glimpse into how he handles reasonable questions and paying customers.

In my personal experience, Scott Pulcini presented himself as a multi-million-dollar trader through his website, which offered indicators, trade room access, and mentorship. I purchased access based on those representations. When I asked for a verified P&L, I received a strongly worded email in response. To me, it felt unprofessional and defensive. I also found the trade room difficult to follow — packed with overlapping software and setups that often contradicted each other. These are just my own impressions, but I hope they help others make more informed decisions.

If you’re searching for Scott Pulcini Trader review or ScottPulciniTrader.com, I hope this post finds you first.

The Monthly Burn Continues

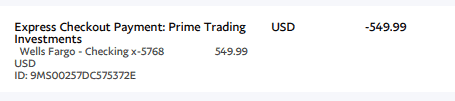

$549.99 to Prime Trading Investments — another dead-end service.

$106.98/month to Dekmar Trades and FastStockAlerts.

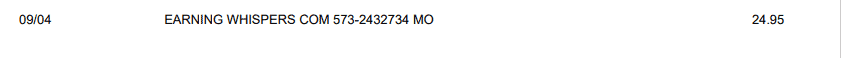

News Feeds and Illusions of Speed

“Instant news” sounds valuable until you realize by the time it’s on your screen, it’s already been acted on by institutional algos. These feeds weren’t edge—they were latency dressed as urgency.

