Trust Your Edge or Get Drowned Out by Noise

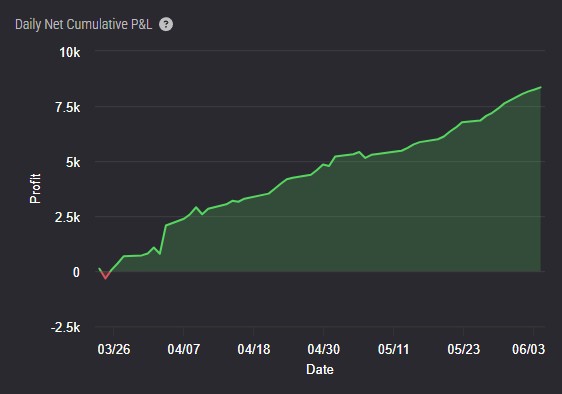

Once you’ve found your edge—really found it—you don’t need the internet’s permission to trade. You don’t need advice from people who never post their P&L. You don’t need anyone’s validation. Because I’ve been there. I’ve built something that works. And I’ve been judged at every step of the way. Here’s what consistency looks like—five funded Topstep accounts, traded using the same 2-minute BOS strategy, stacking small wins day after day.Equity Curve: From Red to Green and Climbing

This is what trusting the process looks like. Every tick up was earned. Every pause was survived. Speaking of survival…

Cumulative profit chart from Topstep showing over $8,000 in gains from March 26 to June 3—compounded across five funded accounts using small, consistent trades.

