Yes—we’ve made good money trading. The potential is real. But the biggest win hasn’t been a car or a flex—it’s who trading forced me to become: stronger, more patient, more disciplined, and more resilient.

The Real Battle Is with Yourself

To master trading, you must win battles—not against the market—but with yourself. There are no boundaries, no oversight… one click, anywhere in the world, and you could make—or lose—a fortune.

There are no redos—no cheat codes like in old-school Nintendo games. Once the money’s gone, it’s gone. And that reality forces you to confront who you really are under pressure.

Why Fewer Than 1% Make It

It’s not charts or systems that trip people up—it’s people themselves. Nobody wants to lose, nobody wants to be wrong. That combo fuels desperation, revenge trading, and blowing up accounts.

While most new traders hunt for the “holy grail” system, here’s the truth: the market evolves, and so must you. Discipline in your approach, yes—but only if you can adapt over time.

Pain, Loss, and the Turning Point

We all start starry-eyed, staring at the wins. But almost everyone needs a wake-up call—a fatal loss or emotional collapse—before real consistency emerges. Unless you’re lucky enough to have a disciplined mentor guiding you early.

The Gambling Approach vs. The Professional Approach

You could trade like a gambler—ride the thrill, bank wins—until the market inevitably takes it all back. Catastrophic losses don’t always mean your bank account goes to zero, but in prop trading, it means “blowing up” your account.

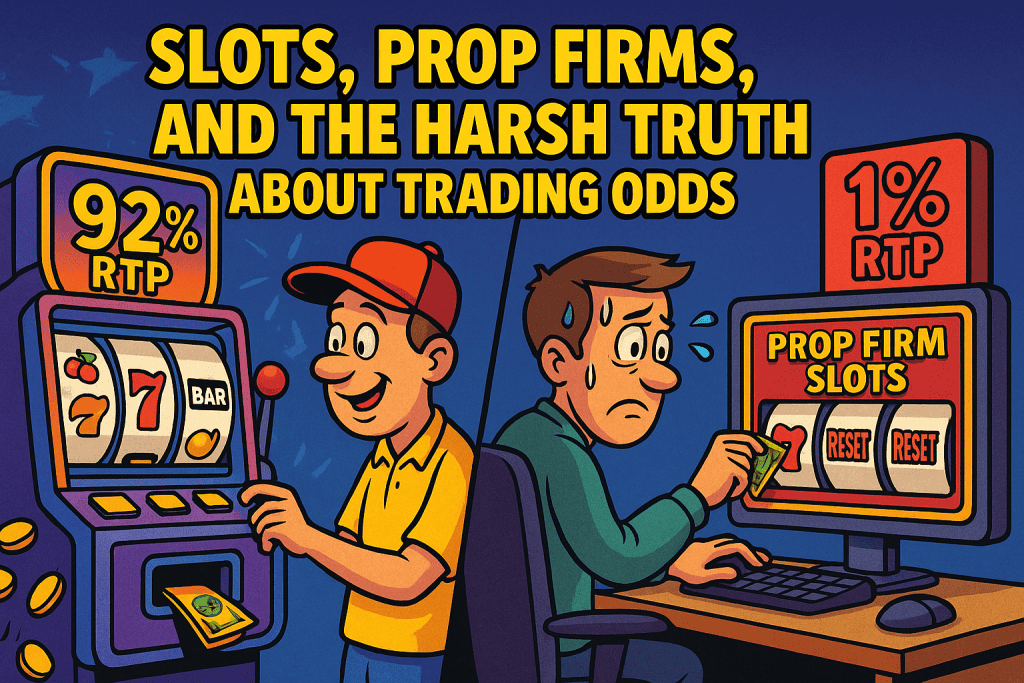

Slots vs. Trading: The Odds Stack Against You

Let’s get real about the odds:

- Slot machines: Regulated slots in Vegas and online casinos pay back an average of 91–93% of money wagered. Some online titles reach as high as 94–97%, with a few even advertised at 99% RTP. That means if 100 people play, roughly 8 could walk away ahead after long enough play.

- Trading: Only about 1 in 100 traders remain consistently profitable long term. Multiple studies show that fewer than 10–13% of day traders are profitable in the short term, and just 1% sustain it for years.

So think about that: the odds of winning on a slot machine—a literal gambling machine designed to take your money—are actually better than the odds of surviving as a long-term trader. Even at a modest 92% RTP, you’re eight times more likely to come out ahead on slots than by gambling prop firm accounts.

And here’s the kicker: casinos are regulated to guarantee that payback. Trading has no such guarantee. The only constant is your ability to control yourself and adapt to a market that’s always changing.

The Prop Firm Slot Machine Analogy

Prop firms bank on failed traders. Many even discount resets, essentially selling you another chance to gamble on the same flawed behavior. It’s not just ruthless—it’s mathematically stacked against you.

How I Do It Differently

Yes—I trade with prop firms too. But instead of gambling, I use controlled tactics:

- I risk relative to account size.

- I detach from emotions.

- I leverage copy-trading for consistency.

Longevity is everything. If you’re still playing, you’re still adapting, still in the game.

The Evolution of a Trader

When it clicks, trading becomes more than just money—it becomes freedom, clarity, confidence.

The Real Reward

Trading has given me discipline, resilience, humility, and self-awareness. It has given me opportunities—money, freedom, choices.

It didn’t hand me a Lamborghini—but… it could have. The difference is the journey: mastering myself, not just chasing wins.

A Small Ask

This blog doesn’t write itself—it takes time, effort, and honesty. If this resonates…

Follow me on @edgeucated, like, and share. It costs you nothing—but it gives me every reason to keep writing the stuff I wish I had when I started.