Today was a perfect reminder of why we play the game the same way — every single day — no matter what. Just like Blackjack, trading success isn’t about reading minds or making hero calls. It’s about following rules. It’s about execution. It’s about showing up, taking the same setup, and letting probability do the heavy lifting.

🕒 The Setup: 10:11 AM Entry

At 10:11 AM, we got our signal:

- ✅ Price retraced into our 15-minute order block

- ✅ Volume spiked above the 10-day premarket average

- ✅ 1-minute BoS gave us the green light

We entered at 6286.25 with three MES contracts. One came off at TP1 — the bottom of the opposing 15-min OB — for a solid partial win. The plan was to move our stop to breakeven… but price reversed so quickly, we couldn’t adjust in time on TopstepX. The final result? A small but real profit of $19.03.

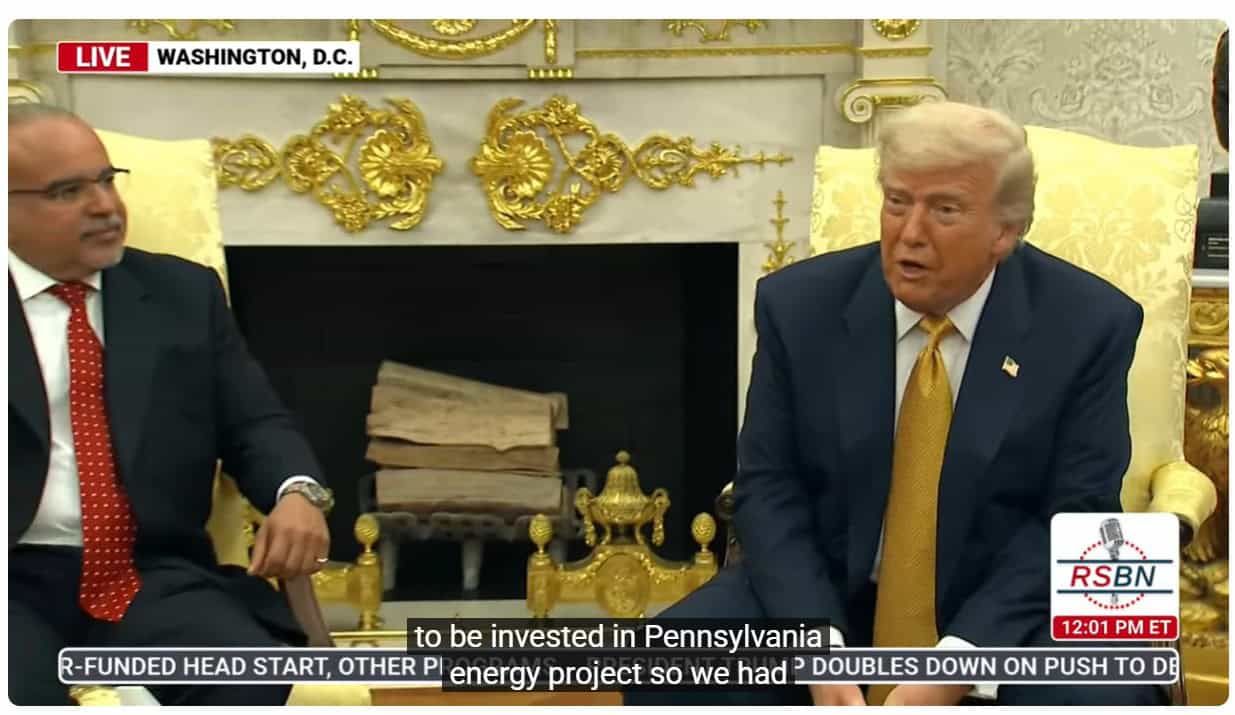

Topstep Leader account showing $19.03 profit from today’s BoS Sniper trade — 1 contract hit TP1 cleanly, but price reversed before the remaining stop could be moved.