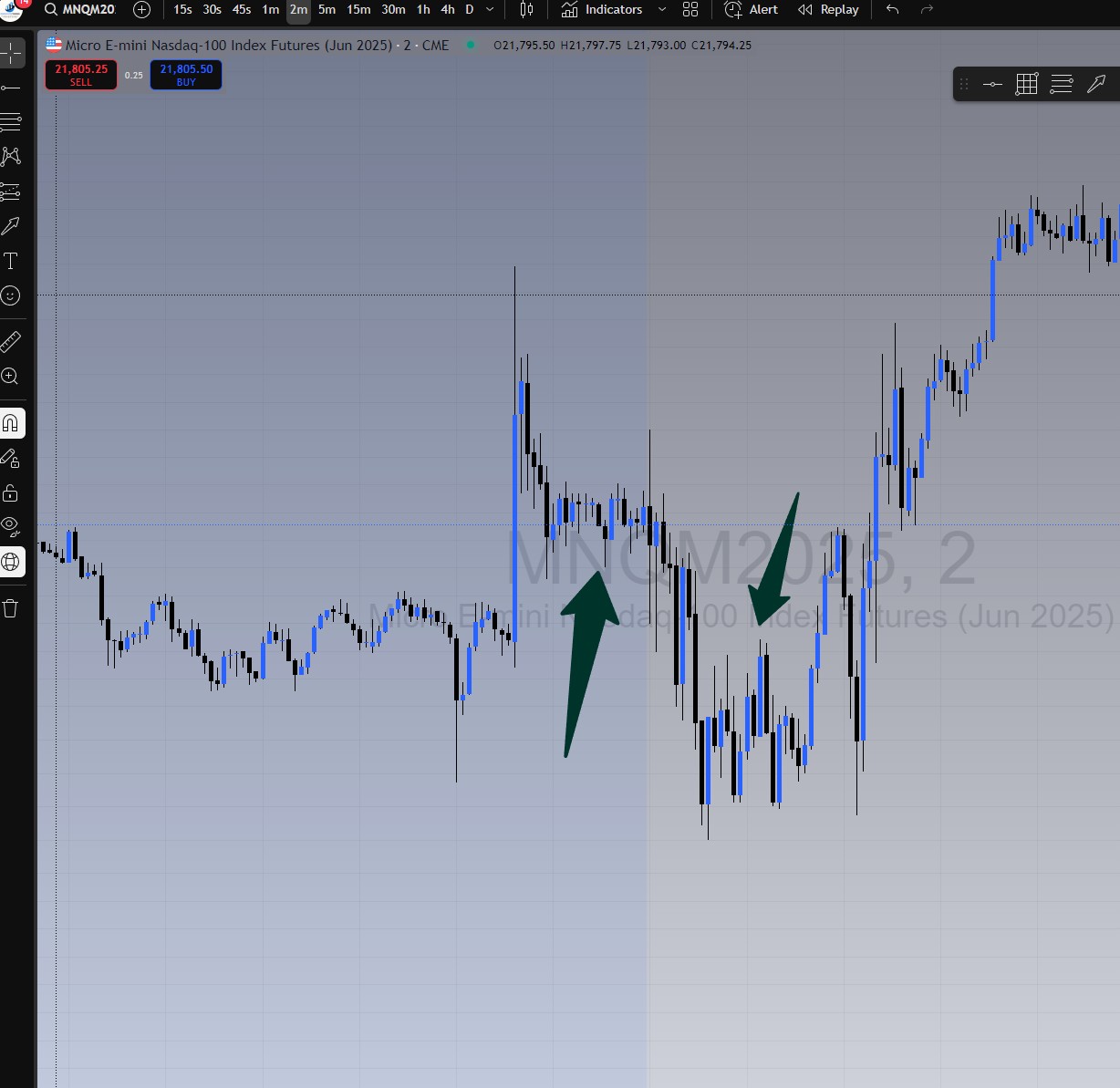

The Chop Is Where Most Traders Die

This is the market before the big moves. Most traders panic here. They give up. They force something. I don’t. I wait. That’s what makes the breakout matter.

Two 30-minute consolidation zones marked by green arrows—this is where most traders lose their edge. Survive the chop, and the move will come.

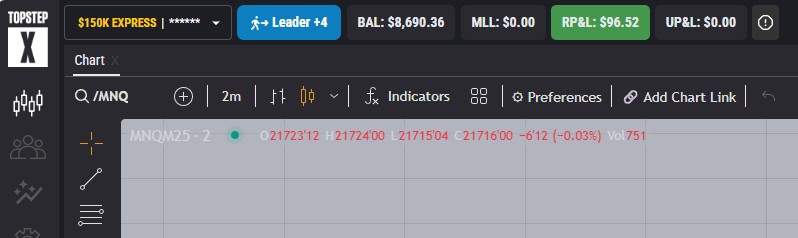

The Accounts Don’t Lie

These are real accounts. Real trades. Real money.

Topstep dashboard snapshot: Realized profit of $96.52 with a growing balance of $8,690.36—proof that small, consistent wins add up.

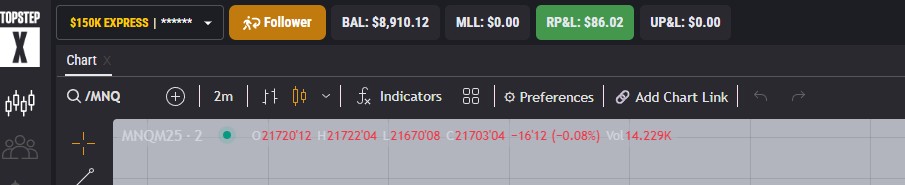

Follower Account 1: Realized profit of $86.02 with a balance over $8,900—just one of five accounts compounding the same strategy.

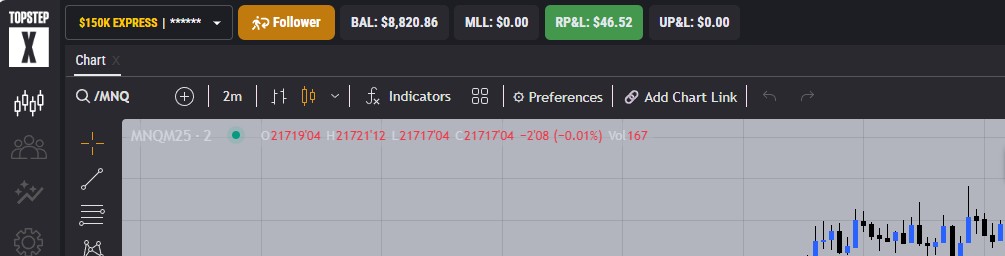

Follower Account 2: $46.52 in realized gains and an $8,820.86 balance—proof that the same edge works across accounts.

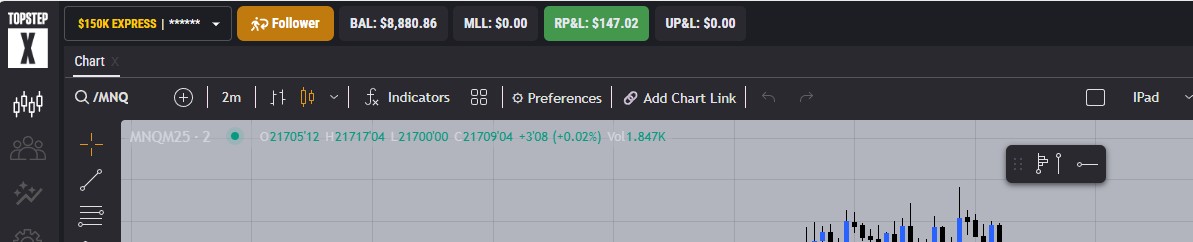

Follower Account 3: $147.02 in gains and an $8,880.86 balance—another piece of the compounding puzzle.

