Trade 13 of 20. A textbook setup. Followed the plan. Took the trade. And still… a loss.

But this post isn’t about the loss. It’s about what happened after the loss. Because that’s where consistency is forged.

🔍 Starting the Day with Bullish Bias

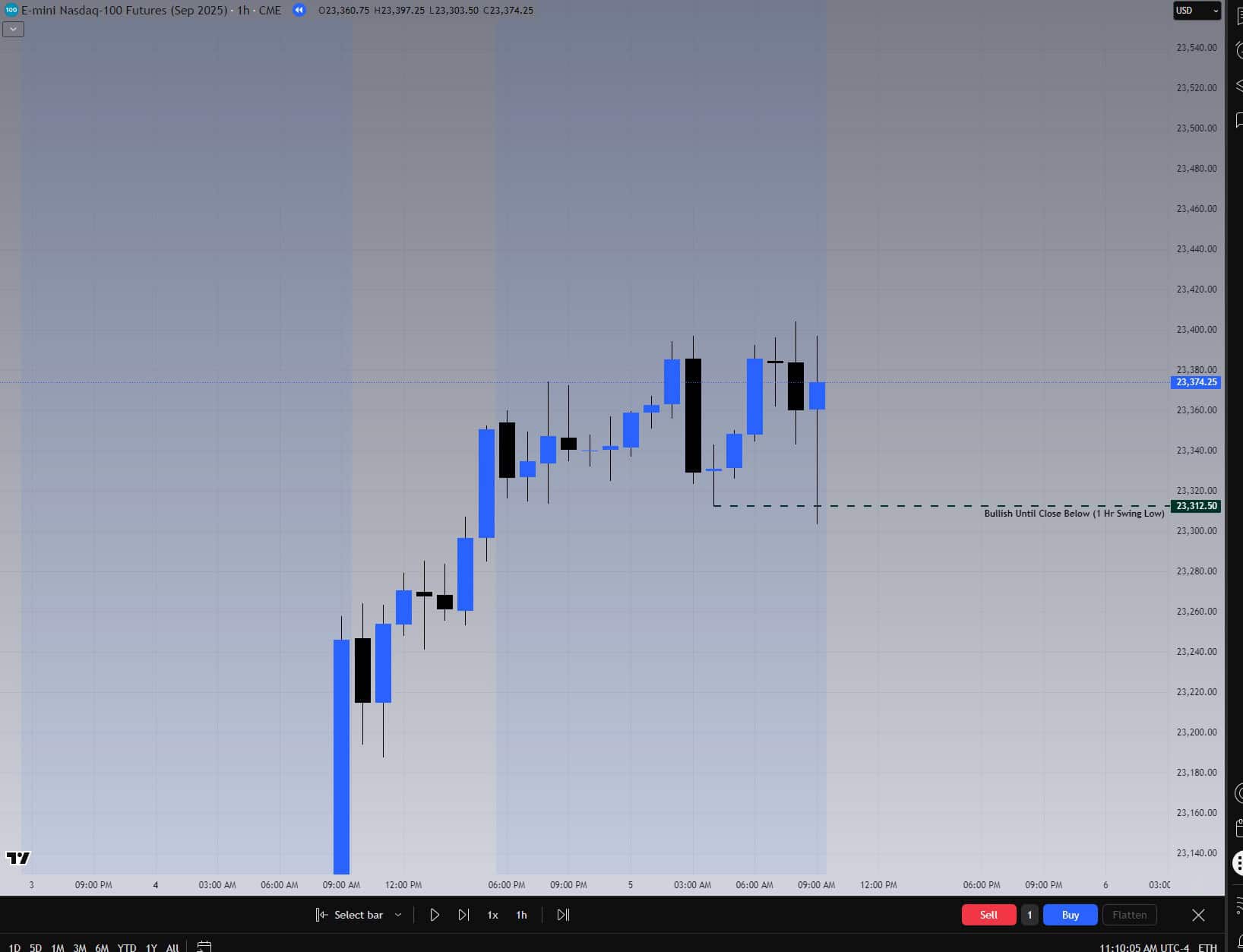

Going into August 5, 2025, our directional bias was clear. The 1-hour chart showed bullish structure, and unless that structure broke, we were only taking long setups.

The 1-hour chart before market open. Clear bullish structure. Longs only.

