Are you serious about becoming a consistently profitable trader?

Because if you are, you need to hear this: trading is not about being right. It’s not about winning every day. It’s about building an edge—and sticking to it long enough for that edge to reveal itself. That’s why I trade like a blackjack dealer. I’m not here to guess—I’m here to run the table. I’m the casino. And the casino doesn’t flinch.

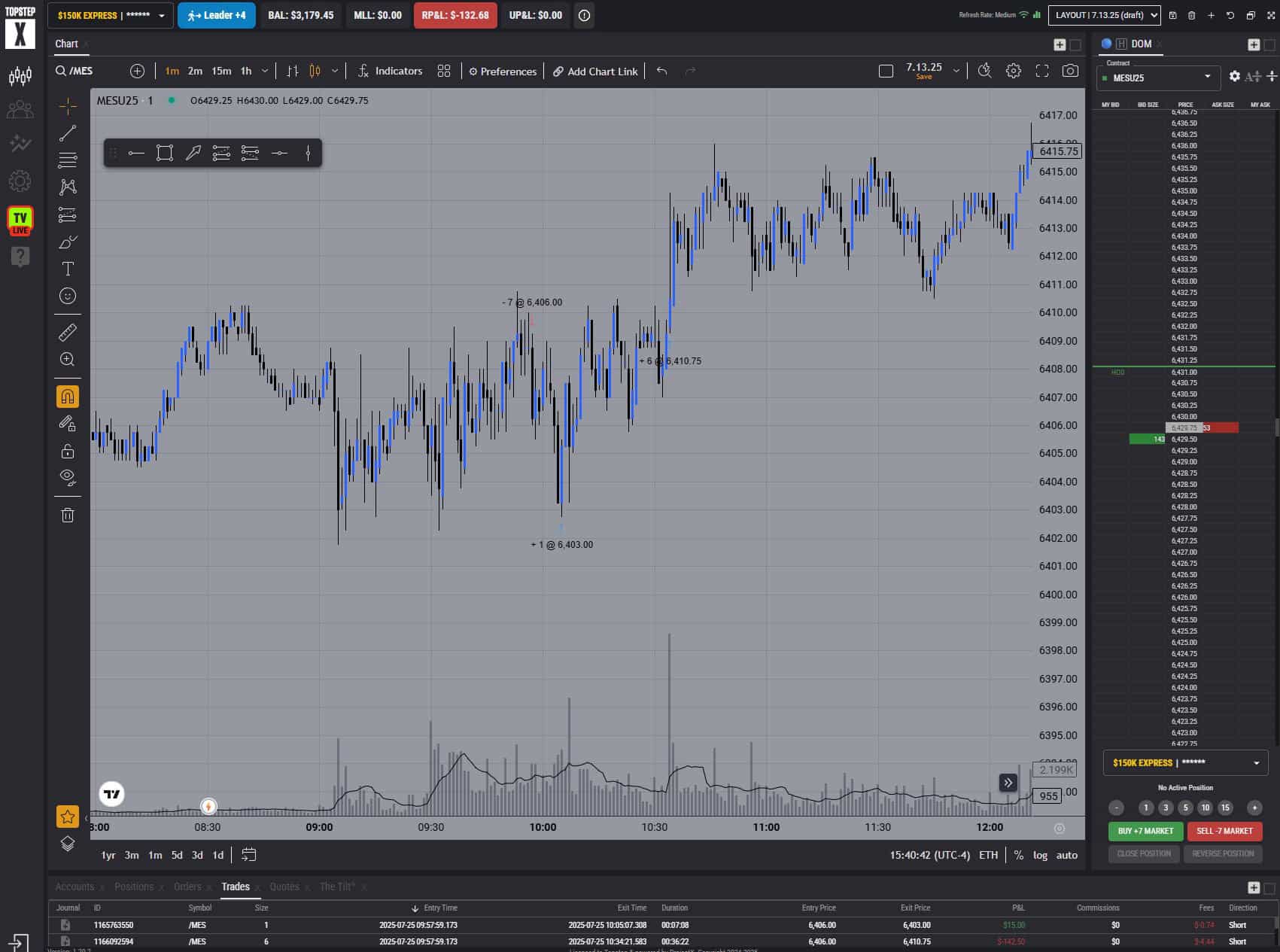

✅ Today’s Setup (July 25, 2025)

At 9:53 AM EST, price retraced into a 1-hour Fair Value Gap, swept 15-minute liquidity with volume confirmation, and confirmed with a clean 1-minute Break of Structure to the downside.

I entered with $150 total risk across 7 contracts. I scaled out one contract at opposing 15-minute liquidity, and left the rest open. I didn’t move my stop to breakeven because the target was close. The market ripped against me. Final result: $133 loss.

📈 20-Trade Challenge Progress

I’m currently on Day 8 of 20 in this challenge. One trade per day. No flips. No re-entries. No emotion. Just sniper execution, every single day. Here’s where we stand:

- 3 Wins

- 4 Losses

- 1 Break-even

Win Rate: 42.86%

Average Win: $25.05 (Only TP1 Trades)

Average Loss: $157.32

🧠 Real Trading Psychology

Now ask yourself: if this were your P&L… would you panic? Would you throw out your strategy and start guessing again? Would you think you don’t know what you’re doing?

Because I don’t. I think this is beautiful.

What I see is control. Discipline. No revenge trades. No spiraling. Just one clean trade a day—win or lose. I’m not trying to catch every candle. I’m trying to build something that scales. That repeats. That works over time.

If you can’t handle 3, 4, or even 5 losses in a row… then you have no business trading. This is the work. This is the cost of owning the edge. The money can’t help but show up—if you can hold the line long enough to let it.

♠️ You’re the Casino. Act Like It.

Think about blackjack. The house doesn’t panic when a player wins three hands in a row. They don’t rewrite the rules mid-shift. Why? Because they know the odds are on their side. They just keep dealing. One hand after the next.

You’re the casino. You don’t flinch. You follow your system. You manage your edge. And you don’t get emotional when the game runs cold. You run your table with consistency and class—and when the math plays out, you get paid.

This is what professional trading actually looks like:

Not theory. Not backtests. Not hope.

Just real trades. Real rules. Real growth.