???? Just Because You Can Trade, Doesn’t Mean You Should

Ask any consistently profitable trader, and they’ll tell you the same thing: some days just aren’t worth it. But how do you know when it’s one of those days?

Today — June 24, 2025 — was one of those days. I didn’t trade. And I’m going to walk you through exactly why — with charts, proof, and mindset.

If you’re serious about trading, you have to accept a tough truth: the market doesn’t hand out money every day. This isn’t a get-rich-quick scheme. Some days, the best move is to keep your capital safe and live to fight another day. That’s the skill nobody on YouTube wants to teach you — but it’s the one that will actually keep you in the game.

???? Pre-Session Volume Was a Warning

At 9:15 AM, our custom pre-session volume indicator printed 188.92%. Now that might sound high — but compared to days where the market’s ready to rip, this is low energy. There was no news catalyst. No fresh story. No fuel for the fire. That’s your first clue.

⚠️ No Clear Direction Before 9:30

The market gave us no structure before the bell. The first signal didn’t come until after 9:30 — a short at $22,277.50. And it didn’t feel right. I didn’t trust it. Why? Because directionless chop before the bell often leads to continued confusion after it. And that’s exactly what happened…

???? Two Minutes Later: Flip Long

The BoS strategy flipped long just two minutes later at $22,304.50. If you had taken the short, you’d be down 27 points instantly — that’s a $54 loss per MNQ. This is what we call whipsaw, and it’s deadly for short-term traders without a system or mentor guiding them.

???? And Then? Flip Back Short… For a 50¢ Loss

Right after flipping long, the system flipped back short at $22,304. That’s a 50-cent reversal. If you’re trading both sides of this chop, you’re losing — fast. This isn’t a strategy failure. This is market indecision. And this is why I sat out.

⏰ 10:01 AM – Still No Direction

By 10:01 AM, we were still getting no clean follow-through. Wicks, reversals, indecision. If you tried to trade this session short-term, you likely got chopped up. If you traded today, you probably lost.

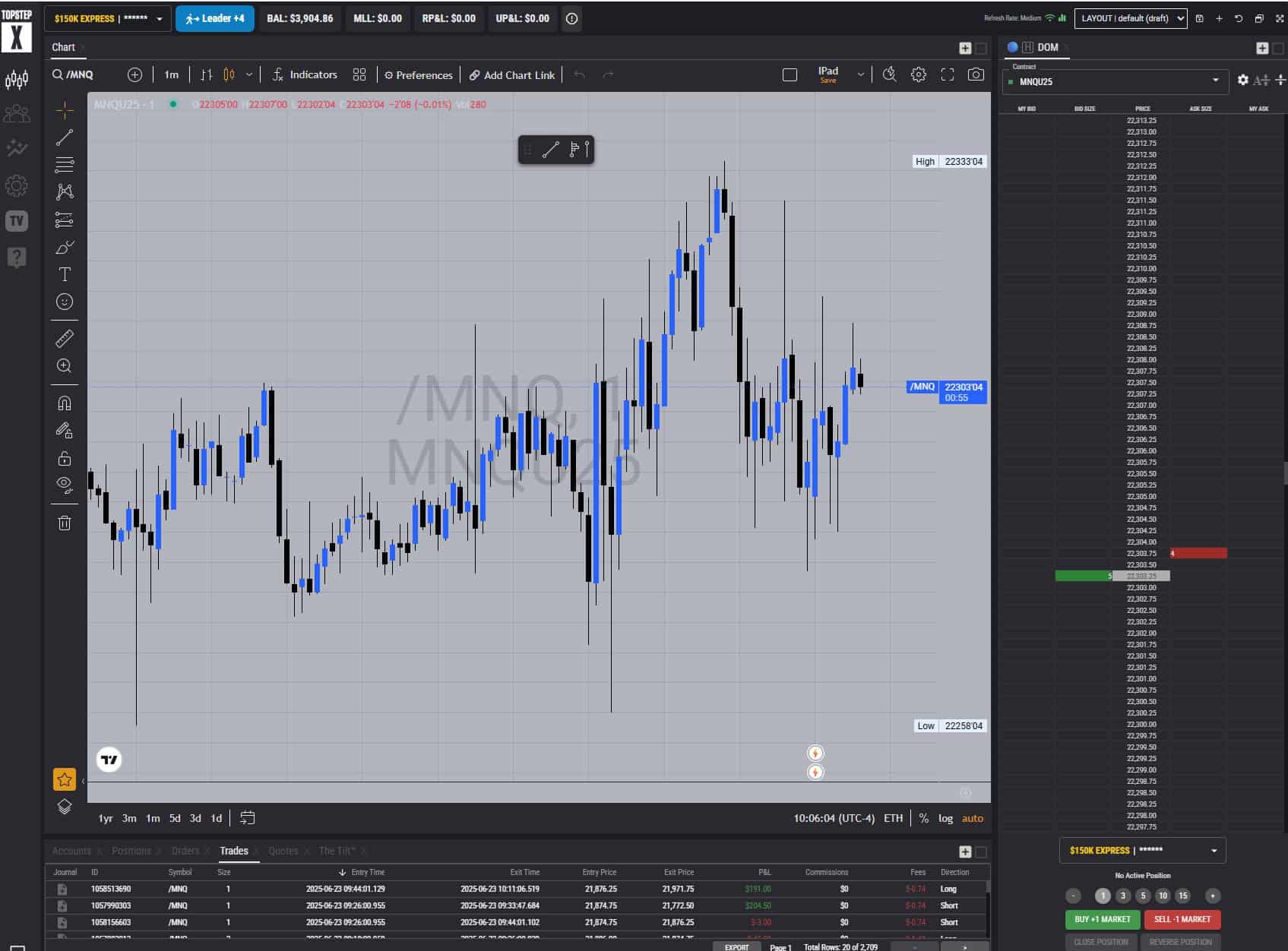

???? Proof: I Didn’t Trade Today

This is a screenshot of my Topstep account. Not a single trade on June 24. The last trades you see here were from June 23. Why? Because knowing when not to trade is part of the job. Could I have made money? Maybe. But I didn’t subject myself to the emotional seesaw of this session — and that’s the win.

???? 10:18 AM – Still Whipsaw After the Session

This chart was taken at 10:18 AM, after our trading session officially ended. The market still hadn’t chosen a side. That final flip would have lost too. This entire session was untradable — a perfect storm of indecision, whipsaw, and false signals.

???? There Are Days You Just Shouldn’t Trade

This was one of those days.

If you’re relying on indicators alone — you’re going to lose days like this. Every single time. Indicators can’t read the environment. They can’t tell you when not to trade. That takes experience, discretion, and mentorship.

If I’m not your chosen mentor, make sure whoever you’re learning from is actually profitable — and shows you their P&L. Don’t follow voices who only speak with hindsight.

???? Want to Trade Smarter with Us?

Join our private Discord where we trade live, share strategy, and help you learn when not to trade — just like today.

The market doesn’t pay you every day. This isn’t about hype. It’s about consistency. Today, the win was walking away — and this breakdown proves why.