???? The Hardest Skill in Trading: Knowing When Not to Trade

Most people think trading is all about knowing when to buy and sell.

But if you’re trying to trade without participation, you’re not trading — you’re gambling.

Today’s market gave us a masterclass in restraint.

The signals were there. The volume wasn’t.

And that’s exactly when you walk away.

???? What Is Pre-Session Volume — And Why Does It Matter?

Every morning before the market opens, we look at how much volume has come in from midnight to 9:15 AM. This pre-session volume tells us:

“Is there real interest in today’s market, or is it going to be slow, choppy, and filled with traps?”

That number is compared to the average of the last 10 days.

The result? A pre-session volume percentage.

If that number is high, it means traders are already active before the bell — likely leading to strong moves.

If it’s low, that means… well, the poker table is empty.

???? The Poker Table Analogy: When Volume Equals Players

Think of trading like playing poker at a casino.

If you walk into a room and the table’s empty — maybe one bored guy and a dealer yawning — should you sit down and risk your stack?

No way.

You want action. You want volume. You want a room that’s alive.

| Pre-Session Volume % | Poker Table Equivalent | Trading Implication |

|---|---|---|

| 200% or more | Table is packed, chips flying, high energy | ✅ Ideal conditions — play with size |

| 150% – 199% | 5–6 solid players, decent bets going around | ⚠️ Cautious participation possible |

| 100% – 149% | A couple quiet players, not much action | ???? Probably choppy — wait for confirmation |

| Below 100% | One guy at the table, dealer checking their phone | ???? Don’t sit down. It’s not a real market today |

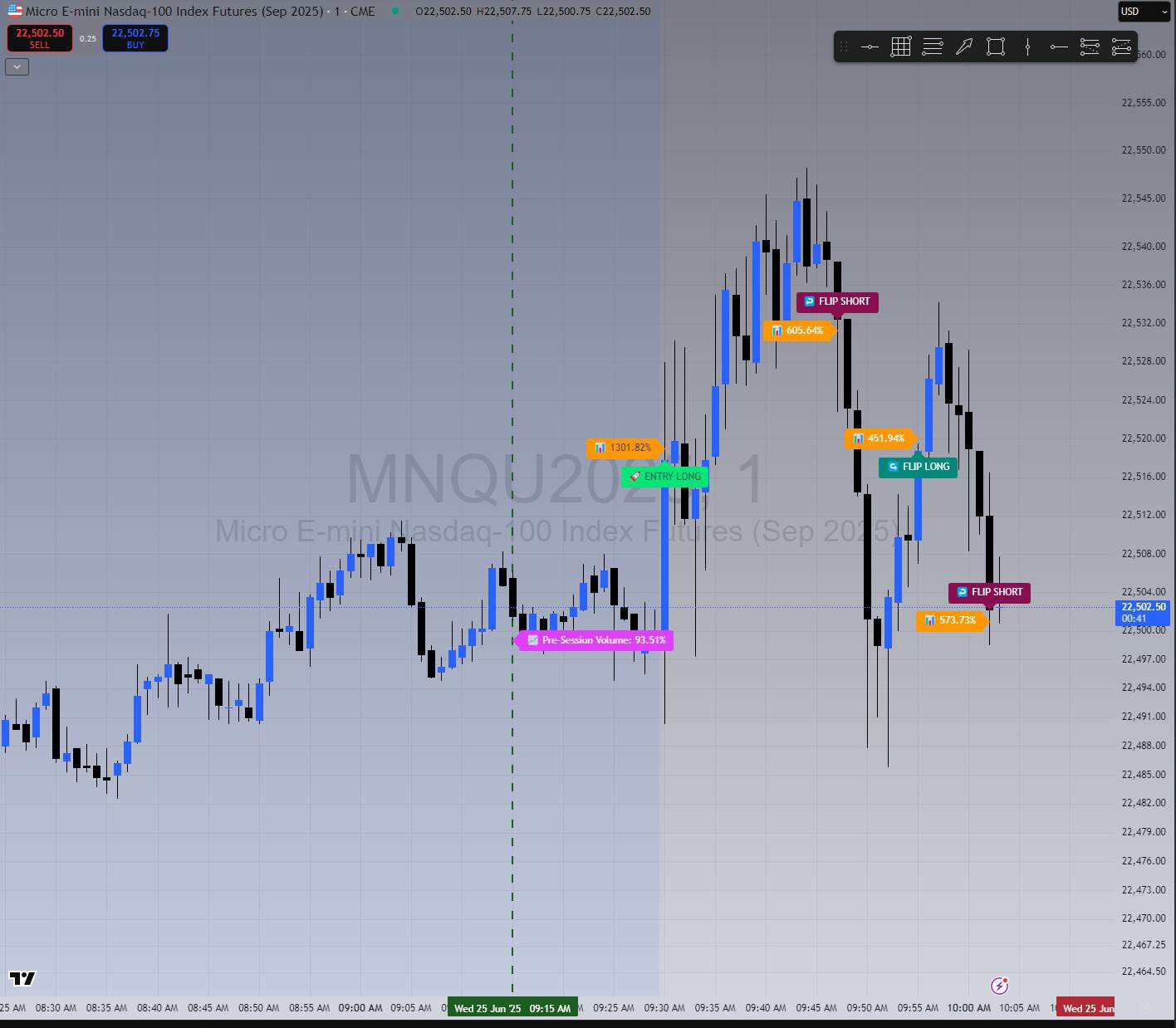

????️ Pre-Session Volume: Only 93% — The First Red Flag

Caption: Pre-session volume is just 93%. Price action is range-bound and full of indecision — a clear early warning to tread lightly or stay on the sidelines.

???? BoS Trigger at 9:30 — But at What Cost?

Caption: Strong volume breakout — but look at the stop. Entry at $22,518 requires a $28 stop, and five minutes later the trade is underwater. Low-volume mornings can turn conviction into chaos.

???? The Trade Worked — But I’m Glad I Didn’t Take It

Caption: Yes, the trade worked — and I still didn’t take it. This chart shows a strong bullish trend with clean structure, but I followed my plan and stayed flat. That’s trading — rules over FOMO.

???? A Flip Short — and the Seesaw Begins

Caption: Flip short worked — but look behind it. With 93.5% pre-session volume, this short entry gave 13 points, but price action is seesawing. In this environment, not every signal deserves full trust.

???? 9:55 AM – Still Whipsawing, Still Low Volume

Caption: The flip worked — but look at the mess. At 93% pre-session volume, this short gave some profit, but the market is still seesawing. This isn’t trading with an edge — it’s sitting down at a nearly empty poker table and hoping for luck.

???? Final Flip Long at 10:05 AM – Still Just Passing Chips Around

Caption: Another flip. Another reversal. Still no edge. At 10:05 AM, the strategy flipped long again — but the volume, like the table, was still empty. This isn’t trading. It’s target practice with no bullseye.

???? No Trades Logged — and That’s the Real Win

Caption: Discipline over impulse. My Topstep account shows no trades today — not because I was scared, but because the table was empty. When you know your edge, sitting out is a winning trade.

???? Final Takeaway: Know When to Fold Before You Even Ante Up

You’ll hear it a thousand times in this room:

“We only want to play the game when the poker table is full.”

Pre-session volume is the most underrated tool for that decision.

- Below 100% = chop, indecision, and traps

- Above 200% = game on

- Today at 93%? That’s a firm no

Signals don’t matter if there’s no one on the other side to play.