I talk to you guys all the time about being disciplined, staying mechanical, and thinking like the casino. But today… I outsmarted myself.

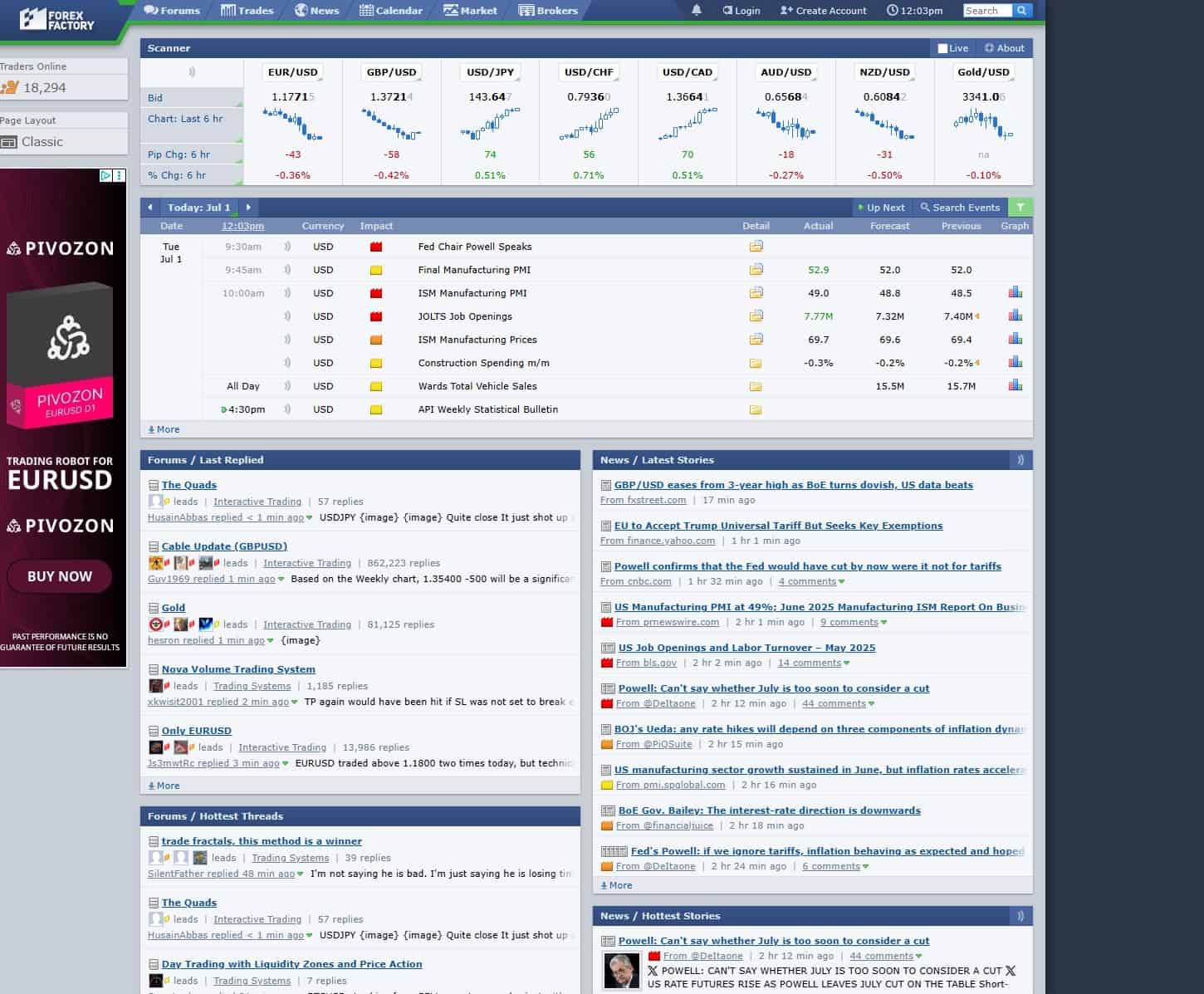

I was ready right at 9:30 like always. I had Bloomberg TV on, I was listening to Fed Chair Powell speak. I checked the economic calendar and saw JOLTS and PMI were scheduled for 10:00 AM. So I stayed locked in and did everything right — until I didn’t.

News events from July 1, 2025 — Fed Chair Powell spoke at 9:30 AM, followed by JOLTS and PMI at 10:00 AM, as shown on ForexFactory.com.

