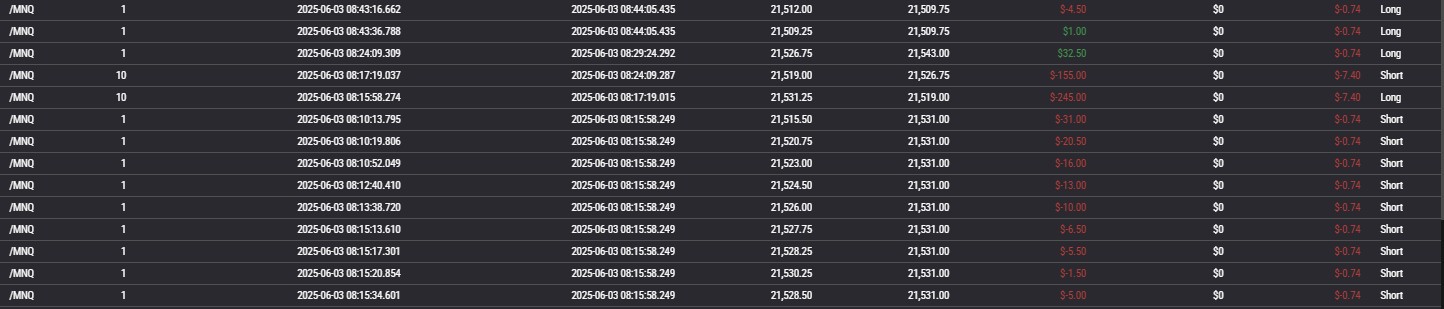

This morning’s trading session kicked off like any other—with discipline, focus, and a willingness to show you everything, win or lose. Our first entry was at 8:15 a.m.—a quick trade that only lasted a few minutes.

As you can see in the image above, the very first trade was a loser. By 8:18 a.m., we were already in the red. But that’s trading. Not every setup works. What matters is how you respond.

The Setup at 8:30 a.m.

By 8:30 a.m., we saw a clean break of structure forming. Based on the system, this was a valid long setup. You’ll see in the chart below, the green line marked the BOS long entry, while the red line showed the BOS short zone we had to respect.

We went long—and got stopped out almost immediately. That’s two back-to-back losses to start the morning. Still, we followed the plan. No guessing. No emotions.

Adding Size, Chipping Away at the Drawdown

After two back-to-back losses, we stepped in with more size on the next setup. Picture three shows that trade—it followed the same 2-minute BOS strategy, but this time we got the move we were looking for.

This third trade went our way, finally. It didn’t bring us back to green just yet, but it cut down the drawdown and gave us a much-needed sigh of relief. By 8:51 a.m., we were still in the red, but now the comeback was in motion. We kept our composure and looked for the next clean opportunity.

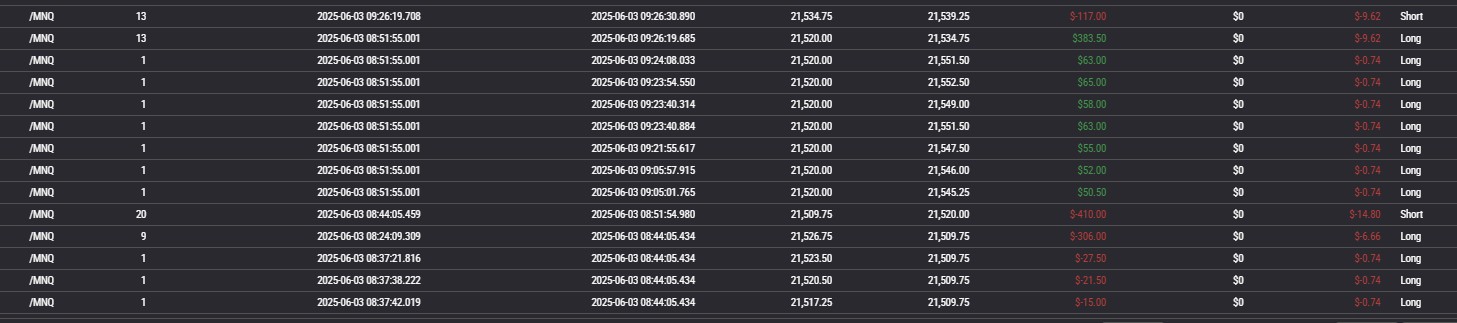

The Comeback Begins

Then came the turning point. Eight contracts. $772 profit. Picture four shows the trade that started to claw us out of the hole.