🎯 The Setup: Every Rule Met

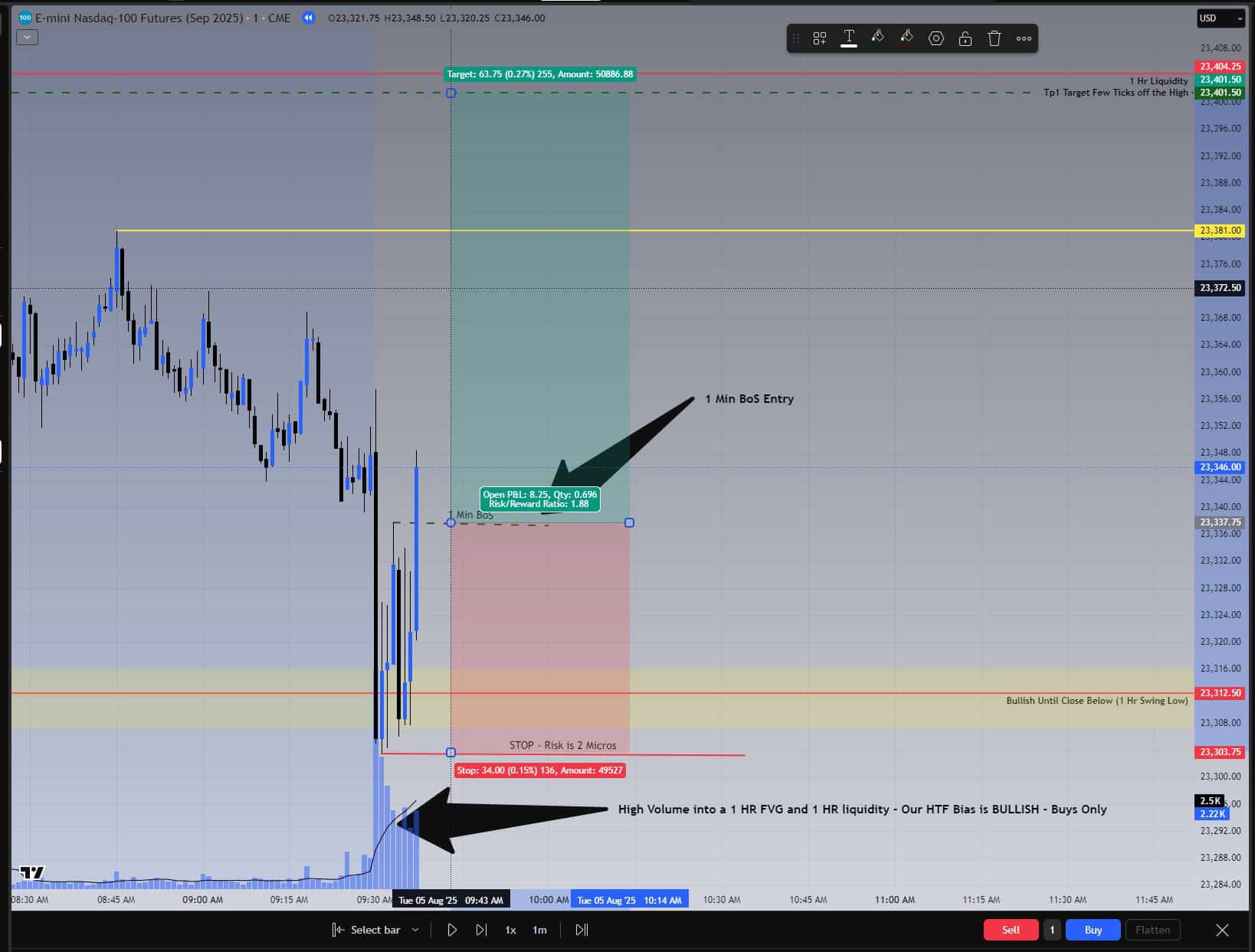

The 1-minute chart gave us a beautiful entry: a sweep of 1-hour liquidity, a tap into a 1-hour FVG, high volume, and a confirmed bullish BoS. Every rule of the BoS Sniper Strategy was respected.

Beautiful BoS entry. One-hour FVG, sweep, high volume. This is the setup we wait for.

📈 Risk-to-Reward and TP1 Planning

TP1 was placed at 23401.50 — just under a 1-hour liquidity level. The R:R was 1:1.88. Nothing random here. Every trade is planned the same way, before entry.