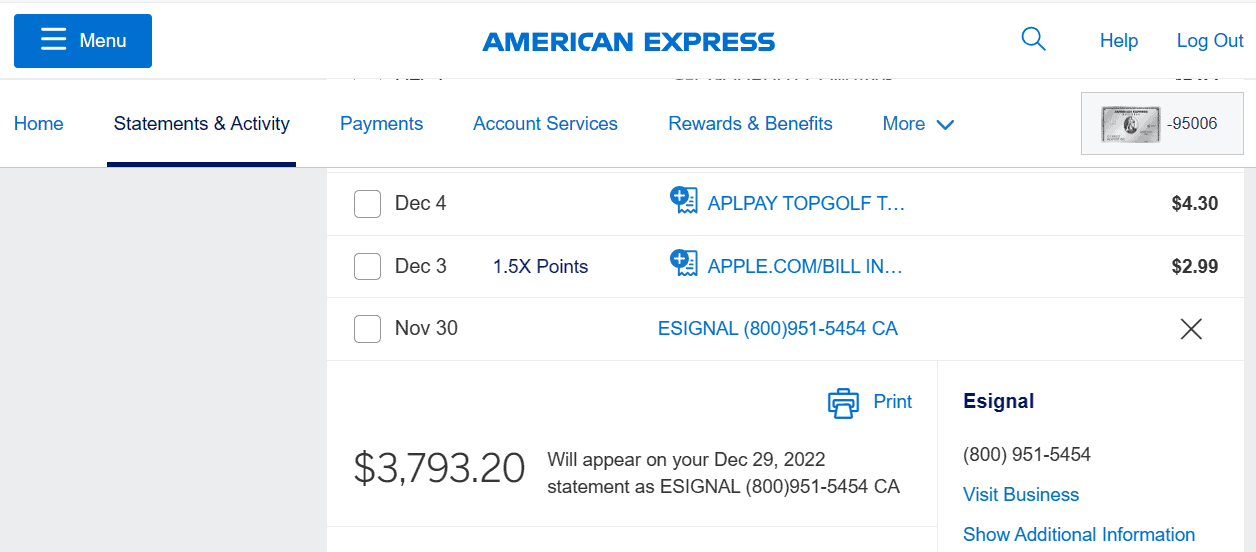

The eSignal Sinkhole

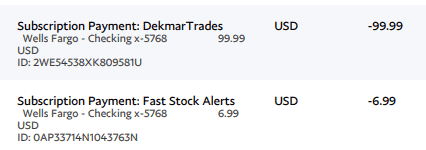

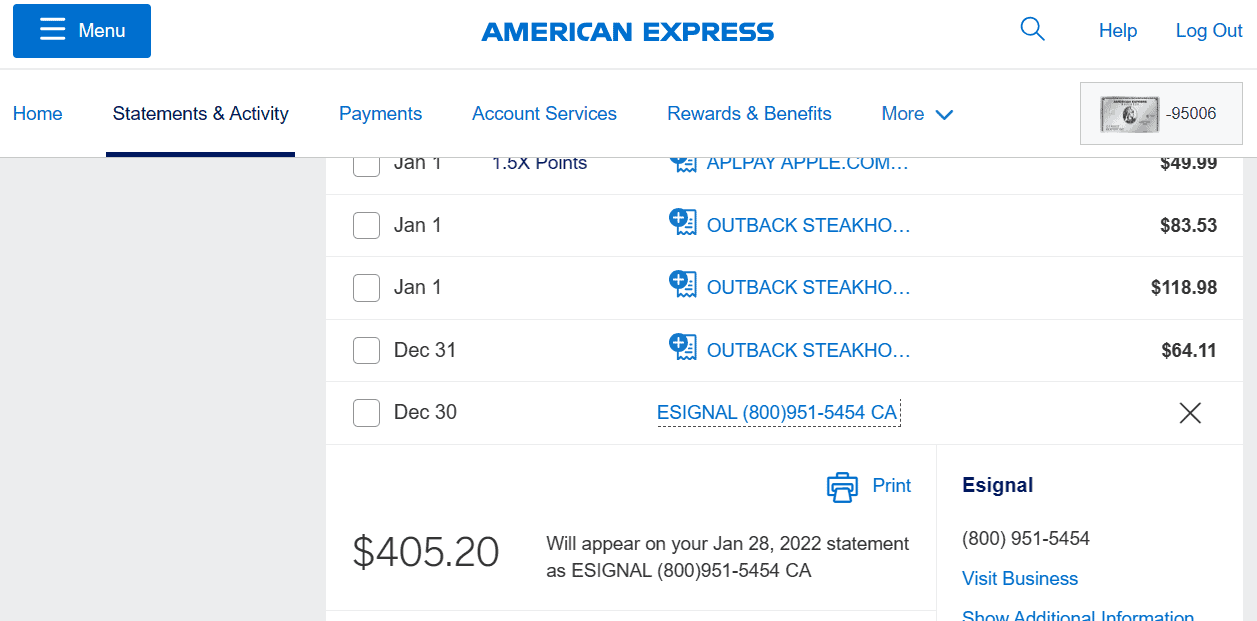

$1,949.20 more into eSignal. Different indicators, same result: I don’t use it today.

Another $405.20 to eSignal. Every time I thought I had what I needed, there was another “must-have” upgrade.

Affiliates, Kickbacks, and Hidden Profits

$1,495 to Millionaire Publishing. Big promises, no proof, and alerts that made zero impact.

$120/month to TJR Trades for mentorship. Another room I am no longer in.

