Date: July 17, 2025

The Setup Was Perfect — But the Time Wasn’t

This morning gave me everything I could’ve asked for:

- A clean liquidity sweep

- A textbook pullback into a 15-minute order block

- Elevated volume confirming the reaction

- A one-minute Break of Structure exactly like we look for

The setup was beautiful. Even the macro news was on our side. Everything aligned — except for one thing: the time.

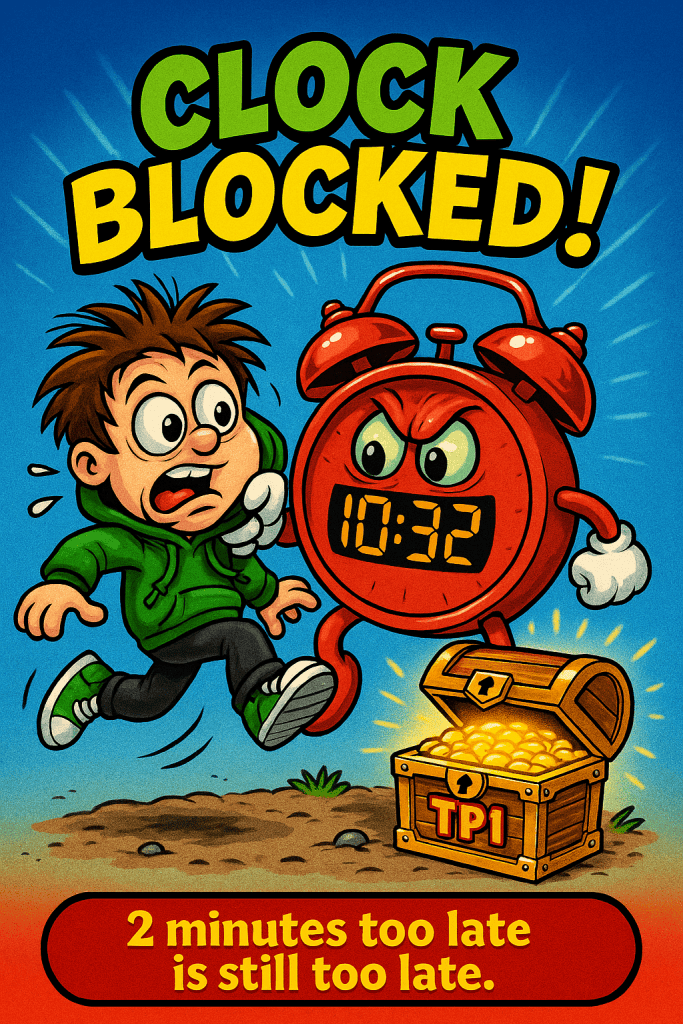

The entry fired at 10:32 AM. And our system rules are clear: Entries are only valid between 9:30 and 10:30 AM. No exceptions.

The Trade That Triggered — But Couldn’t Be Taken

The perfect BOS Sniper setup — liquidity sweep, order block, high volume, and structure break. But it came 2 minutes too late.

Why 2 Minutes Matters

Could I have taken the trade? Yes.

Would it have been a winner? Absolutely.

But I didn’t take it — because I’m not just trying to win today. I’m trying to win forever.

If I break the rules today, I’ll justify breaking them tomorrow. And once that happens, I’m no longer following a system — I’m reacting. I’m improvising. I’m gambling.

Discipline is the only real edge in trading. Not a setup. Not a candlestick pattern. Not even volume. It’s consistency. It’s structure. It’s doing the same thing every day — and letting the edge prove itself over time.

The Setup Worked Anyway — But That’s Not the Point

Here’s the kicker: the trade did work. It went straight to TP1 with precision.

The setup worked. Take Profit 1 was hit clean. But it fired at 10:32 — and that meant no trade.

You Can’t Measure an Edge You Don’t Follow

Could I have made money today? Yes.

But what I care about more than money is consistency. If I keep taking trades outside of my plan, then I can’t evaluate my plan. I can’t refine it. I can’t trust it.

If you’re not evaluating your edge over 20–30 trades, then you’re reacting emotionally, not systemizing. And if you keep adjusting the rules mid-stream, you’ll never know if it works. You’re corrupting your data every time you “wing it.”

Even a win outside the system is a loss in disguise.

Zero Trades, Full Credit

I didn’t make money today — but I earned something far more valuable: trust in my system. And that’s what scales.

Zero trades taken. The system said no — and I listened.

Final Thoughts

I wanted to be in this trade. I would have been happy with the money. But I would’ve known — deep down — that I didn’t follow my rules. And if you’ve been trading for any length of time, you know how that eats away at you.

That’s why I didn’t take it. Not because I didn’t want to — but because I want something more: scalability, trust, and long-term profitability.

You cannot make exceptions when you’re evaluating your edge in the markets.

Your edge only works if you follow it without exception. The moment you start making exceptions, you’re not the house anymore—you’re the gambler.

🚀 Stay Disciplined. Stay Connected.

Follow @edgeucated on X for daily trade insights, strategy breakdowns, and real-time accountability.