Pre-defined target. Pre-defined stop. R:R = 1:1.88. This is how you stay consistent.

💵 The Temptation to Exit Early

At one point, the trade was up $114 across two MNQ contracts. This is the part where most people bail out, post the win on social, and call it a day. But that’s not how casinos play.

Up $114… but we do nothing. Rules first. P&L second.

📉 The Stop-Out

TP1 never hit. The market reversed hard. We were stopped out. On the 1-minute chart, you can also see the 10 a.m. candle shifted the 1-hour bias. A painful loss — but still within the system. Or so we thought.

Market reversed. TP1 never hit. This was a clean stop-out by the book.

📉 Trade Closes with $170.48 Loss

The final Topstep screen confirms it — $170.48 loss across the five funded accounts. Even though the market later dropped hard, we didn’t flip short. Why? Because the system didn’t allow it at the time.

Full loss taken. The rules didn’t permit flipping short. That’s how a system works.

📋 Post-Trade Checklist: The Missed Rule

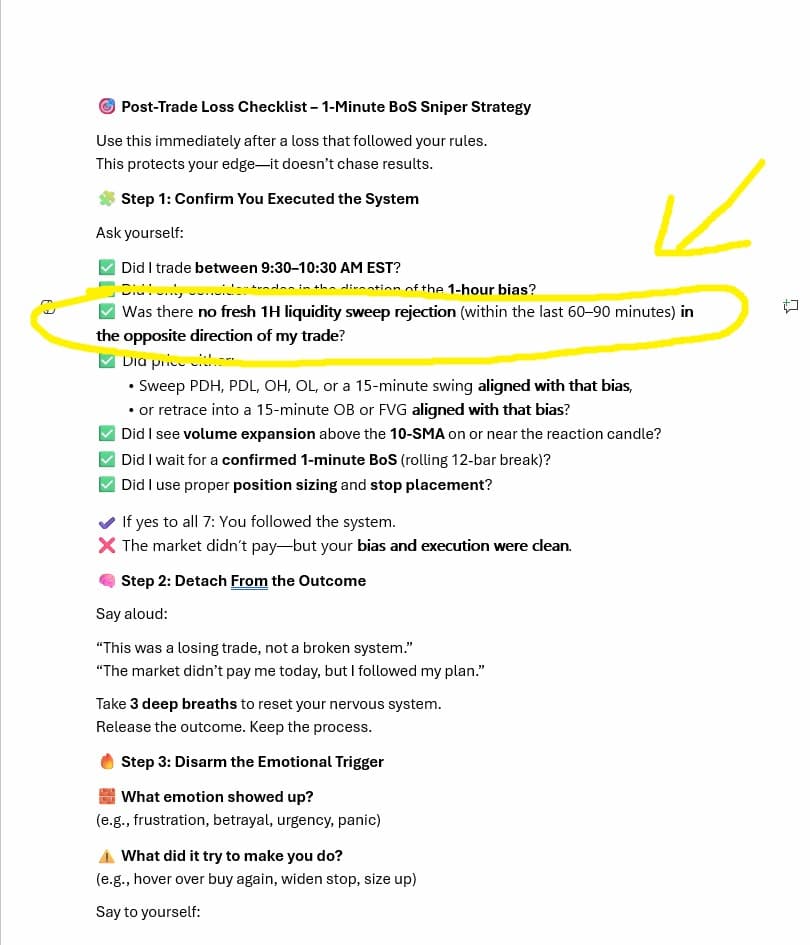

Then came the real growth moment. While reviewing the post-trade loss checklist, one line stood out:

✅ Was there no fresh 1H liquidity sweep rejection (within the last 60–90 minutes) in the opposite direction of my trade?

This rule was on the post-loss checklist… but not on the strategy checklist. That’s on me. And I own it.

This line had been added to the loss checklist—but not the active strategy. Today, that changed.

