For a long time, we traded every 1-minute Break of Structure (BoS) flip. The idea was simple: if price breaks structure, it’s a potential opportunity. And it worked—on paper. We passed Topstep challenges, had profitable days, and built confidence in the concept.

But underneath the surface, something wasn’t right.

We weren’t building something scalable.

The Problem with the BoS Flip System

The 1-minute BoS flip strategy produced a 54% win rate, which sounds acceptable. But it came at a cost:

- Too many trades in a short window

- High mental fatigue

- Constant exposure to chop

- Inconsistent execution

- No real edge beyond reacting to structure

We weren’t filtering for quality. We were reacting to every move. And that turned us into gamblers, not traders.

The Evolution: Introducing the BoS Sniper Strategy

We stepped back and asked a better question:

What if we only traded where traders were trapped?

That’s when the 1-minute BoS Sniper System was born. Instead of reacting to every break, we wait for the market to sweep a key liquidity level—like the overnight high, previous day’s high/low, or a major 15-minute swing.

Only then—after the trap is sprung—do we look for a confirmed 1-minute BoS. The candle must close with conviction above or below structure to qualify.

This isn’t about being in every move.

This is about catching the right move.

Sniper BoS vs. BoS Flip: The Honest Breakdown

Here’s the no-BS truth. Both systems can work. But only one is built to scale.

| BoS Flip System | Sniper BoS System | |

|---|---|---|

| 🎯 Setup Quality | Every structure break (no context) | After liquidity sweep + volume + structure |

| 🔁 Frequency | 3–6 trades per day | 1 trade per day (maybe 2 max) |

| 💥 Emotional Cost | High: Overtrading, chasing, tilt | Low: Structured, rule-based |

| ⚖️ Risk-to-Reward | Inconsistent, often mid-move | Clean RR with potential for big runs |

| 📈 Scalability | Difficult across multiple accounts | Built for 5 Topstep accounts, IBKR, etc. |

| 🧠 Psychological Edge | Erodes fast, constant second-guessing | Strengthens with every session |

Why the Sniper Strategy Wins Long-Term

- Higher Win Rate

You’re not reacting to noise. You’re entering only when emotion and liquidity collide. - Bigger Risk-to-Reward

These setups occur at the beginning of major moves—right when the trap springs. - Lower Trade Frequency = Better Execution

1, maybe 2 setups a day. No revenge. No FOMO. Just clarity. - Scalability

You can confidently apply this system to multiple Topstep accounts and retail brokers without breaking a sweat. - Mental Control

Fewer decisions. Cleaner mindset. No more burnout from “what ifs” or late flips.

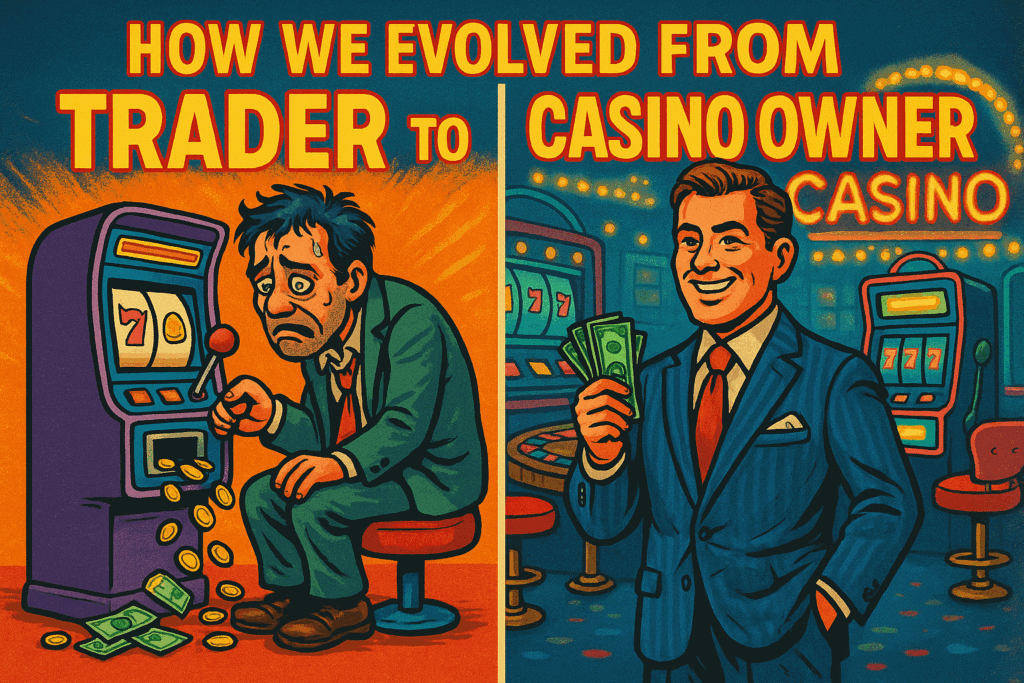

From Gambler to Casino

With the BoS flip system, we were the player.

We had a slight edge, but not enough to endure variance without psychological damage.

With the BoS Sniper system, we are the casino.

We built the slot machine, and it only accepts setups where the odds are in our favor.

The setup isn’t always there—and that’s the point.

No signal? No trade.

And that discipline compounds.

What Actually Matters

Yes, the old BoS flip system might’ve caught a move the past few days.

But that’s not the question.

The real questions are:

– Can I scale this with confidence across 5 accounts?

– Can I execute this without second-guessing or burnout?

– Will this produce a positive curve I can actually follow for 200+ sessions?

The Sniper answers yes to all of those.

It won’t always catch the big move. But it also won’t drown you in chop, indecision, or revenge trades.

Missing a move is survivable.

Chasing every one is not.

Final Thoughts

If you’ve been trading every little structure break and wondering why your results feel random, it’s not you—it’s the system.

The market is full of noise.

We just learned to wait for the scream.