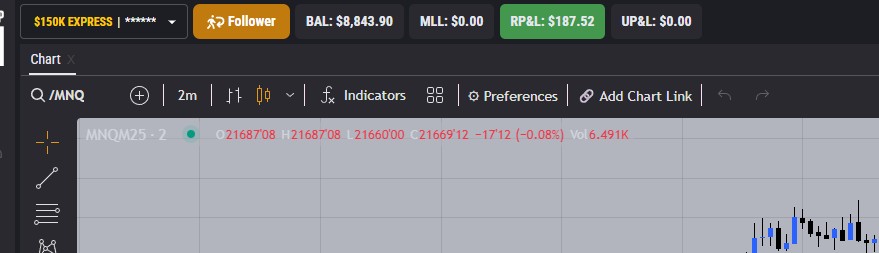

Follower Account 4: $187.52 in profit and $8,843.90 in balance—closing out the five-account copy system with strength.

📌 Combined Account Value: $44,146.10

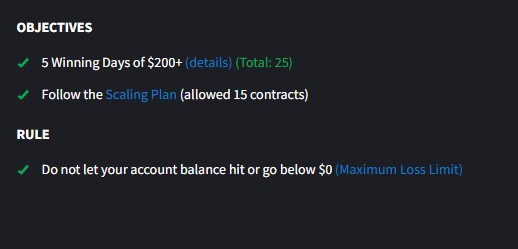

Progress snapshot: 25 days over $200 on a Topstep Express account—just 5 away from unlocking unlimited daily withdrawals.

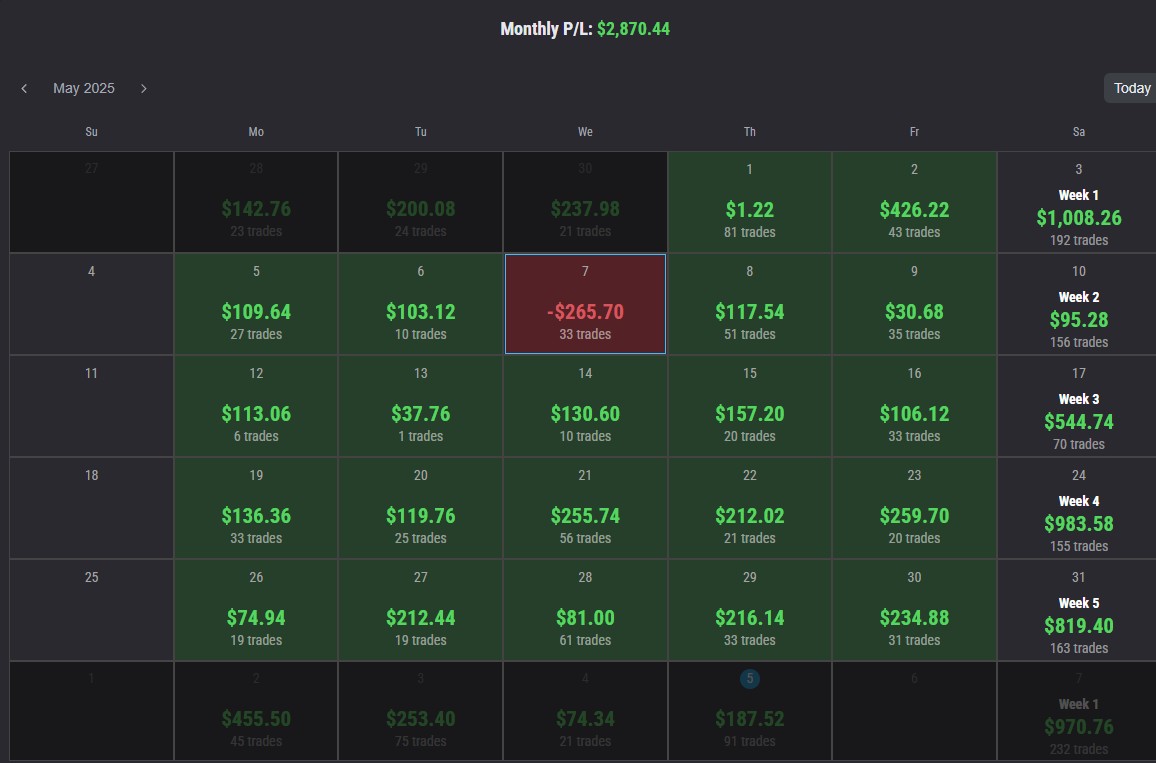

21 days in a row—every box green. This is what it looks like when discipline meets consistency.