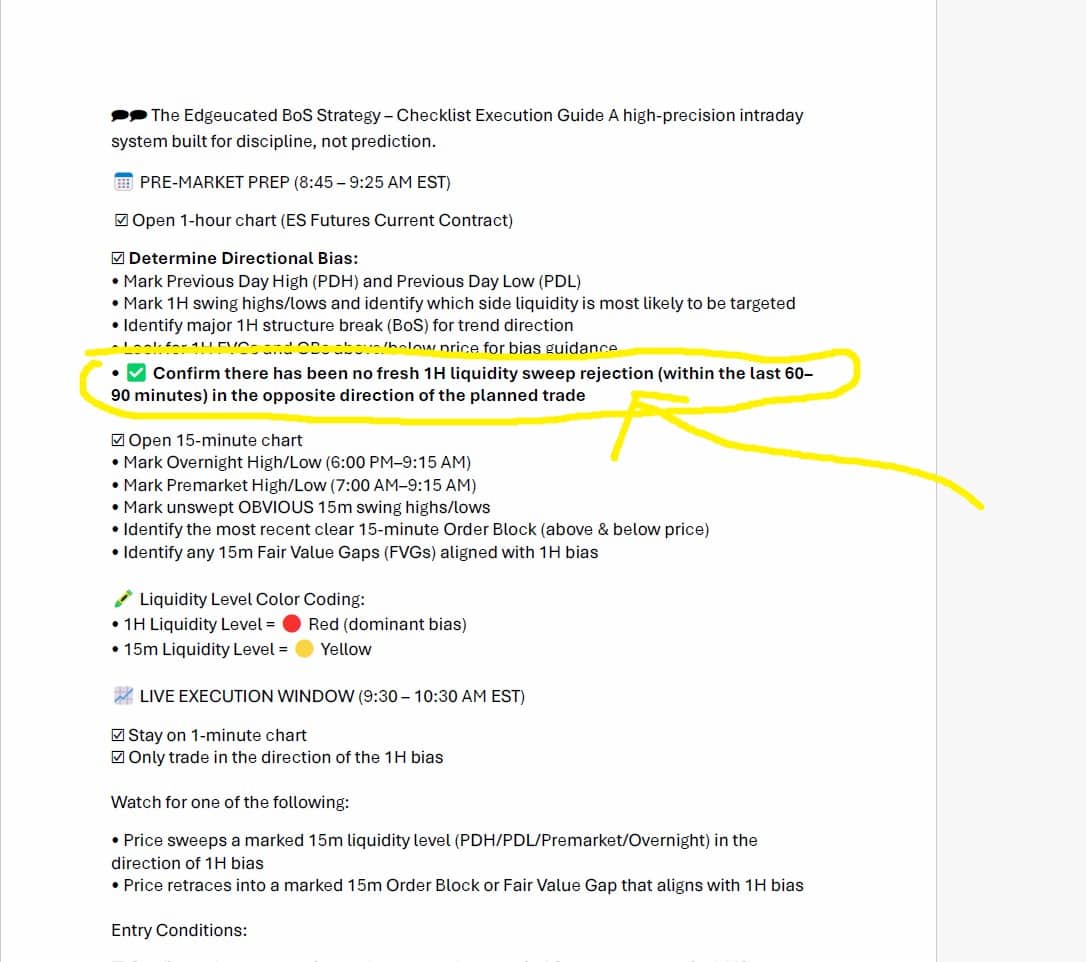

✅ Strategy Updated – Publicly and Permanently

We don’t hide from this. We document it. We learn. And we fix it.

Strategy checklist updated. Not because we lost — but because we missed something that already existed.

🧠 Why I’m Showing You All This

You might be wondering why I’m showing you all of this.

Why am I showing you a trade that was up $114… and then turned into a full loss?

Why am I showing you that I may have had my 1-hour bias wrong today?

Why am I showing you that I missed a rule, and had to go back and publicly correct it?

Because this is exactly what you’re going to have to do if you want to become consistent.

Not necessarily with my strategy — but with any strategy.

Look, we had news come out at 10 a.m. Could that have changed the trade outcome? Sure.

But that doesn’t matter.

We’re not here to make excuses. We’re here to build discipline.

To trade like the casino.

To do the same thing every single time.

That’s why I journal these trades as blog posts. Not for likes. Not for ego.

For accountability.

For growth.

For truth.

And you should be doing the same thing — analyzing your behavior every day.

That’s how you get consistent. That’s how you build confidence.

And that’s how the numbers take care of themselves.

If you do the same exact thing every single day — you’re already successful.

📊 Trade 13 of 20 – Updated Totals

- Wins: 6

- Losses: 7

- Breakeven: 1

The work continues tomorrow. We play another hand — same structure, same plan.