Ask any trader who’s lasted more than a year and they’ll tell you the truth:

The edge isn’t in indicators. It’s in discipline.

This blog isn’t about a flashy green day. It’s not about a new strategy, secret setup, or overnight success. It’s about how five Topstep Express-funded accounts — starting from practically nothing — quietly grew into over $43,000 by doing one thing right:

Trading small, copy-trading smart, and knowing when to stop.

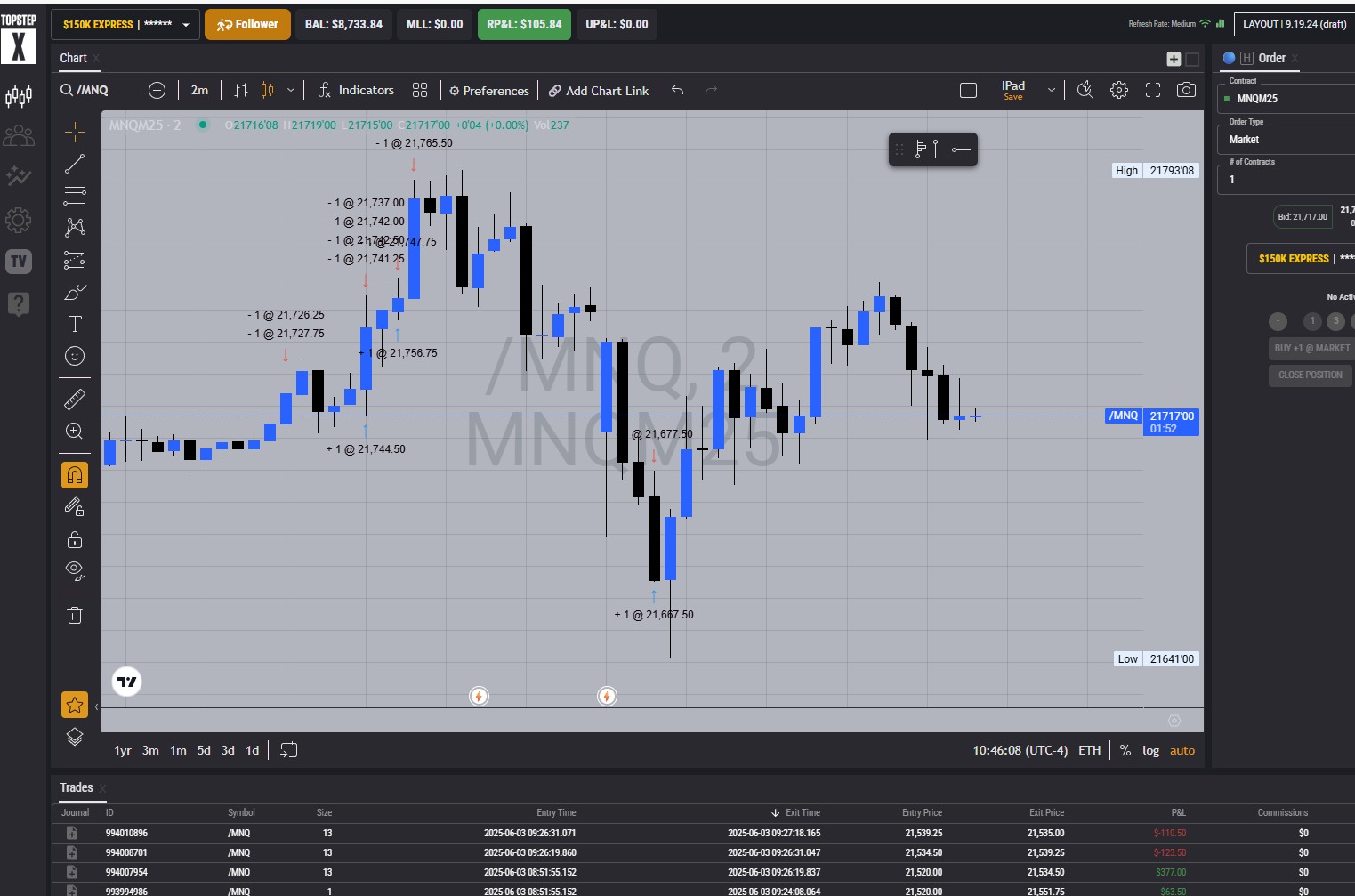

???? Real Talk: I Traded From My Car Today

I wasn’t at a fancy desk. I was in my car. An iPad jammed into a cup holder mount. Not ideal. Not recommended unless you’re experienced. But today, that’s where I was — and I still traded.

I knew I’d only be good for a couple clean trades. Anything more would risk error — overconfidence, revenge trading, oversizing. So I made the trades, followed my rules, and I stopped.

That’s the part no one teaches.

⚙️ The Setup: Copy Trading 5 Topstep Accounts

Here’s what I use:

- One Leader account

- Four Follower accounts

- All are $150,000 Topstep Express-funded accounts

- All trades are manually mirrored

- Same risk per trade, same entry, same exit

Simple. Scalable. Efficient.

Today’s realized profits:

- Leader Account: $74.34

- Follower 1: $80.34

- Follower 2: $103.34

- Follower 3: $105.84

