Nobody tells you this when you start trading:

The chart doesn’t just reflect the market. It reflects you.

Your mindset. Your emotional state. Your unresolved stress. Your ego. Your hopes. Your fear. Your hunger for significance. All of it bleeds into your decisions — and the market doesn’t care.

Today, I got slapped in the face by that truth.

The Market Was Choppy. I Traded Anyway.

There was no real news. No economic reports. No fuel. Just a quiet Monday with low volatility and sideways action. A day that should’ve made me pause.

But I wanted to trade.

So at 8:22 a.m., I took my first position — a setup I trust: the 2-minute break of structure. By 8:28 a.m., it failed. Structure broke down, and then the very next candle exploded up. Classic fakeout. I was red — and just like that, I started chasing.

From Awareness to Self-Sabotage

What followed between 8:28 and 10:10 a.m. was a string of losses. Nothing catastrophic — just slow bleeding. But what was worse than the red was my headspace.

I was angry. I was pissed off. I didn’t have the best weekend; my judgement was cloudy. I was asking the kind of questions losers ask:

Why is the market doing this to me?

I wasn’t following my rules. I wasn’t reading price. I was reacting to emotion — and I knew it. I knew I was making bad decisions. And I kept going anyway.

That’s the part that hits hardest: the awareness was there, but I didn’t respect it… not yet.

The Turning Point: Get Off the Desk

I had a choice. Keep spiraling and revenge trade… or stop. So I stopped.

I walked away from the desk, got on my bike, and went for a ride — still watching the market, but with a different breath, a different pace. I was moving. Breathing. Slowing my mind down.

This is what most traders never show you.

They’ll flash P&L and wins, but they won’t talk about the decision to hit pause — the discipline it takes to stop trading and take care of your own mind. But that is where the real skill lives.

The Comeback: Trading With Discipline Until Green — Then Stopping

After resetting mentally, I came back to the chart and returned to my process: two-minute break of structure setups only. No revenge trades. No impulsive entries. Just focused, rule-based execution.

I took a few clean trades — not forcing anything, not pushing size — just sticking to my plan. Slowly but surely, I crawled my way back.

When I saw I was finally back in the green, I stopped.

Not because I had hit some huge number.

Not because I felt like a hero.

But because I was happy — content with what I had pulled out of a rough market on a rough day.

That’s what growth looks like.

Not perfection. Not massive profits.

Just the discipline to stop when it’s enough.

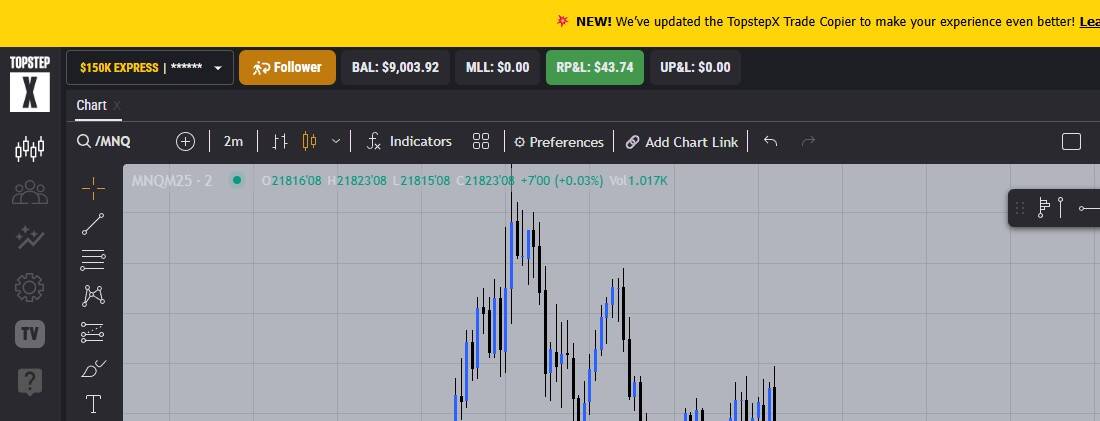

TopStep’s Copier Update: A New Level of Precision

What made today even more significant is that TopStep rolled out a major update — and it went live today:

They now copy executions, not orders.

This is huge.

