It’s June 10th, 2025. You sit down at the screens at 8:00 a.m. like you always do. Eyes locked in. Coffee hot. Charts ready.

But something’s missing.

There’s no news. No momentum. No fuel.

You flip open the headlines. It’s just noise.

Sure, there’s unrest in California. Political stories. Chaos for chaos’ sake. But for the Nasdaq futures market? Nothing actionable. Nothing that tells a clear story.

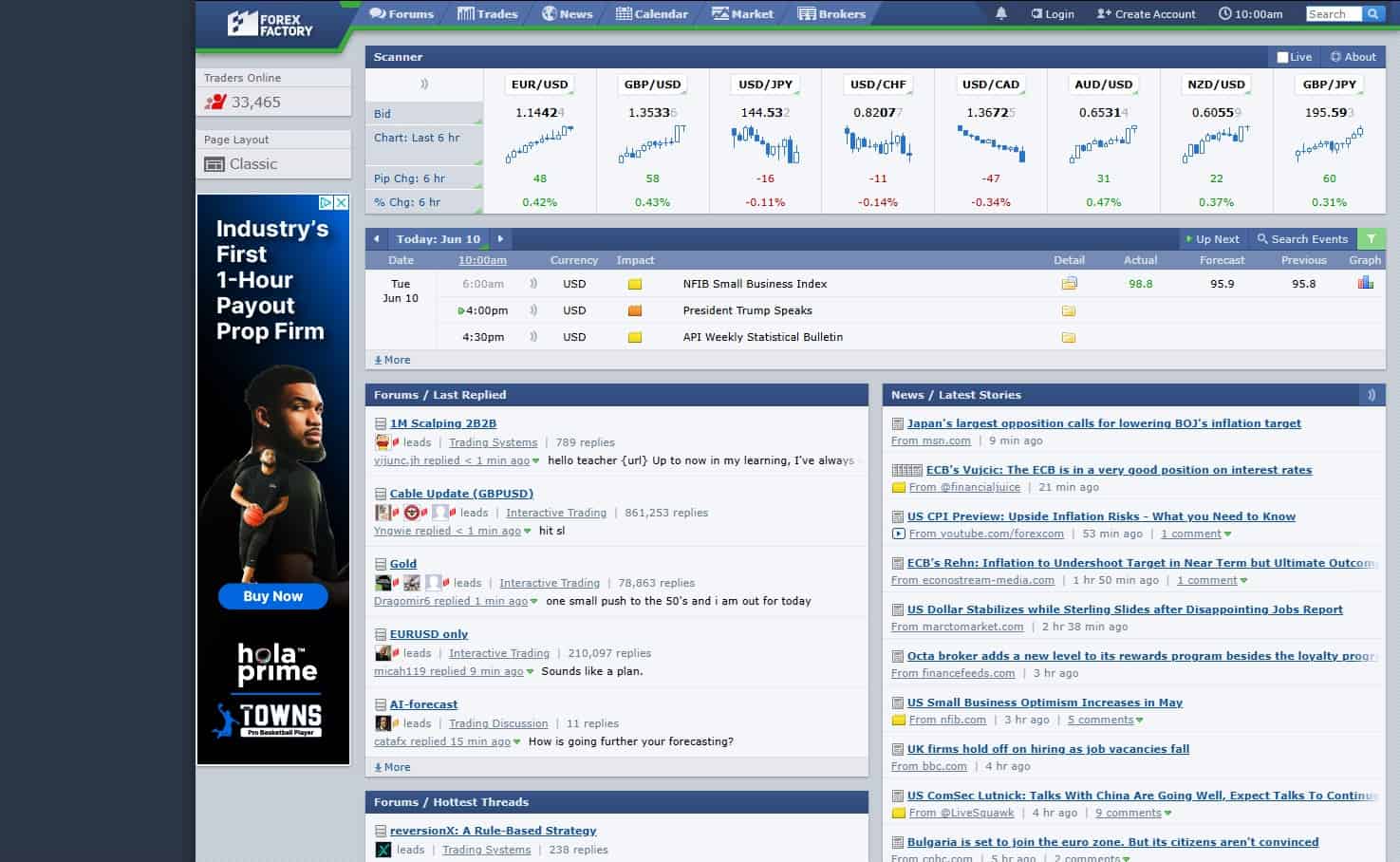

You check the economic calendar to make sure you didn’t miss anything.