- Follower 4: $88.34

Total Daily Profit:

$452.20

Not life-changing. But stack that up day after day — and it becomes something powerful.

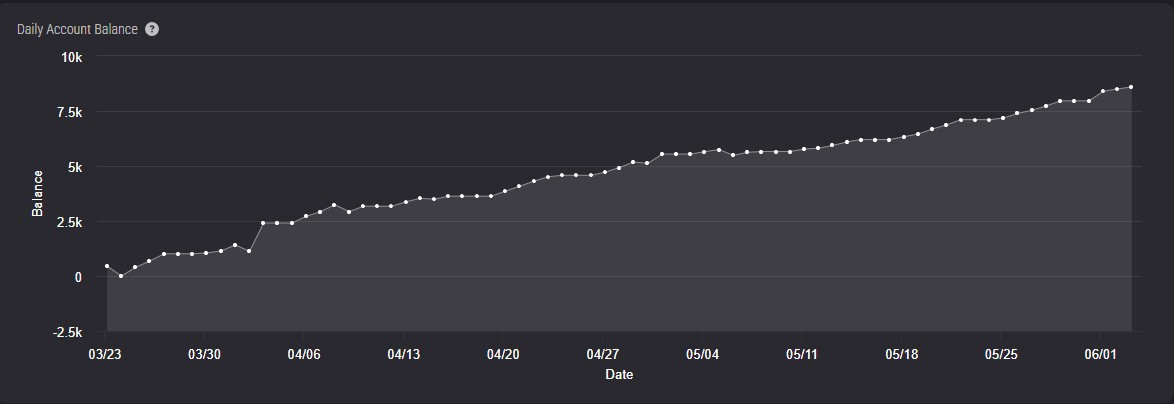

???? From $0.04 to $43,000: The Proof

Let me show you something that matters more than one green day: consistency over time.

That curve you see started on March 25th. My account balance?

$0.04. Literal pennies.

Today, across five accounts, the combined balance is:

-

-

- $8,656.38

- $8,824.10

- $8,774.34

- $8,733.84

- $8,593.84

-

Total: $43,582.50

This isn’t luck. This is what happens when you trade small, follow your rules, and stop when your edge is gone.

???? You Have to Learn When to Walk Away

Here’s the part most traders never master: knowing when you’re done.

You can have the best setup in the world — but if you’re tired, emotional, or trying to force trades, you will give it all back.

I’ve done it. We all have.

How many times have you turned a green day into red because you kept pushing?

How many times have you started with $100 in profit and ended the day down $200?

The difference between profitability and pain is knowing your limits.

I knew today that I wasn’t fully sharp.

So I stopped.

Even though I wanted to keep going.

Even though I “could’ve” made more.

???? Don’t Be Greedy. Be Consistent.

