Trading isn’t about guessing—it’s about discipline and structure. If you’re not defining your risk before you enter a trade, you’re already behind. Today’s ES September 2025 recap shows how we mapped liquidity, waited for a golden pocket confirmation, and executed with a 1:4.5R target—proving that risk-first trading creates clarity and consistency.

Important context: this was not a morning setup. During the live stream we didn’t get an entry, and I told the team I’d keep watching throughout the day. The opportunity finally set up in the afternoon, while I was literally at Outback on my iPad. I couldn’t start the stream until I got back home, but the trade plan was already in motion.

Liquidity & Bias After Noon

The setup formed during the 1:30 PM 15-minute candle. Liquidity was marked in yellow, one-hour bias in red, and the 15-minute gap was identified. Price swept liquidity into this zone, framing the area we would monitor for the afternoon trade.

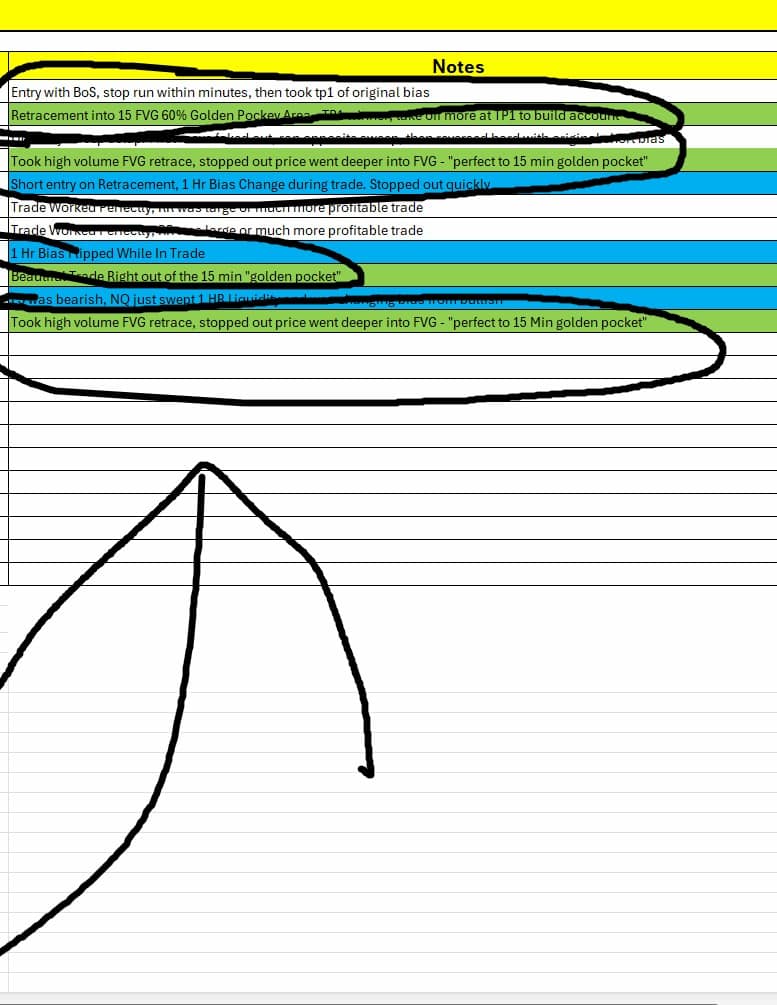

Edge Refinement Notes

Our BOS Sniper Edge Refinement Journal showed recurring setups: retracements into 15-minute FVGs and golden pocket zones often produce clean trades. Journaling helps us recognize patterns, not change our edge—just refine it.

Fibonacci Golden Pocket Confirmation

On the 15-minute chart, price retraced under 50% and swept liquidity. From experience, we don’t jump here. We wait for confirmation—a break of 61.8% into the golden pocket—before moving down to the 1-minute chart.

