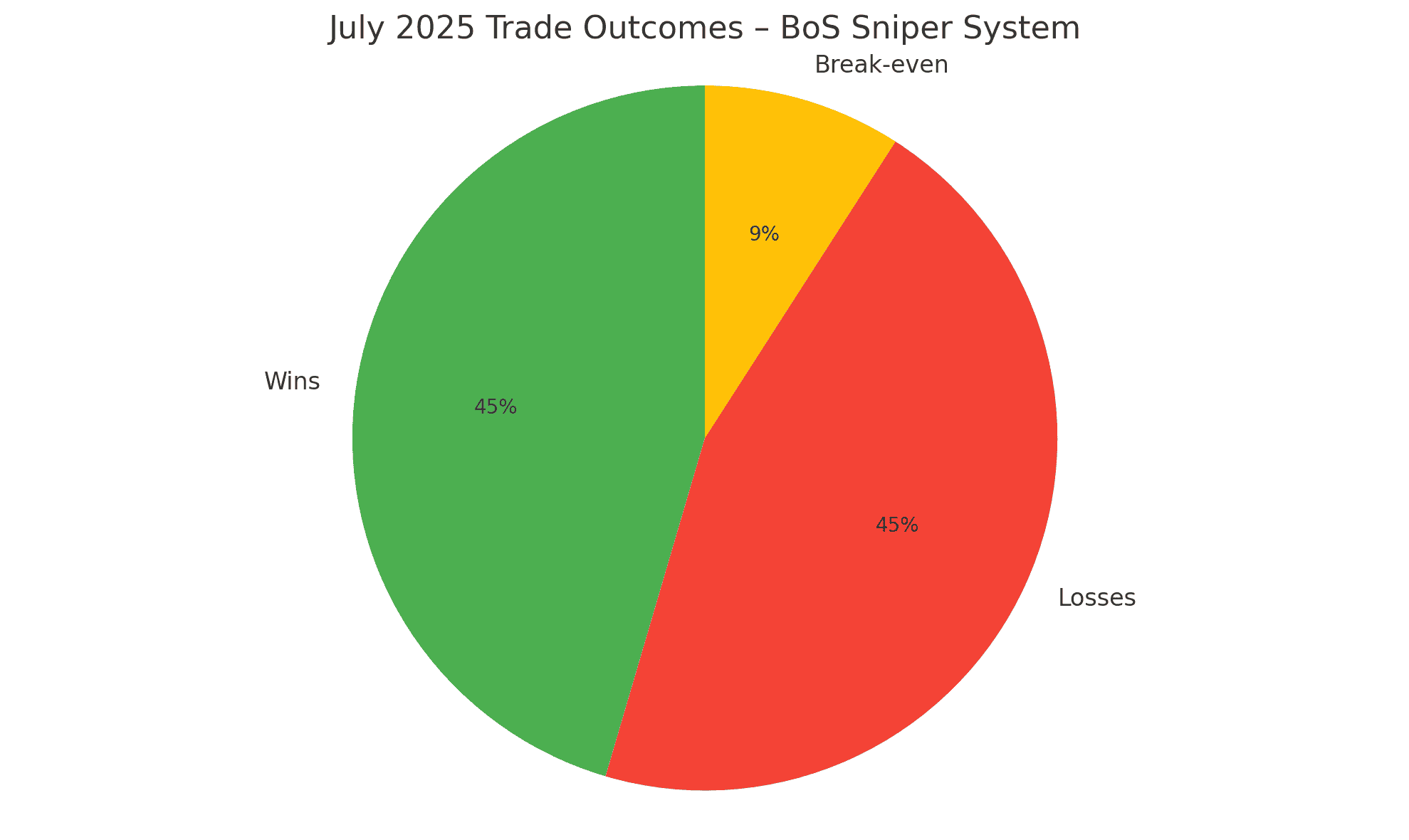

Another tough day? Yeah, it feels like it. But when we zoom out and look at the actual data — it’s not even close to a catastrophe. Today’s BoS Sniper entry was textbook. High volume into an order block, confirmed Break of Structure on the one-minute chart. We took the trade. It rallied… and then it stopped us out. It happens.

But here’s the part that matters: we followed the rules. We took the setup. We didn’t panic. We didn’t flip sides. We didn’t chase. We executed the system exactly as designed.

This is what so many traders get wrong. They want every trade to win. They want immediate results. But this game doesn’t reward neediness. It rewards discipline and repeatability.

Ask yourself:

- What version of you would have already blown up your account by now?

- What version of you would have ditched this system after two or three losses?

- What version of you would have revenge traded and wiped out thousands of dollars just to “get it back”?

If you’re here and still trading clean, still following the rules, still letting the data lead the decisions — you’re already 90% ahead of the crowd.

But you have to build up scar tissue. That means emotionally detaching from the outcome of each trade. Win or lose — it’s just another day at the office. When you show up consistently, execute your system, and protect your risk, the edge will take care of the rest — over time. I’m constantly evaluating my edge, but I don’t make changes based on emotions or individual outcomes. I wait for a sample size of at least 20 trades before even beginning to assess what’s working and what needs refinement.