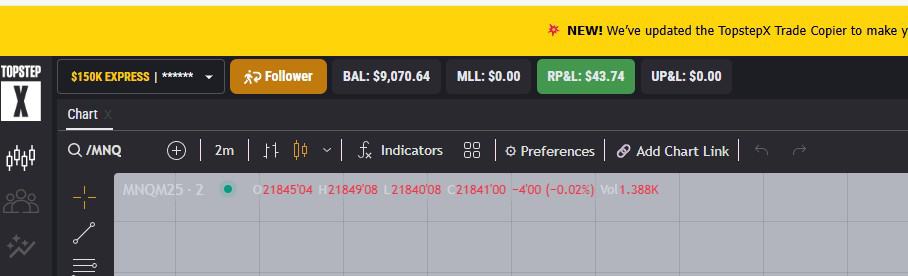

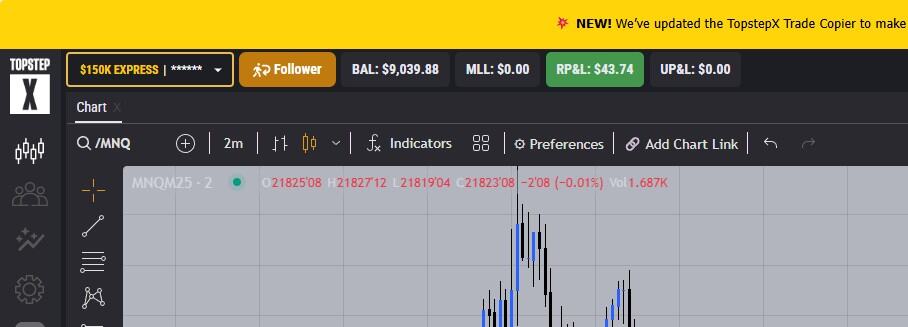

That $43.74 was duplicated perfectly across all five accounts.

Here’s the breakdown:

- Leader account: $8,847.88

- Follower 1: $9,070.64

- Follower 2: $8,984.38

- Follower 3: $9,039.88

- Follower 4: $9,003.92

Combined balance across all five accounts: $44,946.70

Today’s total profit across all 5 accounts: $218.70

You Don’t Have to Be Perfect. Just Consistent.

You don’t need to be a hero. You just need to stick to your edge and be emotionally aware enough to stop when you start slipping.

Here’s the part most traders never understand: you don’t have to be perfect to be successful.

My win rate is just over 50% — literally around 54%. But over the past two months, I’ve accumulated nearly $45,000 in profit. That’s not because I’m always right. It’s because I’m consistent. I follow one setup. I control risk. And I stop when I know I should stop.

This post — this entire day — is living proof that success in trading comes from emotional discipline and knowing when enough is enough.

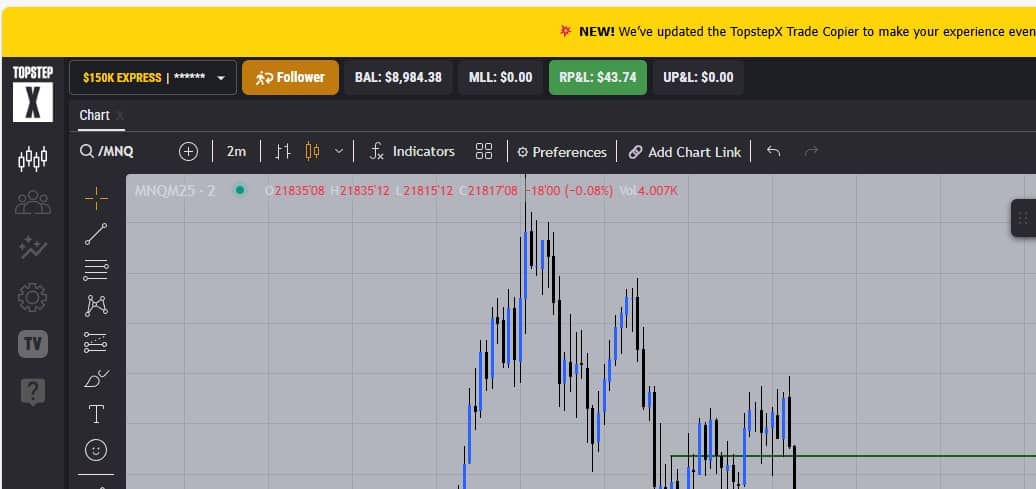

This Chart Proves I Made the Right Call Walking Away

The market hadn’t moved an inch since my last trade. Still sideways. Still no fuel. Still chop. Walking away was the move. That’s what protected today’s win.

$45,000 in Small Wins. And That’s the Truth.

That $43.74 might seem small. But do the math across time and five funded accounts. The small wins add up. I’ve stacked just shy of $45,000 in this exact fashion — with tight risk, repeated execution, and emotional discipline.

That’s the real scorecard. Not the fantasy home runs. Not the Hail Mary trades. Not the glory stories.

$45,000 in small, boring, consistent wins.

Final Word: Know Yourself

Today was a win. But not because of the dollar amount.

Today was a win because I saw the signs of mental and emotional collapse — and I course corrected.

That’s what separates real traders from gamblers.

Because the market doesn’t reward you for being smart.

It rewards you for being stable.

For being self-aware.

For knowing when to engage — and when to get off the damn desk.

So remember:

-

- Stop chasing

- Start listening

- Know your state

- Know yourself

Or you’ll get wrecked.