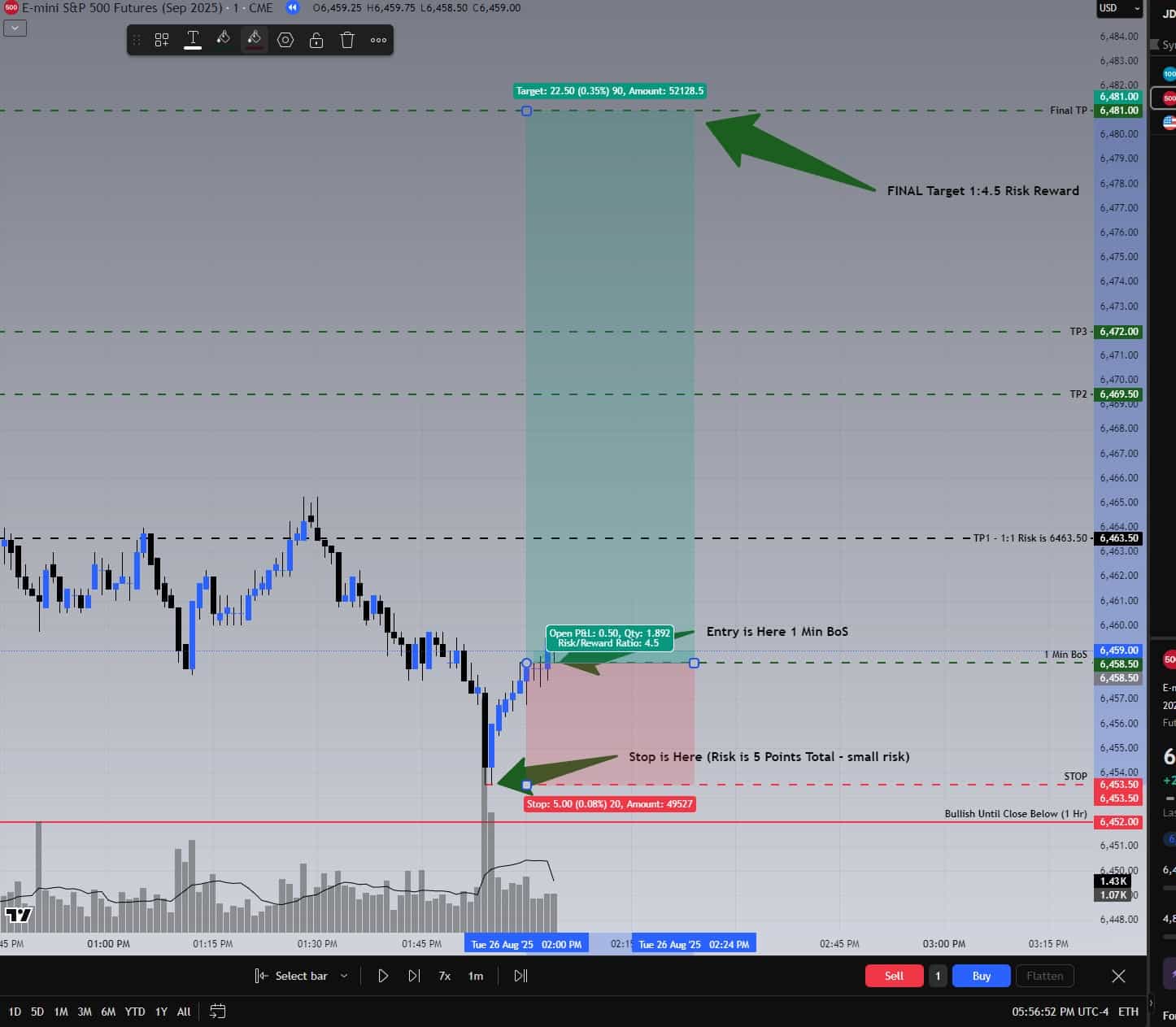

The 1-Minute Trigger: Volume Spike

Price spiked all the way through 61.8% down to 79%—with a massive surge in volume well above the 10 SMA. To many it looked like a crash, but for us it was the exact long signal we had been waiting for.

Entry, Stop & TP1

With the Break of Structure confirmed, entry was marked with a tight 5-point stop and TP1 at 6463.50 (1R), just below the prior high. Risk was defined and acceptable before we entered.

Mapping the Profit Roadmap

Take profits were staged before the trade played out: TP1, TP2, TP3, and a final target at 1:4.5 risk/reward. Planning targets in advance removes emotion and keeps us disciplined.

Outcome: All Targets Hit

Price followed the roadmap: TP1 and TP2 reacted, TP3 was sliced through cleanly, and TP4 was achieved just before the 4 PM bell. The full 1:4.5 R multiple was delivered.

Transparency: Funded Account Results

Execution matched the plan across five $150K TopStep funded accounts. Profits came to $253.34 per account, totaling $1,266.70 across all accounts. This is proof: preparation and discipline translate directly into results.

Hypothetical copy-trade across 20 funded accounts: $253.34 × 20 = $5,066.80.

Key Takeaway

This trade recap highlights why risk must come first:

- Define risk and reward before entry.

- Size down if a loss would affect you emotionally.

- Map liquidity, FVGs, and Fib retracements for context.

- Wait for Break of Structure and volume confirmation.

- Plan all exits in advance.

- Log trades to refine the edge, not reinvent it.

- Stay transparent and accountable with results.

Trading isn’t about predicting—it’s about positioning with discipline. Risk first, profits second.