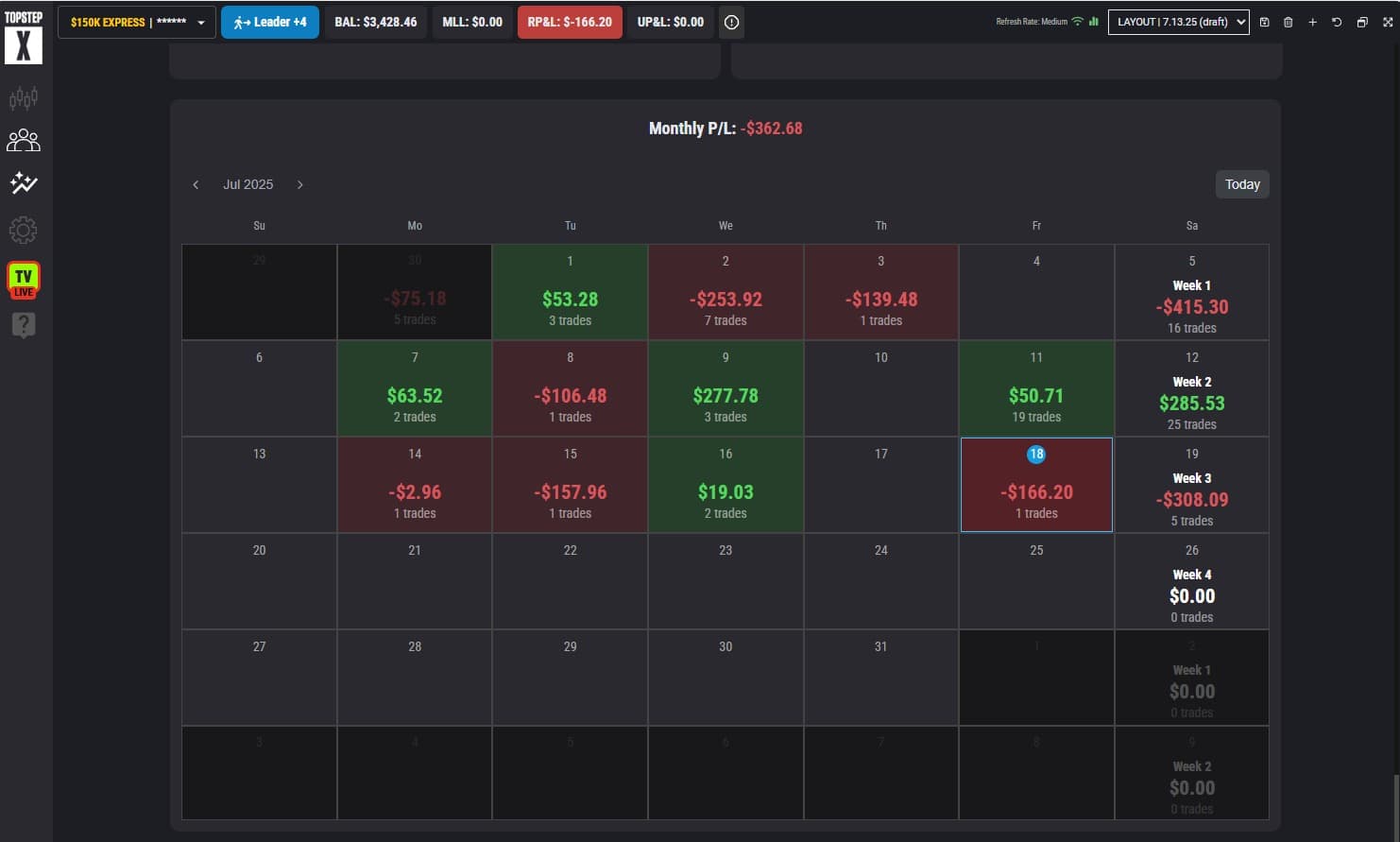

Today’s trade cost us $166.20 per funded account. Five accounts. Full transparency. That’s not failure — that’s structure. That’s execution. That’s how real traders trade.

And even though it’s felt like we’re getting beat up this month… the numbers say otherwise.

We’re only down $362.68 this month. That’s one decent TP2 winner from flipping this whole thing into green. And we’ve only had one day that even hit TP2. That should fire you up.

This chart tells the truth. There are wins. There are losses. But we’re staying tight, controlled, and consistent. And here’s the hard truth most people don’t want to hear:

Trading full-time doesn’t happen because you “want it.” It happens after you’ve proven, over time, that you can trade with edge and emotional control.

If you’re trying to make trading your only source of income, this is what you must go through. The ups, the downs, the flat months, the heartbreakers, the near misses. Having a system is just the starting point — staying disciplined enough to execute it consistently is what gives you a real shot at long-term success.

This is trading. This is what you have to do to be successful. You must stick to an edge long enough to analyze the results and build the muscle memory that makes execution automatic.

We’re not stopping this BoS Sniper system anytime soon. The only thing that would be unacceptable right now is quitting.

So ask yourself again…

- What version of you are you showing up as today?

- Is it the one that folds under pressure?

- Or the one that doubles down on discipline and keeps showing up for the next trade?

One setup. One trade. One job. Let’s go again tomorrow.