Nope. Dead quiet until 4 p.m., when President Trump is scheduled to speak. That’s hours from now. The open is coming fast—and the market has no reason to move.

But you still watch. Because it’s what you do.

And what you see… is this:

From 8 a.m. to 11:10 a.m., the Nasdaq chopped around like a drunk stumbling out of a Waffle House at 2 a.m. Up, down, back again. No trend. No conviction.

Now pause and imagine: You’re a new trader. You look at that chart and think, “Maybe I’ll catch a move if I just try hard enough.”

Don’t.

This chart will kill your account and destroy your psychology. Trying to trade a two-minute break of structure in this mess will leave you confused, angry, and emotionally wrecked by lunch.

This is not your day.

So Why Did I Trade?

Because I saw one chance.

At the open, I followed a setup I trust: wait for a breakout candle, wait for break of structure, and if it’s there—I take it.

And today? It was there.

One clean move. I rode it.

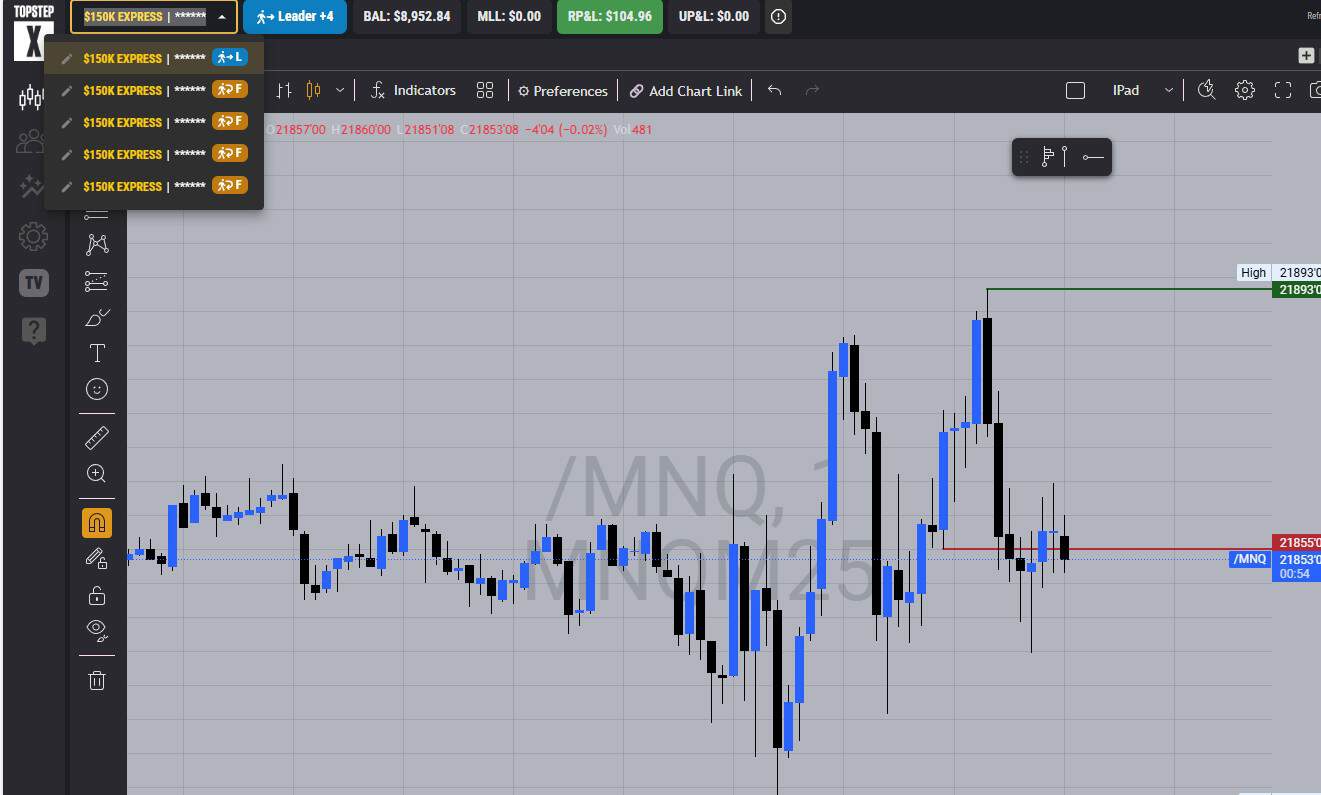

I took a $104.96 gain on my leader account.

And that would be just fine on its own. Because small wins on days like this are big wins in disguise.

But I don’t trade just one account anymore.

Small Win, Times Five

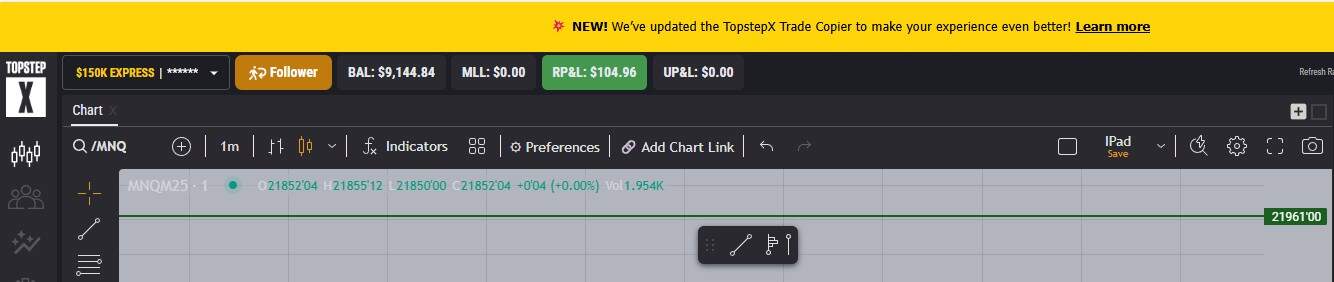

Thanks to TopStep’s new trade copier, which mirrors realized P&L down to the penny, that $104.96 win was duplicated across four more accounts.

