???? The Truth About a Bad Day

June 15th. I broke my rules.

I was pushing hard for max payout across all five of my TopStep accounts. I wanted every account over $10K — and I forced it. I ignored the 2-minute BOS strategy that got me here in the first place.

Result?

A $977.10 loss on the leader account. Times five accounts…

That’s –$4,885.50.

In the past, that would have marked the beginning of the end. Tilt. Overtrading. Chasing.

But not anymore.

???? Step 1: Withdraw to Reframe the Loss

Instead of trying to “make it back,” I followed my Red Days Are Green Days Strategy — a simple but powerful move:

Withdraw profits from each account.

Zoom out and remember — you’re still winning.

I pulled a total of $22,275 out of the market across five funded accounts.

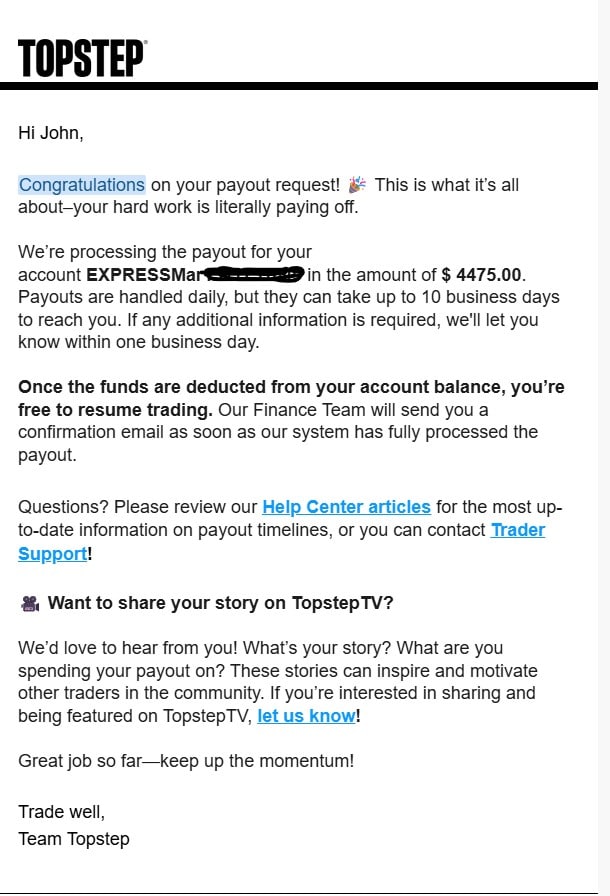

✅ $4,475 withdrawal — the first move to reframe the red day.

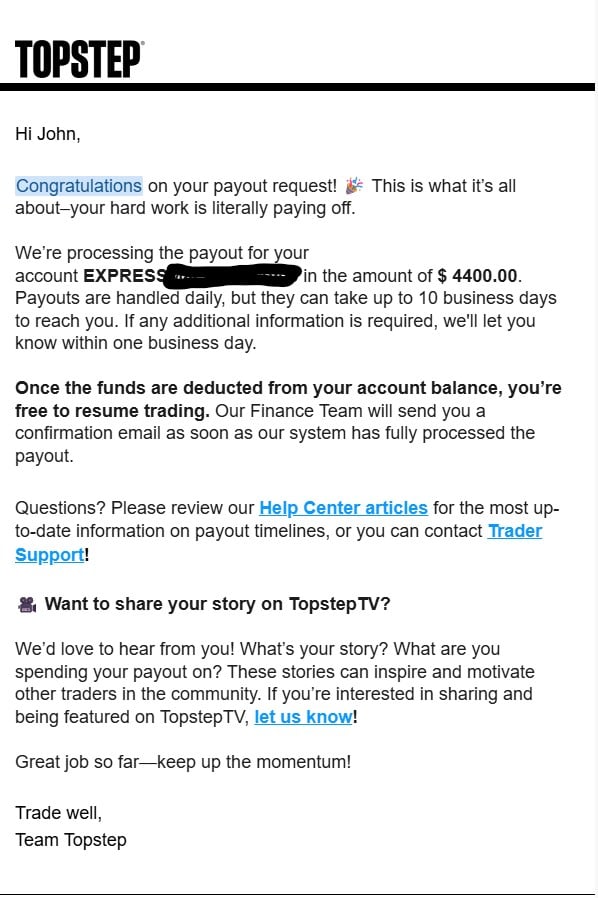

✅ $4,400 withdrawal — Step 2 of the reset plan. Confidence rising.