Last night I had dinner at Outback. It cost me $22 and it was amazing.

Today I made enough to buy 20 of those dinners — trading from a cupholder — and I still grew five funded accounts.

That’s the lesson:

You don’t need to crush it every day.

You don’t need to trade every move.

You just need to protect your equity curve.

Let the other traders chase dopamine hits and revenge setups.

You? Stack quiet wins. Compound. Walk away green. Repeat.

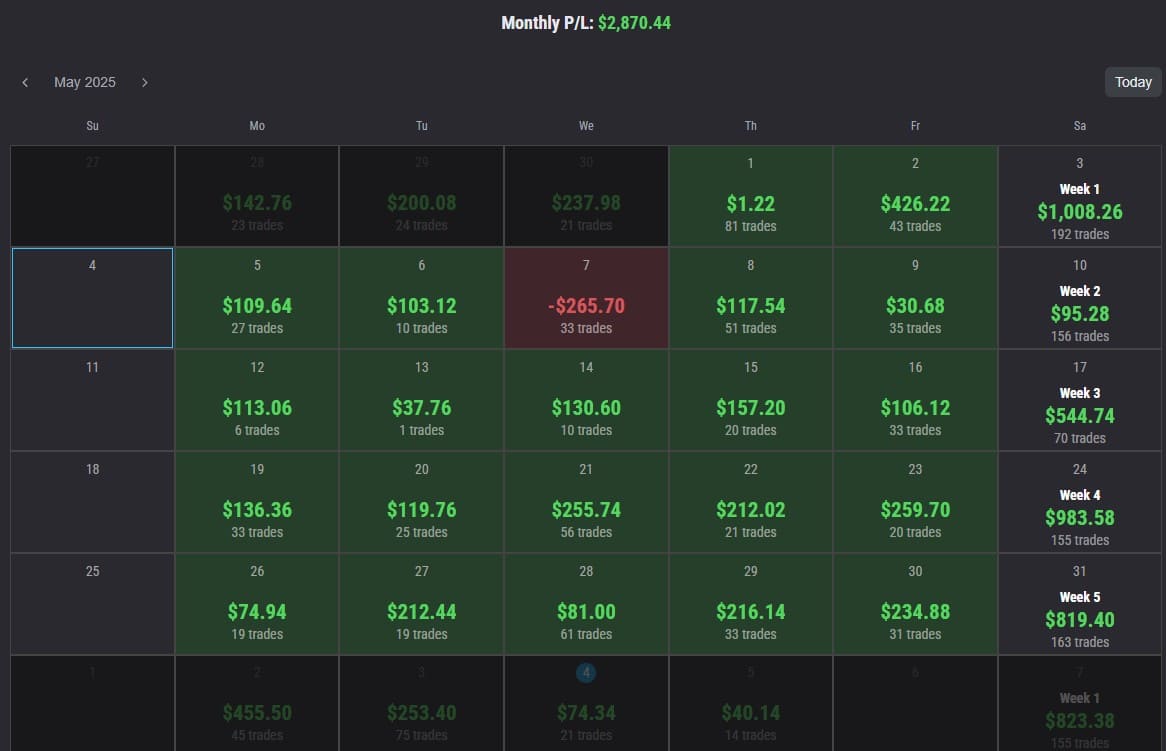

And to prove it’s not just today — here’s a snapshot of my Topstep calendar. Today marked 20 consecutive green days. Every one of them small, controlled, and copy-traded across five accounts.

Stacking small wins like this doesn’t just build your balance — it builds confidence, emotional control, and consistency. Multiply that by five accounts, and this is how real progress happens.

???? Final Thoughts

-

-

- Small trades add up.

- Copy trading can scale consistency.

- Discipline is the edge.

- Stopping is a skill.

-

If you’re struggling with overtrading, chasing, or burning yourself out — maybe it’s not your system.

Maybe it’s just time to draw the line and say: “That’s enough for today.”

Because $43,000 didn’t come from going harder.

It came from knowing when to stop.