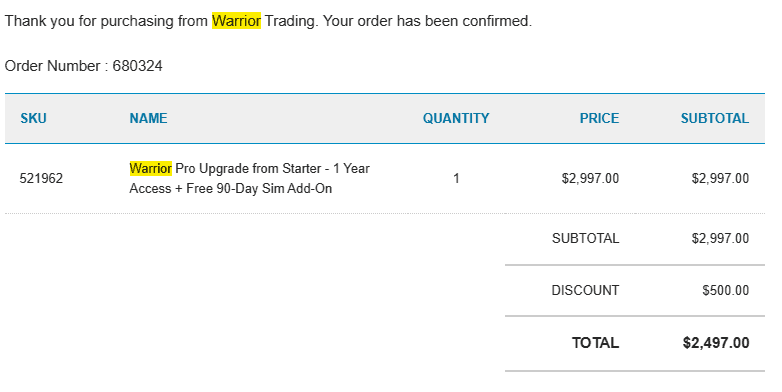

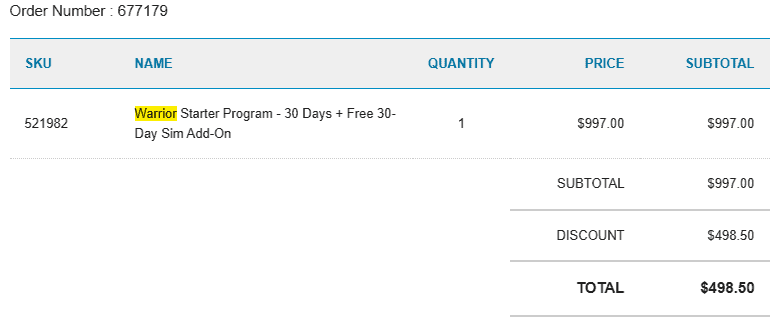

$2,497 to Warrior Trading. Ross trades live — but if you buy when he buys, you’re likely catching the top while he sells into you.

$498.50 for a “$997” Warrior Trading course. Ask for discounts — most of these guys aren’t making money from trading.

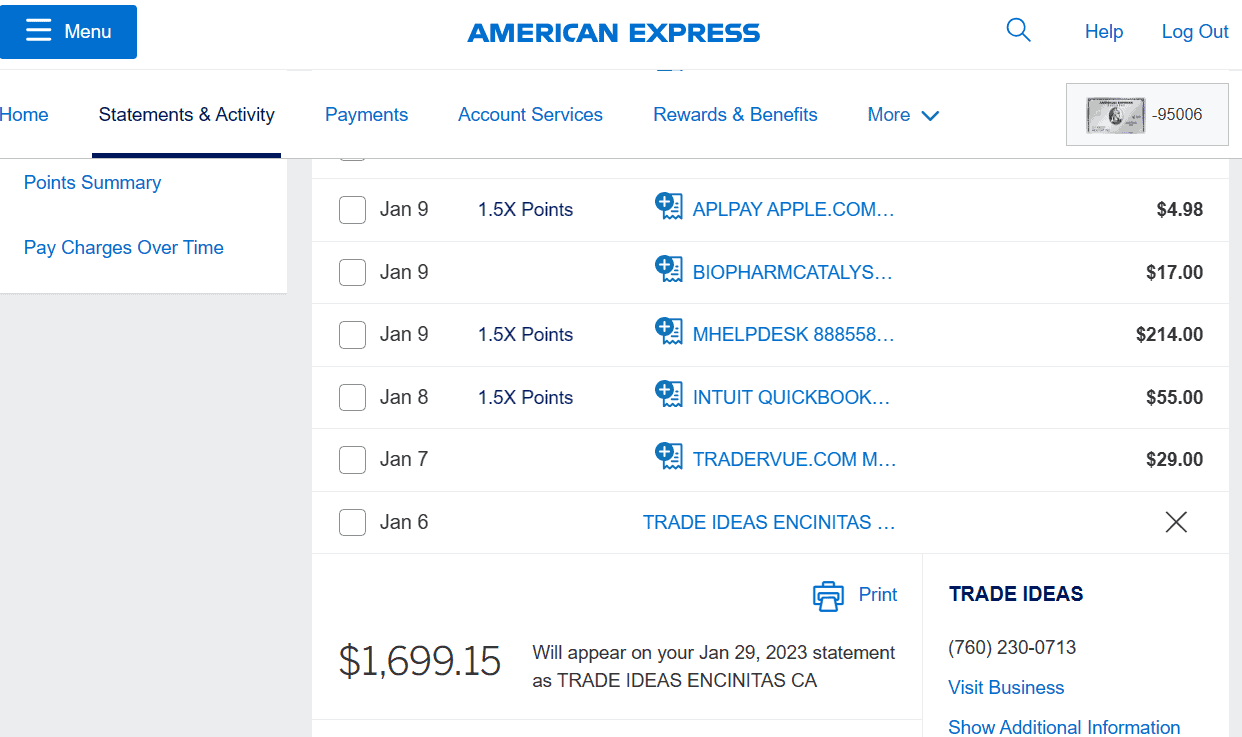

$1,699.15 to Trade Ideas — promoted by Dekmar. Most of these mentors get a cut of what you spend. It’s not about edge. It’s about profit — theirs.