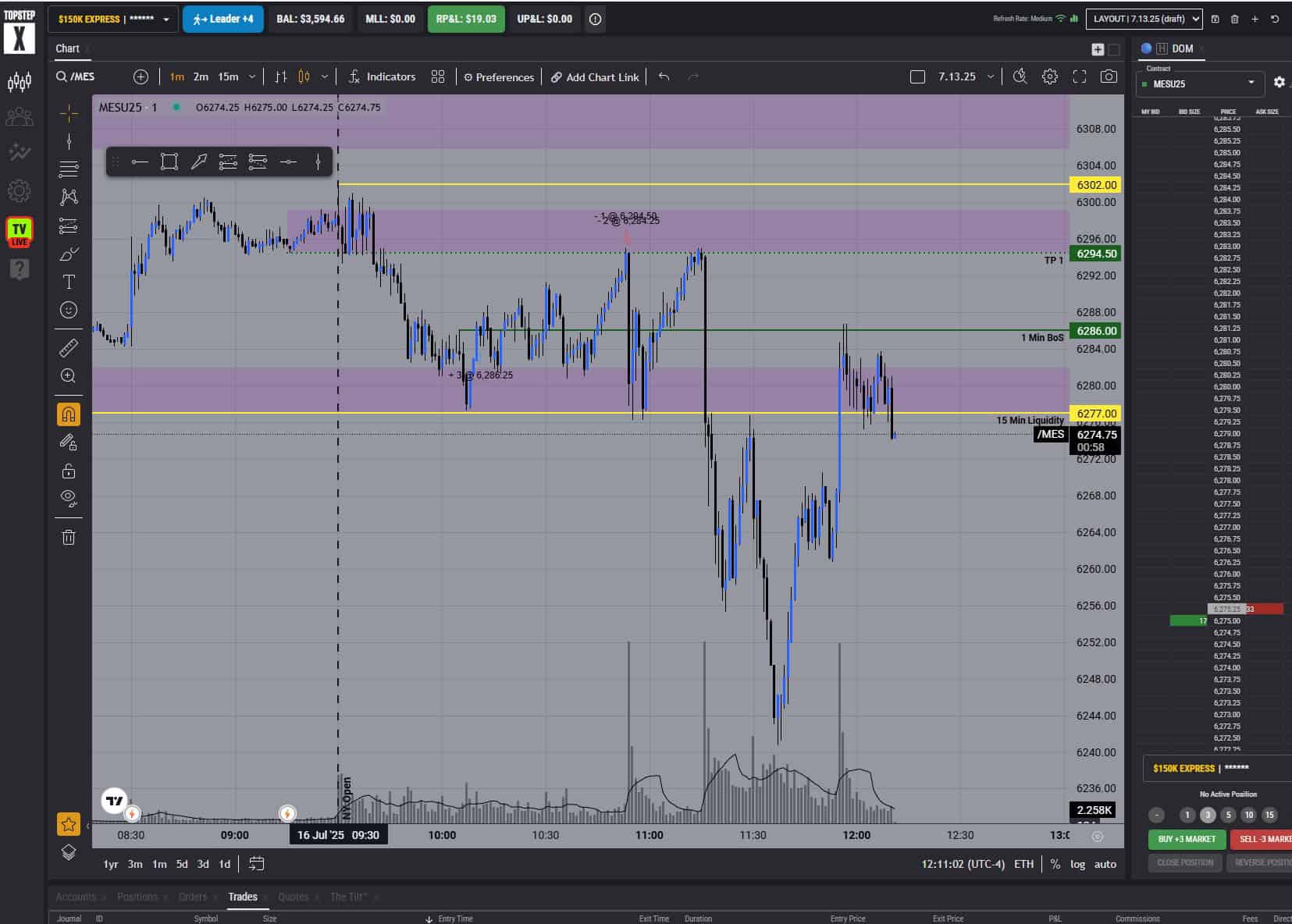

📊 The Chart: Strategy Executed Flawlessly

This chart shows it all — the retracement into the 15-min OB, the clean BoS, the volume confirmation, and the precision TP1 fill. Strategy did exactly what it was built to do.

TradingView chart showing textbook BoS Sniper execution — price retraced into the 15-minute OB, volume increased, BoS confirmed entry, and TP1 was tagged at the bottom of the opposing OB.

🗞️ Then This Happened…

While we were managing the morning, Trump went live on Bloomberg and casually dropped that he may fire Fed Chair Jerome Powell. That’s not something you plan for. And that’s the point.

Trump goes live on Bloomberg during the session threatening to fire Jay Powell — a clear example of unpredictable market-moving news, reinforcing the need to stick to your trading system.

And if that wasn’t enough, here’s the Reuters headline that followed:

Reuters headline on Trump likely firing Powell — a stark reminder that markets can shift on news you haven’t even seen yet.

📰 Source: Trump will likely fire Fed’s Powell soon – Reuters

Did this ruin our trade? No.

Did it explain the reversal? Possibly.

Could we have predicted it? Never.

🎰 Be the Casino, Not the Gambler

Here’s what the market looked like after 12:11 PM. Total chaos. And we were already out.

By 12:11 PM, MES looked unrecognizable. We were already done. One trade. Small gain. No stress. Most would trade places with that outcome.

Most traders get pulled back in, chasing moves, reacting to the noise. That’s not us.

We played our system. Took our setup. Secured a win. Shut it down.

🧠 Final Takeaway

This is what trading with an edge looks like:

- 🎯 One trade per day

- 🎯 Volume, structure, and liquidity confluence

- 🎯 No flips, no chasing, no revenge

Like Blackjack — the edge isn’t in the cards. It’s in how you play them.

Today’s win was small on paper. But massive in execution.

The strategy worked. We followed the rules. We beat the chaos.

One setup. One trade. One job.

🚀 Want more trading insights and behind-the-scenes breakdowns?