This single trade erased the early damage. Not fully—but enough to reset mentally. Now we were just about at breakeven, and the day wasn’t over yet.

Wrapping Up: Small Win, Big Lesson

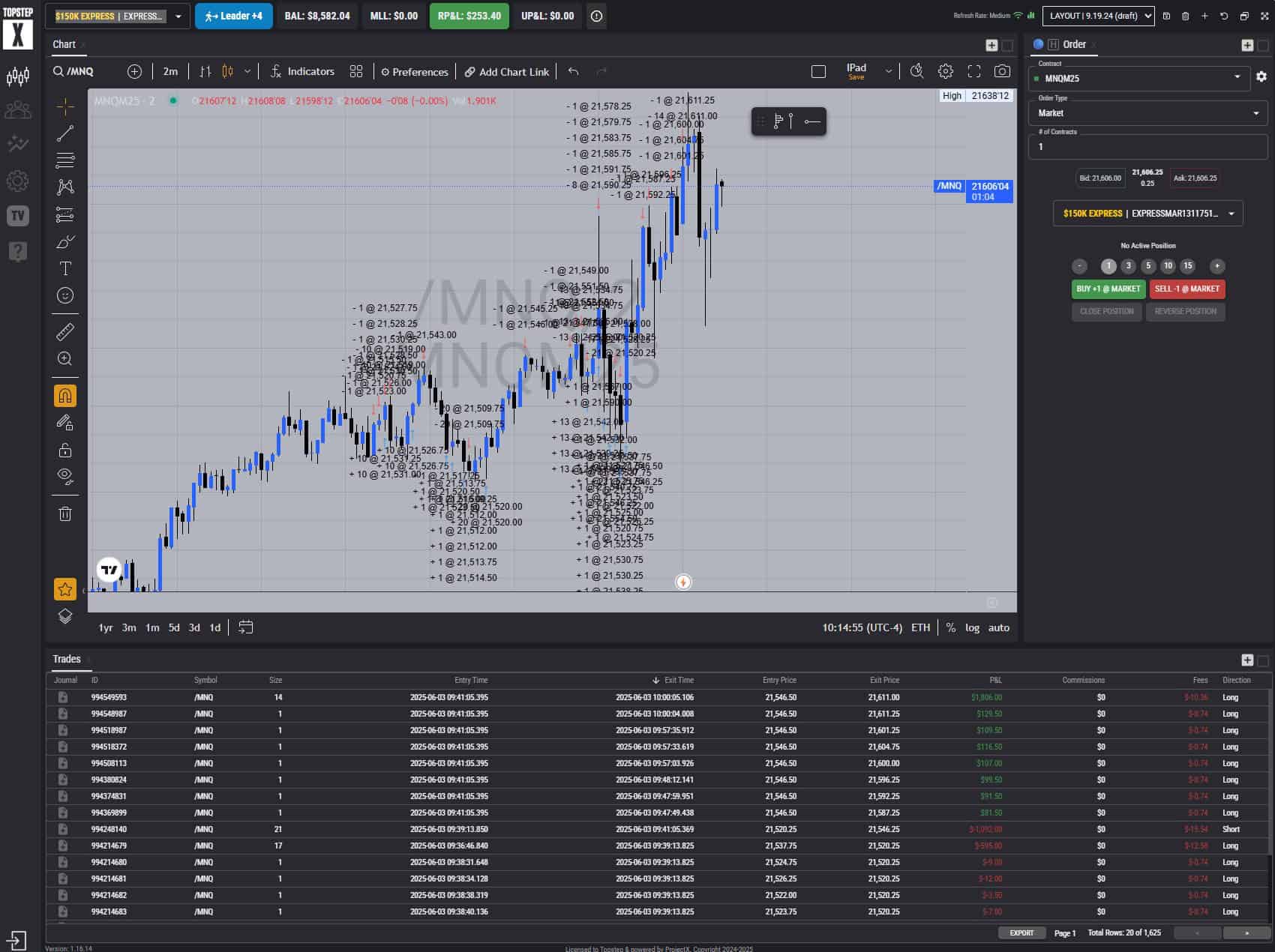

Picture five shows the full execution list. This is the reality of BOS trading—scaling in, scaling out, handling losses, and taking advantage of winners when they show up.

The final P&L was $253.40—times five accounts, that’s $1,267. Not a home run. But a win after a rough start.

The Bigger Picture

Zoom out. Picture six confirms the Topstep setup: five $150K funded accounts, one of which shows a balance of $8,582.04. Total capital created? Over $42,000.