Bloomberg TV broadcast of Fed Chair Jerome Powell speaking live at 9:30 AM on July 1, 2025 — a key market catalyst during the BoS setup window.

From 9:30 to 10:00, the market did almost nothing. It just sat there. Even five minutes after the job numbers dropped — still nothing. I told myself, “This session is dead,” and that’s when I made the mistake.

I left early — at 10:05 — and took the iPad with me. I figured I’d just glance at NQ while out running errands. I wasn’t fully engaged. I wasn’t watching ES. I wasn’t focused like I would be at the desk.

And that’s when it happened.

At 10:15 AM, NQ tapped a key level. I saw the rejection and didn’t think much of it. But what I didn’t see — what I should have seen — was ES stabbing straight through that same level.

At 10:15 AM on July 1, 2025, NQ barely touched the key level while ES stabbed cleanly through it — a clear example of divergence and the “sick sister” setup.

That’s our sick sister setup right there. ES made the sweep. NQ didn’t. It’s literally the definition of what we look for.

And guess what came next?

Volume. A big spike in volume — exactly where we expect trapped traders to get crushed.

Clear volume spikes during the liquidity grabs on NQ and ES 1-minute charts — the Sniper BoS strategy triggers cleanly with a labeled structure break on NQ.

Then the 1-minute BoS printed. Boom. Clean as it gets. The trade dropped over 200 points and went straight to the previous day’s low — which was the exact target.

But I missed it.

Not because the setup wasn’t clear. Not because the strategy failed. I missed it because I bailed out early and didn’t stay locked in until 10:30 like I was supposed to.

The Shift: From Every Flip to Sniper Entries

Until recently, we were taking every single flip on the 1-minute BoS strategy. While the strategy is sound, that approach was leading to a 54% win rate. It works — we’ve proven that. But now, we’re refining it.

We’re moving to a Sniper BoS strategy — a more selective, higher-probability approach that focuses only on premium setups:

- Liquidity grabs

- Volume spikes at key levels

- Confirmed BoS in alignment with structure and divergence

Why? Because this is how we increase our win rate and position ourselves to withdraw larger profits from Topstep and beyond. We’re not here to chase every signal. We’re here to execute with precision.

And today’s setup proved exactly why this sniper mindset is the right path forward.

The Lesson

This is a numbers game. That’s all.

You can’t treat it like the market is out to get you. You can’t tie emotion to one missed setup, or one losing trade, or one green scalp.

You just have to show up. That’s your only job.

You’re the casino. You don’t get emotional when someone hits a lucky hand. You just keep the table open and run the edge.

What I Did Catch

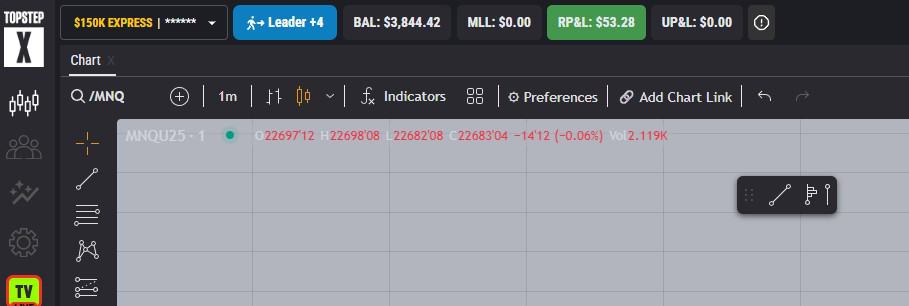

Eventually I did get back to the screen. I was able to catch a few minor scalps — nothing crazy. Closed the day with $53.28 on the Leader account, which is run across five funded accounts, so it helps offset the $70 losses I had on Friday and Monday.

July 1, 2025 – Leader account closed with $53.28 profit across five funded accounts. Small scalps helped offset prior red days. Balance: $3,844.42.

This is part of the game. You don’t win them all. You just show up, run the math, and stay ready for the next high-probability move.

Final Thought

This post isn’t about missing the trade. It’s about acknowledging what happens when you break your routine, lose focus, and let external stuff distract you.

I’m not mad. I’m motivated.

Because this setup today? It’s proof that the strategy works.

And more importantly, that it works without me needing to feel anything about it.

It’s mechanical.

It’s repeatable.

It’s real.

From now on, this blog will follow the Sniper BoS framework.

We’re not here to chase every flip — we’re here to take the best ones and get paid for our patience.

Stay sharp,

— John

The Edgeucated Trader