Every trader needs to ask themselves a hard question:

Do I have a defined process I follow with total discipline — or am I just gambling with a chart in front of me?

If you don’t have clear rules for when to enter, when to exit, and how much to risk, you’re not trading — you’re pulling a lever and hoping for the best.

I’ve been there.

I used to overtrade, let emotions take over, and convince myself that “I saw something” — when in reality, I was just reacting. There was no structure. No repeatable edge. Just stress.

It took time, but I evolved.

Now I trade a system: the 1-Minute BoS Sniper Strategy.

I don’t try to predict where the market will go.

I don’t guess.

I wait until other traders are trapped — and then I strike.

That’s the edge.

That trade didn’t work out.

But we didn’t flip bias.

We didn’t double down.

We didn’t take another shot.

We executed the plan — and that’s what matters.

And that discipline has paid off.

I’ve withdrawn over $20,000 from Topstep funded accounts in just the last few months. That didn’t happen by chasing. It happened by following the system, every single day.

Let’s talk about edge.

A casino slot machine can lose money for days, even weeks. But the casino doesn’t care. Why?

Because over hundreds or thousands of pulls — it wins.

It has the edge.

You’re either the casino — or you’re the one feeding the machine.

Most people are not trading. They’re guessing.

They’re copying.

They’re emotional.

They’re reacting.

They hop systems, chase candles, over-leverage, and call it “intuition.”

Let me be blunt:

✅ A real trader has rules.

❌ A gambler has feelings.

✅ A trader uses data.

❌ A gambler uses hope.

✅ A trader accepts red days.

❌ A gambler sees them as failure.

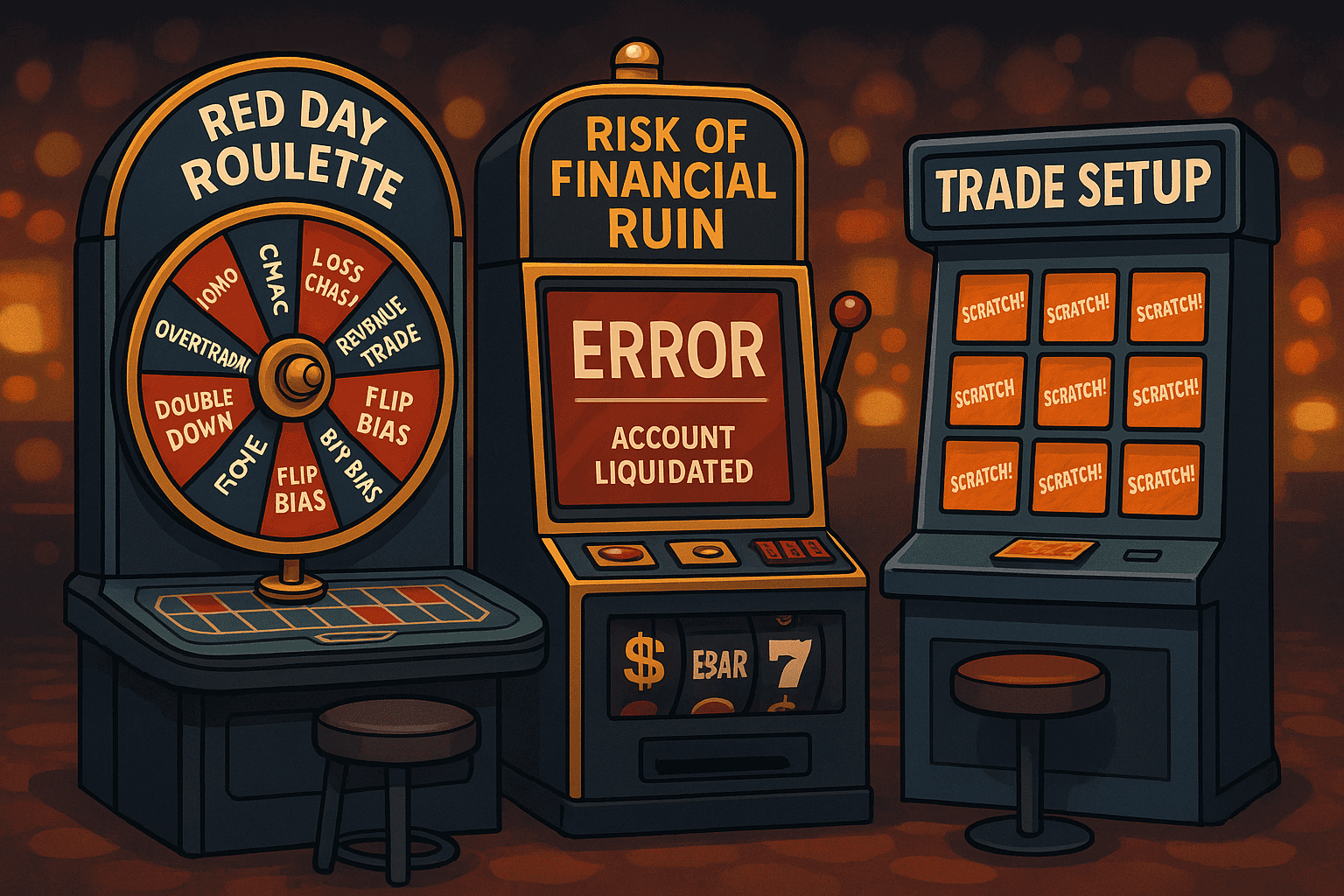

This is what trading without a system looks like.

Red Day Roulette.

Risk of Ruin Slots.

Scratch-off Trade Setups.

Every machine in that casino is waiting for one thing: you to lose control.

And if you’re not following a system you trust — you will.

It’s not easy to be patient. It’s not easy to trade one setup a day.

It’s not easy to walk away after a loss.

But it’s how you scale. It’s how you win over time.

It’s how you move from gambler… to trader.

We trade the 1-Minute BoS Sniper System — a disciplined, proven approach built around structure and traps.

What do you trade?

???? Want instant updates when new posts drop?

Follow us on @edgeucated for real-time blog alerts, trade insights, and exclusive behind-the-scenes content.