Most people who fail at trading do so for one reason: they can’t sit still. They hop from strategy to strategy, tweak their plan after every loss, and chase the illusion of perfection. But perfection doesn’t exist in trading — only probabilities do. And your job as a trader isn’t to win every day — it’s to follow your edge every day. Just like a casino.

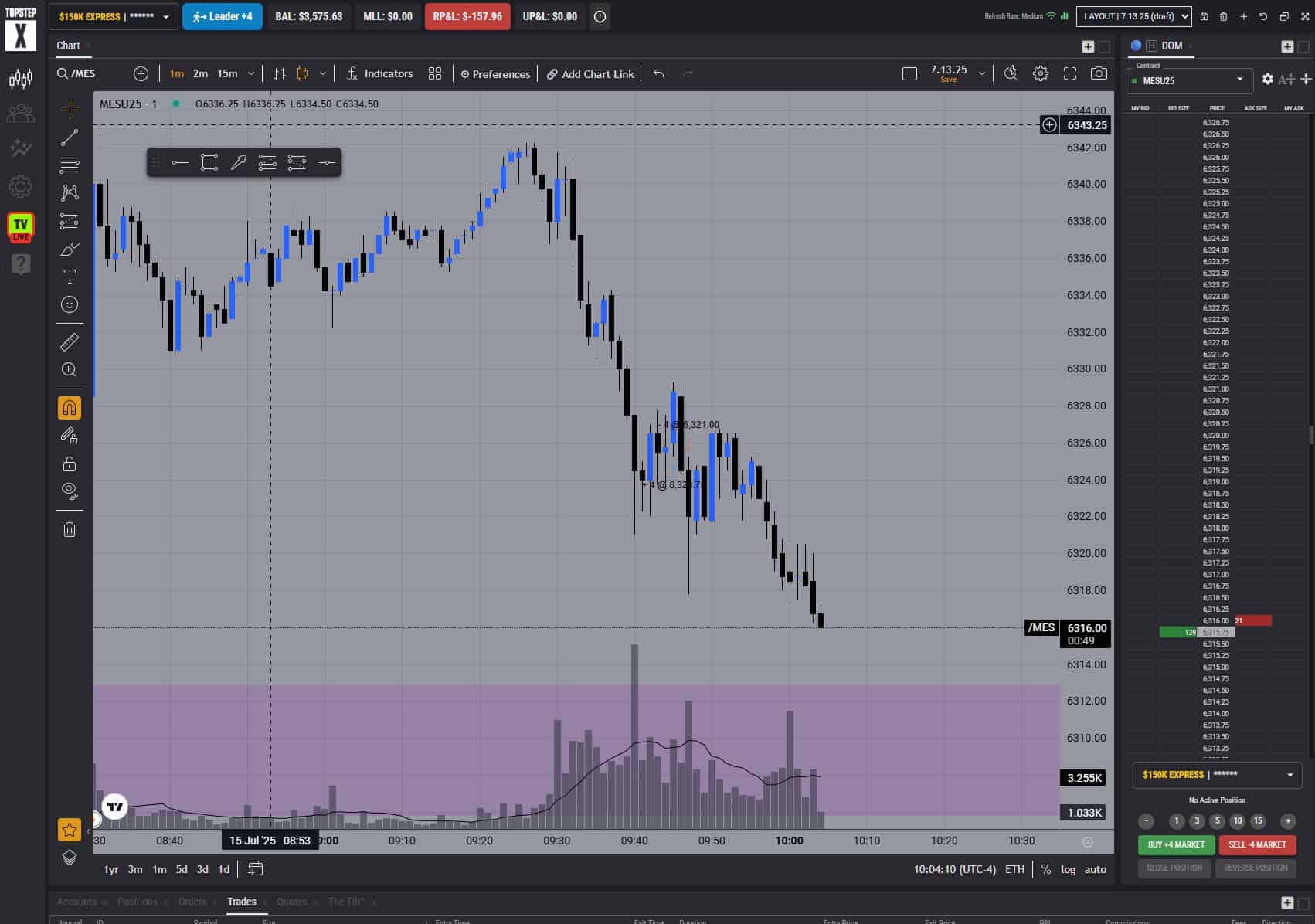

Today’s trade on July 15, 2025 was a perfect example of that mindset in action. We took the setup. We followed the system. And we lost — exactly as planned.