Today was about mindset. Trading is hard. It will test your patience and your plan. You don’t need to be perfect—you just need to be consistent and honest with yourself. That’s the edge.

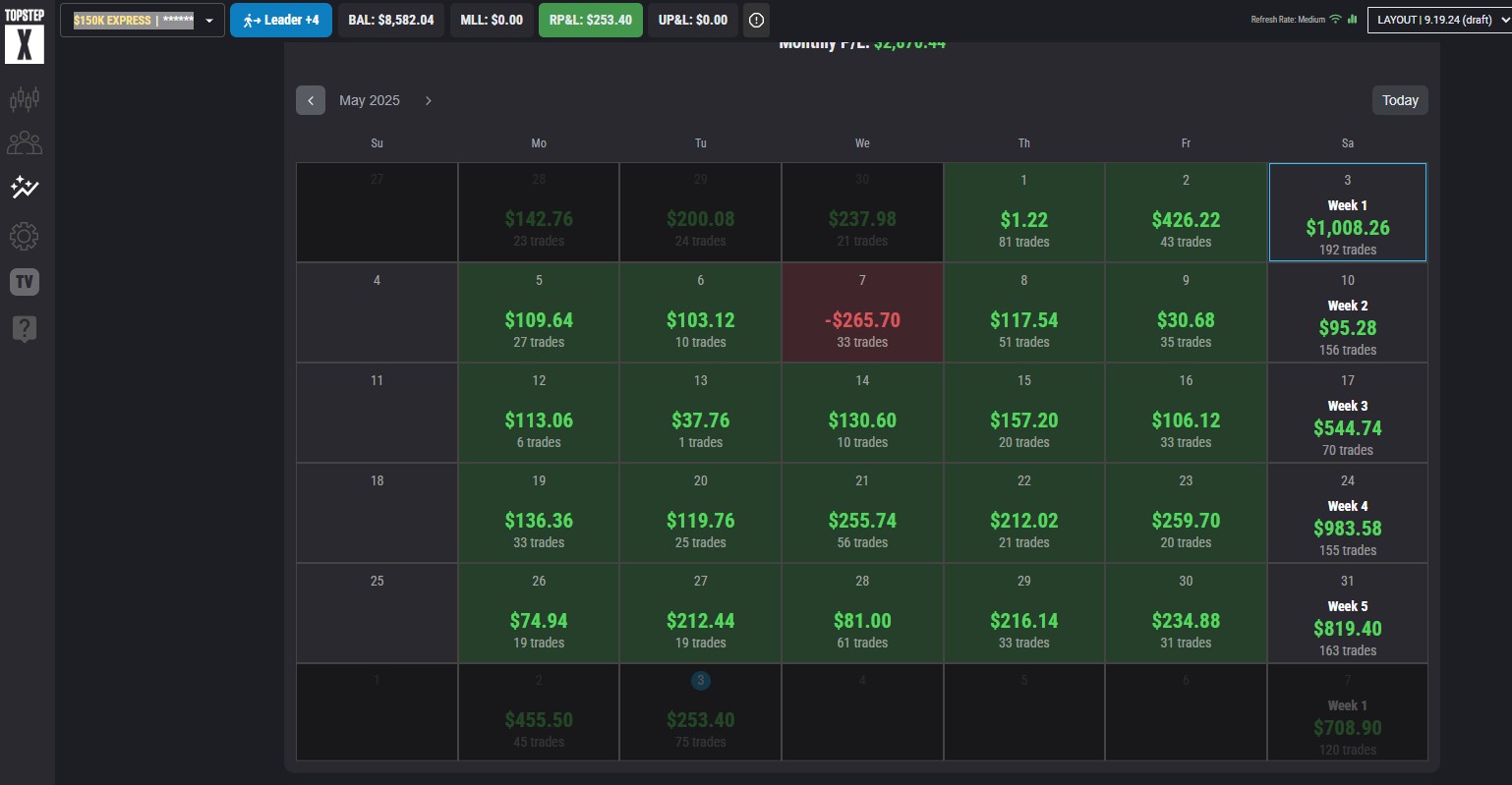

Here’s the raw, unedited calendar straight from my Topstep account. You can count them yourself—19 green days in a row. No fluff. No cherry-picking. Just structure, execution, and proof.

Thanks for following along with today’s session. If you’re serious about trading, understand this: the wins don’t come from hype—they come from showing up, staying patient, and sticking to your edge every single day. I’ll be back soon with another real-time breakdown. Until then—stay disciplined.