When a Loss Isn’t Really a Loss

You followed your plan. The setup was there. The execution was clean. But the market didn’t pay you today.

Does that mean you lost?

Absolutely not.

Our 1-minute BoS sniper strategy is about consistency, precision, and long-term edge. That edge is measured not by a single win or loss—but by how often we follow our rules. When you execute your process with discipline, you’re doing what the casino does: you’re playing a game you’ve rigged in your favor, and letting the odds play out over time.

📍 The Setup Was Valid

Today we had our premarket low marked clearly on the chart. We waited patiently for it to be swept with volume, and when it was, we took the confirmed 1-minute BoS long entry—exactly as the system calls for.

🎯 Executed with Precision

This wasn’t a random entry. We took 2 contracts, just as planned. We knew where our stop was. We knew exactly what we were willing to lose if the market didn’t agree with our thesis. That’s the point.

🎲 You’re the Casino—But Only If You Follow the Math

This loss doesn’t hurt—because we follow the math. The casino doesn’t win every hand, every spin, or every roll. But over time, it crushes. That’s because the edge is in the structure, not the outcome of any single event.

The only way to even measure whether you have an edge is to behave consistently. That means:

- Only entering valid setups

- Sticking to planned stops and sizes

- Following the same process every time

If you revenge trade, move your stop, or deviate from your rules—even once—you’ve broken the structure that creates your edge. You might get away with it for a trade or two, but over time, that inconsistency guarantees failure.

I was 100% comfortable with this $106 loss today. Why? Because I knew the risk. I had the plan. And I stuck to it.

🧠 Reflect: Are You Really Following Your System?

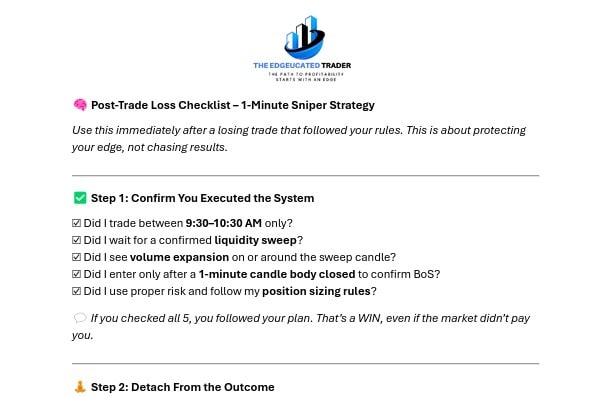

This is where most traders fall apart—not with strategy, but with discipline. In our Discord, we even have a post-loss checklist. It’s there to hold us accountable—to force us to ask: “Did I follow my rules?”

Take a moment to look at your own system. Are you trading with a clear set of rules? Are you journaling losses and checking yourself after red trades? Or are you just reacting to the market and hoping for a win?

The edge isn’t in the win. It’s in the repeatable process that produces profit over time.

If today was a loss—but you followed your plan—you didn’t lose. You leveled up.