Here’s one of them:

$104.96 on every account.

That’s a total of $524.80 today—in a market that offered nothing but pain to anyone trying to force it.

And here’s the crazy part.

This is just one of the follower accounts:

Look at the equity curve. Steady. Growing. With a 54.56% win rate. That’s just over 50%—and yet it’s now up over $9,000 since March 24th.

Why?

Because I’m not trying to be perfect.

I’m trying to be disciplined. And when I win, I win across five accounts.

Here are the current balances across all five:

- $8,952.84

- $9,175.60

- $9,089.34

- $9,144.84

- $9,108.88

That’s a total of $45,471.50.

The Lesson

Today, you didn’t need to be a hero.

You didn’t need to chase.

You didn’t need to scalp chop for three hours.

All you needed was one clean setup, one good decision, and the patience to know what kind of day you were in.

There will be bigger days. Days with fuel. Days with momentum. Days where the market gives you the kind of trend that funds weeks’ worth of gains.

But today?

$104.96 was a blessing.

And when you’re trading with discipline—and using tools like the copier—that small win becomes something powerful.

So if you’re reading this as a developing trader, take this to heart:

You don’t have to win big.

You just have to win smart.

And you have to know when not to trade.

The Edge isn’t always in the setup.

Sometimes, it’s in the restraint.