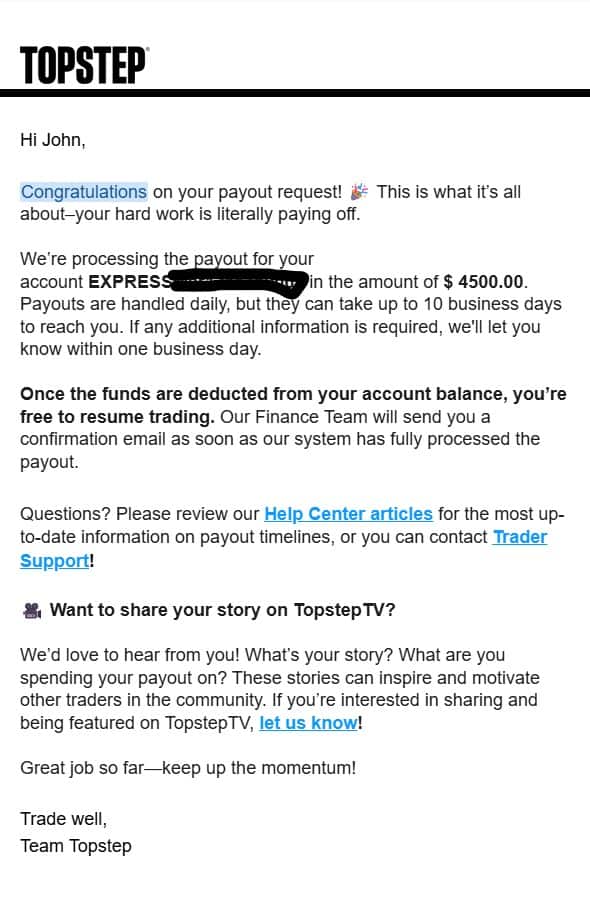

✅ $4,500 pulled from the third account — proving the plan works.

✅ $4,400 — fourth account locked in. Green days hiding inside the red.

✅ $4,500 from the last follower account. Total: $22,275 withdrawn.

???? Step 2: Size Down, Sharpen Up

The old me would have doubled down.

The new me? I downsize and reset.

Here’s my rule after a tilt-triggering loss:

- ⚖️ Trade only 1 contract

- ???? Switch to 1-minute BOS for clarity and control

- ???? No sizing up until I go 3 straight days without breaking a single rule

This isn’t a suggestion. It’s mandatory.

Discipline > dopamine.

???? Step 3: Step Back and Zoom Out

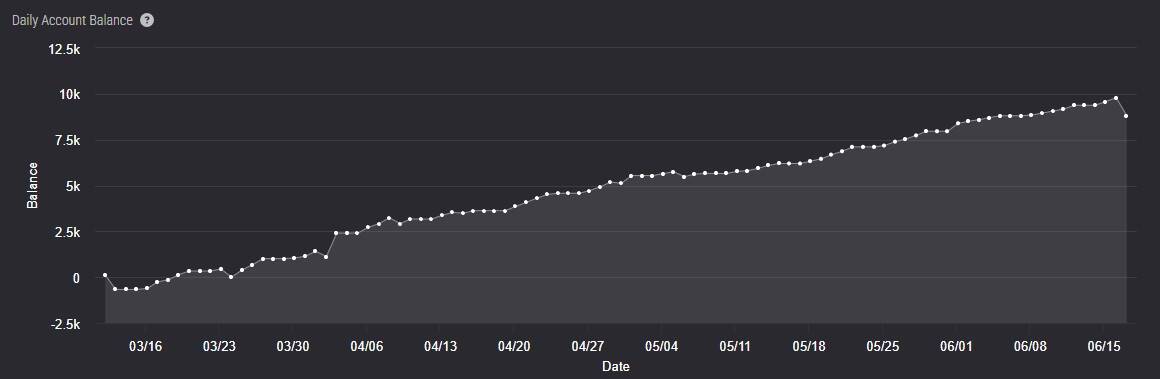

Want proof this works?

Here’s my equity curve.

There’s a steady rise since March. Then a minor setback.

Not catastrophic. But real.

What happens next determines where this curve goes.

And I’m in control of that.

???? Final Thoughts: How Will You Respond?

Losses used to destroy me.

Now? They activate me.

I’ve got a plan.

I stick to it.

I extract clarity from chaos.

This is the Red Days Are Green Days mindset. It’s how you build emotional capital, not just financial capital.

So now I’m asking you:

- ❓ What do you do when you take a loss?

- ❓ What’s your system for managing tilt?

- ❓ How do you hold yourself accountable?

Because if your strategy doesn’t hold you accountable…

Then what — or who — will?