Earlier today, I posted a blog saying I was done trading for the day. I had already gone green early and walked away like I always do — locked in profit, stayed disciplined, and stuck to my system.

But then something happened.

While I was at Outback eating lunch, a headline flashed across the screen:

That’s not just global chaos — that’s market fuel.

If you trade NASDAQ futures like I do, this kind of drama is a flashing neon sign.

Bigger the drama, bigger the fuel. Bigger the fire.

Drama = Volatility. Volatility = Structure. Structure = Your Shot.

I don’t chase trades. I don’t guess. I don’t throw darts at price action.

I wait for movement. I wait for volatility. Then I check my charts.

And if I see the market reacting — if there’s volume, momentum, and clean structure forming — then and only then do I act.

This is where the 2-minute Break of Structure (2M BOS) comes in.

It’s not about the news itself.

It’s about how the market reacts to that news.

And today, it reacted fast.

The Result: $1,049.10 Across Five Funded Accounts

Once the headline hit, I pulled up my charts and waited. I saw the structure forming.

The reaction was clear.

I executed one BOS setup. One trade. Clean. Controlled. No overtrading.

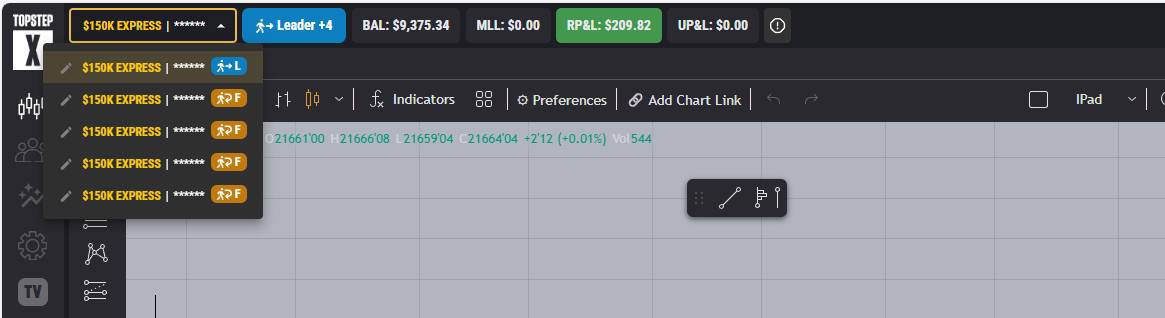

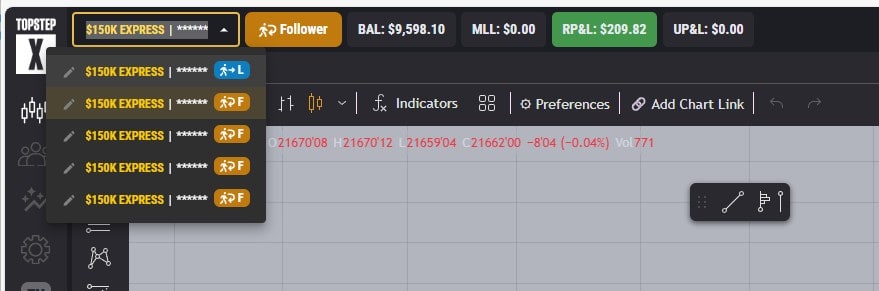

And that one disciplined entry helped me crush my Topstep daily goal of $200 per account, which is part of their 30-day rule for unlocking daily withdrawals once I go live.

Here’s the breakdown:

| Account | Balance | Profit Today |

|---|---|---|

| Leader Account 1 | $9,375.34 | $209.82 |

| Highest Account | $9,598.10 | $209.82 |

| Account 3 | $9,511.84 | $209.82 |

| Account 4 | $9,567.34 | $209.82 |

| Account 5 | $9,531.38 | $209.82 |

| ???? Daily Total | $1,049.10 |

Total across all five funded accounts: $47,584.02

My Rules Didn’t Change — The Conditions Did

Earlier today, I said I was done.

And I meant it.

But when the world drops a headline like that, everything changes.

This isn’t emotional trading — it’s responsive trading.

You don’t jump into a slow, sideways market just because you’re bored.

You wait. You stay flat. You protect your capital.

But when the fuel hits — when the volatility kicks in — you go check your charts.

If the NASDAQ is moving with structure, you step in and do what you’re trained to do.

If You Want to Be Profitable, Don’t Guess — Wait for the Fire

Consistency isn’t about predicting the future.

It’s about preparing for it.

The 2-minute BOS strategy works because it waits for structure.

And structure only forms when the market cares — when there’s something real going on.

I don’t need to win every trade.

I don’t even need a high win rate.

My win rate is just over 54%, and yet I’ve pulled in over $9,598 in one of my Topstep accounts since starting in March.

Started below zero.

Now pushing toward five figures.

Why? Because I don’t chase the market. I ride the wave when the fire hits.

Final Word: Ride to Your Target, Then Sail Away

Once I see fuel, I go to the charts.

If structure is breaking, I execute.

I ride to my target.

And then I sail away with the money.

This is what I do.

This is how I trade NASDAQ futures.

And this is how I pushed to $1,049.10 in one afternoon across five small-risk accounts — with nothing but rules, patience, and timing.

If you want consistent results, stop forcing trades.

Wait for drama.

Wait for fuel.

Then do your job.