📉 The Setup: Picture-Perfect Execution

At the New York Open, we saw price sweep liquidity into our 15-minute order block with strong volume. Then came a clean 1-minute break of structure to the upside. The trade triggered at 9:45 AM with a long entry at 6328.75, stop at 6321.00. Everything aligned:

- ✅ Liquidity sweep

- ✅ High volume

- ✅ Clean 1-minute BoS

- ✅ Predefined $150 risk

The trade stopped out at 9:47 AM. Total loss? $157.96 across 5 Topstep accounts. Right on plan.

🧠 The Mindset: You’re Not the Gambler — You’re the House

Too many traders think their job is to win today. But that’s gambler thinking. Your job is to execute the same rules over and over again, regardless of the outcome. That’s how casinos operate — and that’s why they always win over time.

A casino doesn’t shut down the blackjack table every time a player hits 21. They don’t panic after a few losses. They stick to the rules — because they know the edge plays out in the long run.

Trading is the same. If you have an edge — your only job is to execute it consistently. No emotions. No tweaking. No revenge trades. No quitting.

This is why we take only one trade per day. This is why we stop after a loss. This is why we log it, share it, and keep going.

📚 Why 95% of Traders Fail

Most people lose in trading not because their strategy is bad — but because they can’t stick to it. They treat trading like a slot machine. But the ones who succeed — the 5% — know they are the house. They trade small edges with consistency and discipline, not emotion and hope.

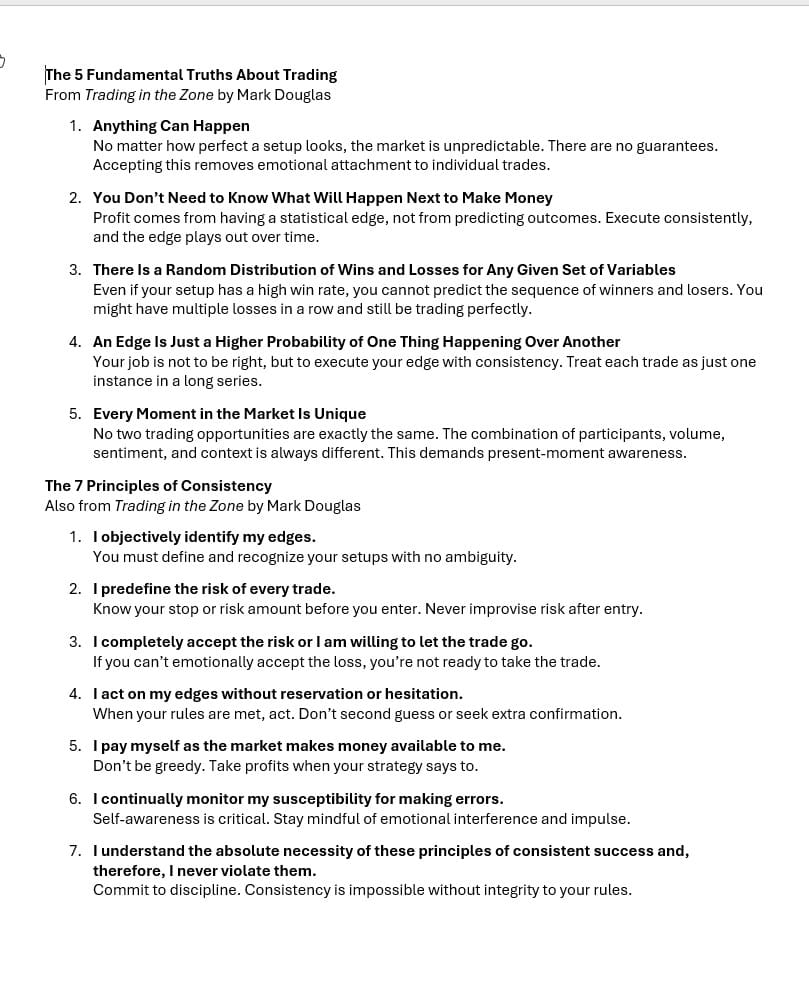

There’s no better reminder of that than the teachings of Mark Douglas in his legendary book, Trading in the Zone. If you haven’t read it yet, start here.

These are the truths we trade by. These are the principles that keep us sharp even when the market isn’t.

🔁 Final Reminder: Don’t Change the Rules

Today’s trade was a loss. But it was a perfect loss. One setup. One entry. One stop. One clean execution of our system. No hesitation. No second-guessing. No emotional deviation. That’s what makes this a win — even in red.

You are the casino owner.

You don’t change the rules just because someone wins a hand.

You follow your edge. You keep the odds in your favor.

And you win — over time.

🚀 Want more trades, mindset tips, and strategy breakdowns?

👉 Follow us on X (@edgeucated)