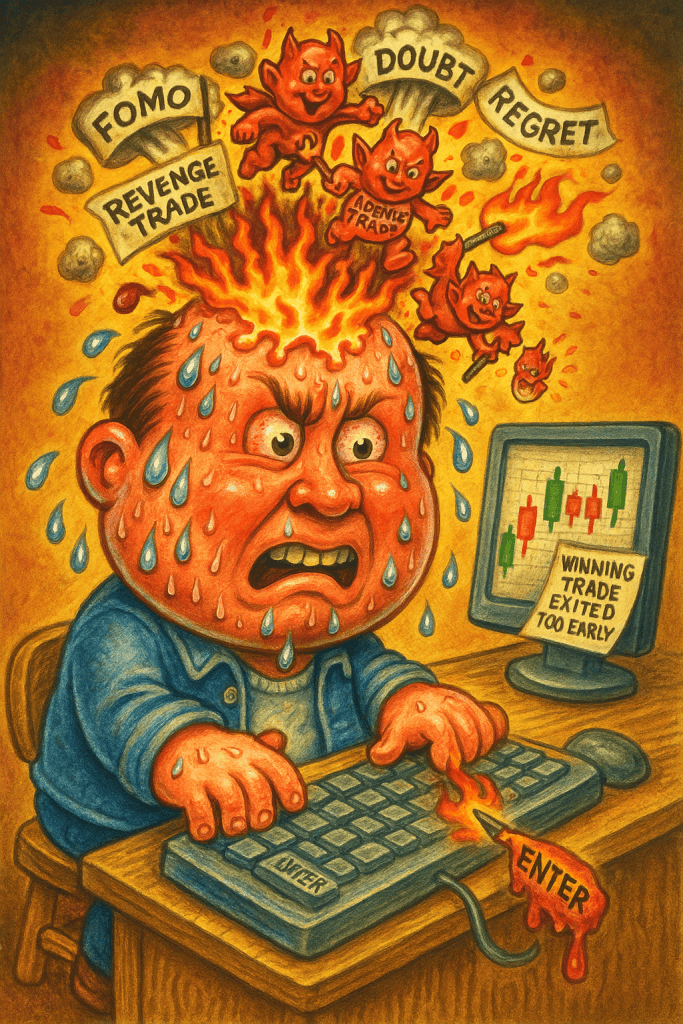

This is what a crack in discipline looks like.

I followed my system to the letter. Waited for the setup. Executed with precision. Managed risk with intention. But when the trade didn’t reach target fast enough — I flinched. I exited early, not because the strategy told me to, but because fear did.

The trade played out exactly as the system anticipated. I didn’t. But I didn’t chase. I didn’t re-enter. I didn’t let FOMO drag me into a spiral.

That was discipline. And that’s how you protect your edge — even after a misstep.

This post walks you through the entire trade I took on July 14, 2025, using the BoS Sniper Strategy. If you’re working on consistency, this kind of story matters more than the wins. It’s about honoring the system, not chasing the outcome.

🧭 The Pre-Market Plan: Patience Over Prediction

My prep started before the bell. On TradingView, I had 15-minute order blocks mapped in purple and liquidity zones marked in yellow. The market was ripping at the open, so I waited to see if it would pull back into one of these zones — that’s where I wanted to strike.

Pre-market setup: price moving fast at the open, but we wait for it to retrace into a key 15-minute area.

🔍 Zooming In on Execution Timing

I dropped down to the one-minute chart and kept my levels intact. I was waiting for volume to confirm interest and potential accumulation at the level. The BoS Sniper Strategy demands precision. No confirmation? No trade.

Same levels, tighter chart. No rush. Let the market show its hand.

📈 The Trap Sets: Volume Spikes and Smart Money Moves

At 9:45 AM, price retraced into our 15-minute order block. Volume spiked above the 10 SMA. Two-sided aggression was clear. Were shorts pressing? Were longs absorbing? Either way, conditions were aligning.

We’re trading the ESU25 contract, and I always double-check that it has the highest open interest before the session begins. You can track it here on Barchart.

Volume crosses above the average. Institutional activity confirmed. Buyers and sellers engaged.

“Traders are trapped short in this area.” That’s what the chart said — and I believed it.

✅ The Entry: Break of Structure + Perfect Position Sizing

At 9:47 AM, price broke structure. Entry was $6,288.25. Stop was $6,280.00. That gave me $8.25 of risk per contract. Risking $150 total, that meant I could size into the trade with 4 MES contracts. That’s what I did — across five funded accounts I’m managing through Topstep.

Entry, stop, position sizing — all calculated, all clean.

Live in the trade. No second guessing. Structure, volume, and rules aligned.

🕒 Trade Management: It Was Working… Until It Wasn’t

I held from 9:47 AM until 10:28 AM. During that time, the trade was up over $225. But that’s not good enough. My target was the bottom of the next 15-minute order block — $6,305.25 — and the BoS Sniper Strategy is built on achieving at least 2:1 R:R. I don’t partial early. I don’t scalp. I follow the edge.

By 10:30, price returned to entry. I moved my stop to breakeven and got out.

📉 The Reality: No Profit — And a Teachable Moment

I was in the trade for over 45 minutes — focused, disciplined, and emotionally steady. But I’m human. By 10:30 AM, the energy fades. Price had come back to my area three times. Then I saw a BoS against my position with volume — and I flinched.

Instead of letting the trade play out, I moved my stop to breakeven. It wasn’t part of the plan. It was fear dressed up as logic. The setup was still valid — I just didn’t trust it.

And that’s the real takeaway here. You can follow your system for 99% of a trade and still sabotage the outcome in the final moments. That’s not total failure — but it is a lesson.

I’ve been watching the economic calendar on ForexFactory to avoid news volatility. I’ve been scaling across multiple funded accounts. Discipline matters — but only if it stays intact from entry to exit.

📸 The Aftermath: Price Hit the Target Without Me

By 11:40 AM, price pushed past $6,305 — right into the exact 15-minute target zone. The strategy worked. I just wasn’t in it.

And that’s on me. I exited too early — not because the system told me to, but because emotion crept in. This wasn’t a trade that failed. It was a moment where I did.

Consistency isn’t just about entries. It’s about trusting the full process — all the way to the exit.

Target hit. Beautiful structure. The BoS Sniper Strategy worked perfectly — even without me still in it.

End-of-Day Confirmation: This 4:00 PM TradingView screenshot shows the full move — both take profit levels hit. Price reversed right after. The BoS Sniper Strategy nailed the trade from start to finish… I just wasn’t in it.

🔁 Final Thoughts: The System Delivered. I Didn’t.

The moral of today’s trade?

I followed every entry rule. The setup worked. But I didn’t get paid.

Trading isn’t about catching every move — it’s about executing your edge with consistency. When you change the rules — even with good intentions — the edge breaks.

Today, I let fear talk me out of the trade. I moved my stop to breakeven and stepped aside, thinking I was protecting capital. But the truth is: the trade was still valid. I didn’t trust the system all the way through — and that cost me.

To follow the BoS Sniper Strategy means we exit only at a stop or a target. Anything else is noise.

The strategy did its job. I didn’t. And that’s the work — holding yourself accountable and showing up sharper tomorrow.

— The Edgeucated Trader

📣 Never miss a trade recap.

Follow us on Twitter/X for real-time updates every time we post a new blog.