The Only Thing I Still Use

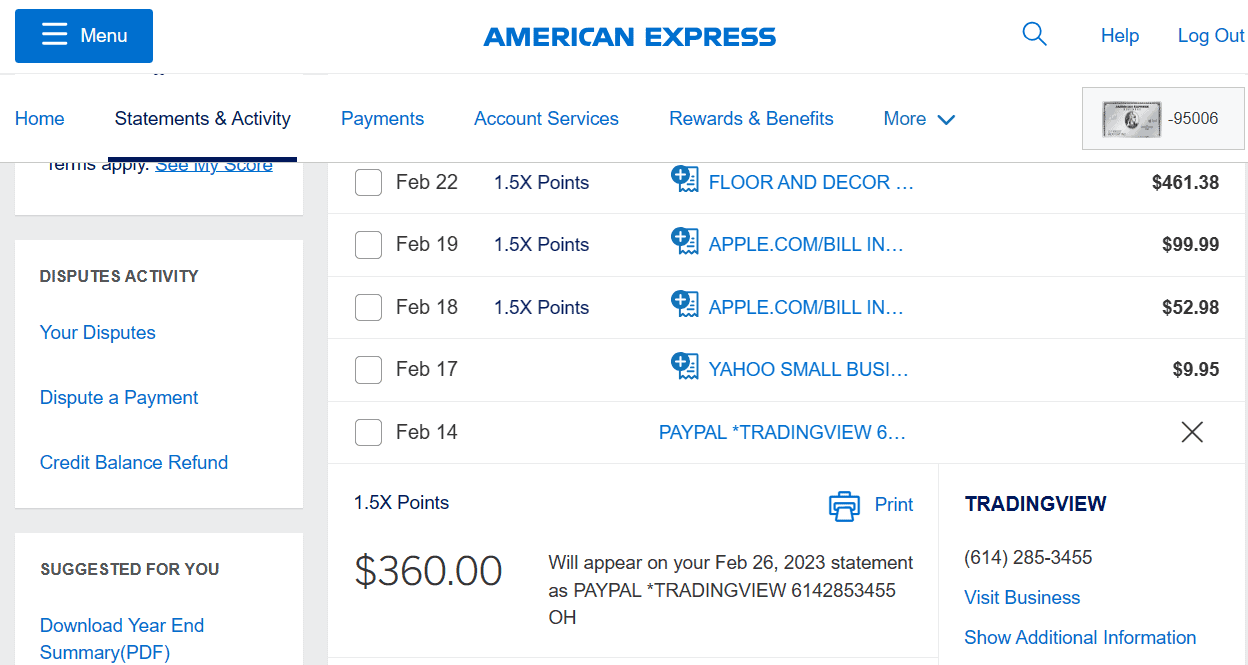

$360/year for TradingView. No affiliate link. No fluff. Just the one tool I still use — and I use zero indicators.

What Changed My Trading

Not one guru. Not one tool. Not one signal service. Just two books:

- Trading in the Zone by Mark Douglas

- The Disciplined Trader by Mark Douglas

If you’re not sure what works for you, please — read these two books. No links. No promo. Just truth.

Final Words: From One Trader to Another

It’s borderline embarrassing how much I spent trying to figure this game out. But now that I’ve come out the other side as a consistently profitable trader, I’m finally in a position to help someone else avoid all the noise.

I wrote this post to reach the person who won’t quit. The one who knows this journey is hard but believes it’s worth it. The one who is trying to stay afloat in a sea of marketing, fake gurus, and overpriced tools.

If that’s you, I hope this saved you money. I hope it helped you see through the fog. I hope it gave you clarity.

Don’t chase indicators.

Don’t follow hype.

Don’t trade someone else’s plan.

Trade your own.

And above all: Be disciplined. Every single day.